Finance & Accounting Dec 1, 2024

Half of All Species Might Face Extinction. Could Biodiversity Bonds Help?

Maybe. But don’t expect investors to cut governments a break.

Yevgenia Nayberg

Scientists estimate that as much as half of all species face extinction by the middle of this century.

Biodiversity conservation could help stem the tide. But efforts to promote it—and stave off ecological collapse—often come at a high cost.

To fund conservation programs, governments are increasingly borrowing money from investors by issuing bonds. But how much do investors value efforts to protect biodiversity? Will they lend to the government at a lower price if they know it will protect habitats, plants, and animals?

Jacopo Ponticelli, an associate professor of finance at the Kellogg School, sought to tackle these questions in his latest research. To do so, he teamed up with Fukang Chen, Minhao Chen, and Haoyu Gao of the Renmin University of China, along with Lin William Cong of the SC Johnson College of Business, to analyze the performance of bonds in China that funded the protection of its national nature reserves.

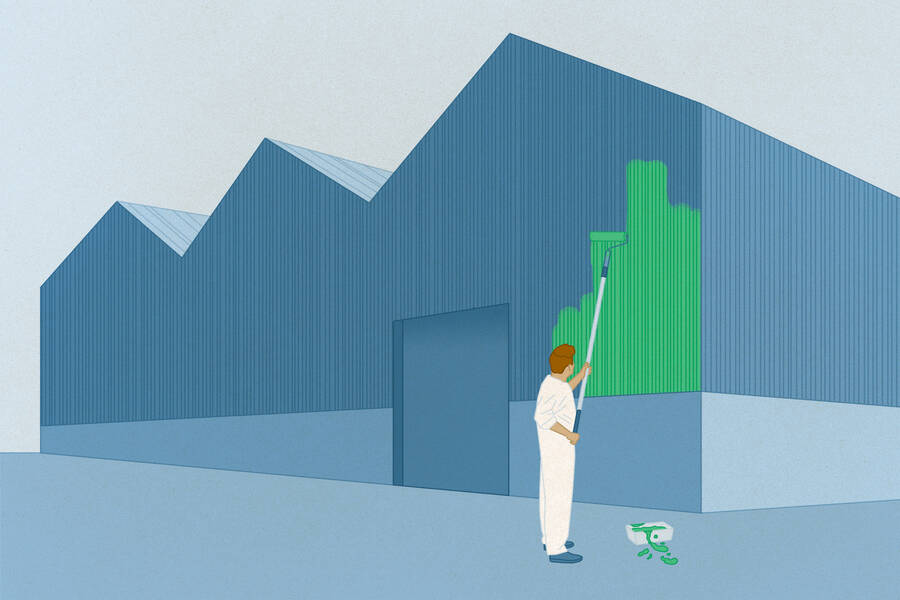

The researchers found that, although the increased investment into biodiversity conservation helped improve the condition of national nature reserves, it also increased the bond yields—the interest that the municipalities issuing the bonds had to pay investors.

“Biodiversity costs are very large, and so financing them triggers additional costs for the government,” says Ponticelli. And these additional costs might be concerning for investors.

Furthermore, the research indicates that people who invest in conservation efforts are motivated purely by financial returns, whether or not they believe there is intrinsic value in protecting nature.

“Am I willing to get a lower interest rate if I know I’m financing something that’s good for humanity?” Ponticelli asks. “And the answer is no.”

A shock to the system

To understand the finances behind biodiversity conservation, Ponticelli and colleagues examined how China funded the preservation of its national nature reserves.

By 2016, China had established more than 440 national nature reserves to protect rare and threatened species. The nation is second only to Brazil in its variety of species and home to more than 6.4 percent of all known life forms.

“Am I willing to get a lower interest rate if I know I’m financing something that’s good for humanity?”

—

Jacopo Ponticelli

However, widespread and illegal mining, tourism, and hydropower plants in recent decades led to bleak conditions that imperiled biodiversity in the reserves.

The central government responded by launching an ambitious initiative in 2017, Green Shield Action, to hold local governments accountable for safeguarding nature reserves. But it left local authorities to shoulder most of the bill. Their challenge was to raise enough funds to fix the 20,800 issues across hundreds of national nature reserves that the initiative had flagged.

To finance this work, local leaders turned to state-owned enterprises (the main source of local-government financing) to issue and back municipal corporate bonds. Local governments regularly relied on such bonds to fund their expenses in general. And for cities that had national nature reserves, some of these expenses included biodiversity-conservation efforts like closing illegal businesses, relocating residents, and demolishing unauthorized facilities.

“This is the type of shock that you want to study … because it’s a government enforcing protection of biodiversity areas,” says Ponticelli. The policy provides a clear line for telling a before-and-after story about conservation.

Satellites and birds

First, the researchers wanted to understand: Did the Green Shield Action actually improve biodiversity?

To assess their impact on biodiversity conservation, the researchers turned to observations that citizens uploaded to the China Bird Report Center from 2015 through 2021. Ponticelli and colleagues found that the number of observed bird species started to rise soon after the Green Shield Action was implemented in 2017—suggesting that biodiversity indeed improved after local enforcement of the federal mandate.

They also consulted bird observations that the Chinese National Ecosystem Research Network provided in five-year intervals. This data similarly showed that the number of observed bird species only began to rise once the federal rule came into play, reversing the decline over the previous 15 years.

In addition, the researchers found evidence of a spike in public conservation spending in national-park municipalities following the national mandate. They scanned procurement contracts from China’s Ministry of Finance and found that the number of contracts that mentioned national nature reserves doubled after the mandate, whereas the number of such contracts had been relatively stable for years before then.

“What we can observe is that procurement contracts related to biodiversity conservation increased after the introduction of the Green Shield Action,” says Ponticelli, “though we don’t actually have a smoking gun that directly links this increase in contracts to conservation efforts.”

Finally, the team examined many before-and-after pictures of the reserves that showed how once-denuded landscapes turned green in the years following Green Shield Action.

Different landscapes, different bond markets

The improvements to biodiversity, however, put financial pressure on the municipalities with national nature reserves. And this financial pressure likely affected how investors viewed these bonds.

“When the expected costs that municipalities have to pay for conservation efforts move up or down, that influences how investors think about the ability of those local governments to repay,” Ponticelli says. High costs or expenses could negatively impact a municipality’s balance sheet, and thus make it feel like a riskier investment.

The researchers sought to confirm this was the case. They compared the differences in bond yields between municipalities with and without national nature reserves, from 2013 to 2022.

Once the regulatory policy took effect in 2017, a clear gap emerged. The bond yields rose significantly more in municipalities with a national reserve—by a difference of twenty-four basis points—than in those without one. The team also looked at the bond yields in municipalities with nature reserves that did not fall under the national mandate for conservation; bond yields did not rise in these regions.

In other words, the bond market demanded higher returns only from the municipalities that were funding conservation efforts.

Investors considered these to be riskier, and they weren’t willing to absorb the risk with lower profits, Ponticelli says. “The fact that we see these effects on bond prices really means that investors think these governments have to spend a lot of money to reverse this process of destruction of these natural reserves.”

The researchers found further evidence of this dynamic by examining nighttime satellite images of the nature reserves. They identified areas that were the most brightly lit at night (past closing time). They viewed these heavily lit areas as evidence of banned activities, which, in turn, indicated more issues and greater costs for local authorities. Juxtaposing this data against bond yields, “you would see that the larger that [nighttime] activity was, the larger was the bond adjustment,” Ponticelli says.

What’s more, the researchers found no evidence that might connect the rise in municipal-bond yields to other environmental protection and antipollution campaigns (beyond the national mandate).

Biodiversity-investment risks and rewards

Despite the financial pressure, local governments seemed to have responded well to the push for biodiversity conservation. The central government only provided a tiny fraction of the funds needed to address biodiversity conservation in China, yet regional governments appeared motivated to try to outdo one another in rehabilitating their nature reserves, according to Ponticelli.

“There is almost this tournament across different municipalities on who better implements the policies that the central government cares a lot about,” he says. “And in a way, it’s a good incentive scheme.”

Overall, Ponticelli hopes the research can offer lessons for biodiversity conservation more broadly, especially in developing regions.

One takeaway is that investors still want to be compensated more for taking greater risks, even when investing in conservation. Even though none of the municipalities in the study defaulted on the bonds, some investors likely feared that, under the increased financial pressure to improve biodiversity, they might.

“Investors don’t seem to treat this effort in biodiversity differently than any other effort that would make a bond riskier. And that means that borrowing becomes more expensive,” he says. “There’s a financing cost that people weren’t really thinking about before.”

Elsa Wenzel has covered business, technology, and sustainability for GreenBiz, PCWorld, CNET, the Associated Press, and Mother Jones. She holds an MS from the Medill School of Journalism at Northwestern and a BA from the University of Iowa.

Chen, Fukang, Minhao Chen, Lin William Cong, Haoyu Gao, and Jacopo Ponticielli. 2024. “Pricing the Priceless: The Financial Cost of Biodiversity Conservation.” Working paper.