Featured Faculty

Professor Emeritus of Accounting Information & Management

Previously a Visiting Scholar at Kellogg

Member of the Department of Accounting Information & Management faculty until 2017

Proponents of corporate social responsibility (CSR) initiatives tend to justify their position by arguing that these expenditures improve a company’s economic performance―allowing it to earn higher profits through enhanced brand reputation, more-productive employees, and insulation from regulatory penalties. In other words, executives promote the company’s own interests by pursuing a strategy of “doing well by doing good.”

In contrast, economist Milton Friedman proclaimed in 1970 (the relative infancy of the modern CSR movement) that in a free society, “there is one and only one social responsibility of business—to use its resources and engage in activities designed to increase its profits so long as it stays within the rules of the game.” The seeming contradiction between Friedman and CSR proponents lies in how each defines CSR. Friedman focuses on “true” CSR expenditures, which provide only social benefits. As a result, under Friedman’s view, companies undertaking CSR initiatives do so to the detriment of shareholder value.

These findings should serve as a wake-up call to executives who are either currently undertaking CSR or considering future CSR investments.

Our research on the impact of CSR expenditures on financial performance suggests that the views of both CSR proponents and Friedman are incomplete. We find that CSR expenditures generate insufficient returns and hence reduce shareholder value, consistent with the Friedman view. However, we also find that companies whose CSR spending exceeds investor expectations experience positive stock returns, consistent with evidence promoted by CSR proponents.

We reconcile these conflicting results by identifying a signaling component to CSR expenditures. When investors see a firm withhold or devote resources to CSR initiatives, they infer that its executives are acting on private information about the future earnings and cash flows of the firm. For example, if a firm spends more on CSR than investors expect, the excess component of CSR is viewed as an indicator of positive future financial performance. We find that the positive stock returns experienced by CSR firms do not arise because the economic benefits of CSR exceed their costs but because investors interpret excess CSR expenditures as a precursor to positive future financial performance. To put it simply, CSR is what “rich” companies do!

At a time when more and more corporations pursue CSR initiatives, often untethered from business strategy or performance metrics, executives need to understand the long-term value of these efforts and recalibrate their strategies accordingly. They must consider whether the corporate benefits from CSR justify their costs. Our research shows that, on average, they do not.

Over the past decade, more companies have embraced CSR and now disclose their activities to investors on an annual basis. In 2011, for instance, 57 percent of Fortune 500 companies issued corporate accountability reports, up from 20 percent the previous year. The growth of CSR can be traced in part to the expectation that companies can profit by serving the greater social good. For example, one of the justifications for CSR is that it builds pride and cohesion among employees, which results in better operational performance.

Many corporations have sought to use social impact as a core element of business strategy, identifying benefits and making informed choices. Others have proceeded in a more slipshod way, assuming that markets and customers would reward them for their corporate citizenship and virtue. However, absent a direct connection between CSR and financial performance, Friedman and his followers would seem to be right: executives would be irresponsible to pursue CSR initiatives.

Our research addresses two primary issues. Is CSR associated with improved financial performance? If so, what is the direction of the causality? In other words, do CSR expenditures lead to improved financial performance or does the anticipation of improved financial performance lead to CSR expenditures. We address these issues by focusing on three broad categories of strategic goals for CSR expenditures.

Are CSR expenditures charitable donations? The truest form of CSR is when a company makes a direct monetary contribution for which it expects no return. An anonymous gift to a good cause would be one example.Do corporations view CSR as a business investment? As noted above, many companies use CSR to address a social issue (such as the environment) while earning a positive economic return (for example, in the form of enhanced reputation). Although the benefits can sometimes be less tangible and thus harder to measure, executives expect some return on this investment. Spending need not be directly related to operations―McDonald’s establishment and support of the Ronald McDonald House charities is one example. By seeking to serve the greater social good, these efforts may increase the corporation’s image, boost revenues, and reduce costs (for example, if employees value such contributions and therefore accept lower direct wages).

Do CSR expenditures provide new information about future financial performance? Consider a business that has experienced a breakthrough that will cause profitability to soar in future periods. Information about this development is known only to the company’s executives. If executives were to increase the current level of CSR expenditures because of this information, then the CSR expenditures act as a mechanism that signals information about the company’s future prospects to investors.

To explore the link between CSR expenditures and financial performance, we collected information on CSR activities from the Thomson Reuters ASSET4 database, which provides comprehensive CSR data for companies in the Russell 1000. ASSET4 evaluates companies using 250 key performance indicators (KPIs) in four categories of performance: economic, environmental, social, and corporate governance. Our sample consists of hundreds of companies from 2002 to 2010 across a number of industries, and the primary measure of CSR investment relies on environmental and social factors only.

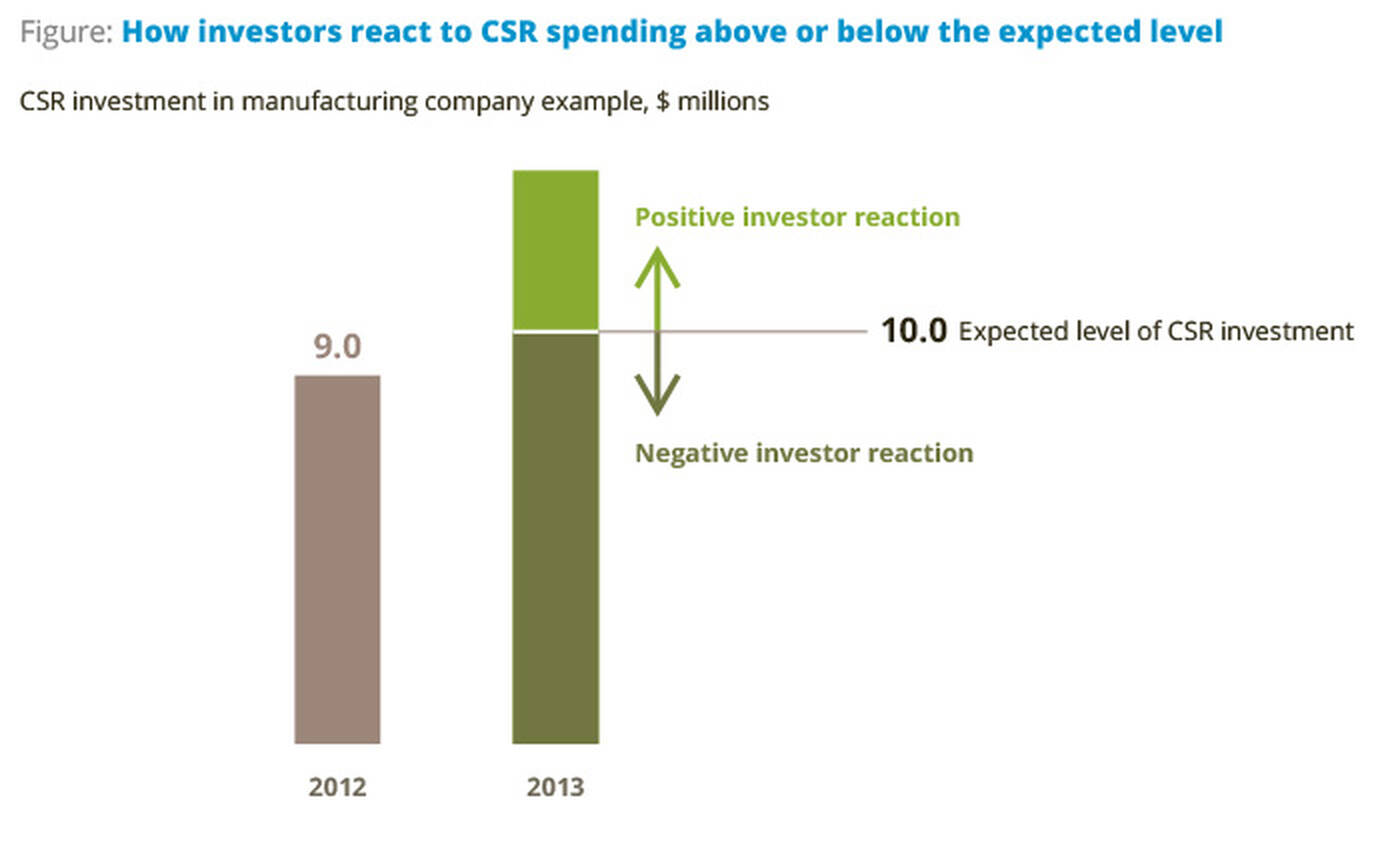

We compare a company’s CSR expenditures with its financial performance as measured by return on assets, operating cash flow, and size-adjusted stock returns. A key assumption in our analysis is that, based on a company’s current observable performance, operating characteristics, and industry, investors expect a certain level of CSR investment. To understand how CSR expenditures affect future performance, we distinguish between the expected and unexpected components of CSR expenditure. A positive association between financial performance and the expected component of CSR expenditures is consistent with CSR behaving much like a business investment, whereas a positive association between financial performance and the unexpected component is consistent with signaling. Our results are inconsistent with the investment explanation but consistent with the signaling explanation.

When investors see a company devote significant resources to CSR initiatives, they infer that its executives are acting on private information about future earnings and cash flows. In essence, only businesses that expect to have excess cash down the road can undertake such initiatives now. Even if a company took pains to communicate that it is a socially responsible enterprise, our results indicate that information in the corporate accountability report can be used as a more accurate predictor of future financial performance.

These findings contradict the current school of thought, which holds that CSR expenditures create value by being mutually beneficial to the company (through better operations or performance) and society (by helping to make a positive social impact). Our results show that CSR expenditures typically destroy shareholder value: the return they generate, on average, is below the company’s cost of capital. So while executives may believe that CSR creates goodwill among consumers and regulators—and it may do so in targeted circumstances —our research indicates that from the perspective of investors, these expenditures do not make a sufficient contribution to the bottom line to justify their capital costs.

However, the overall level of CSR investment does have an impact on market perceptions. In short, investors expect that only successful companies have enough cash and resources to sustain CSR expenditures. Companies that exceed the expected level of CSR spending are perceived by investors as signaling better future performance. To highlight our approach and results, assume that in the previous year a company spent $9 million on CSR efforts. Investors, anticipating continued strong performance, might expect its level of CSR investment to be $10 million for the coming year. If executives spend $10.5 million—thus exceeding the expected level—investors interpret it as a positive sign and respond by bidding up the company’s stock price. Similarly, if CSR expenditures only total $9.5 million, investors will perceive this underinvestment as a negative indicator of future performance.

These findings should serve as a wake-up call to executives who are either currently undertaking CSR or considering future CSR investments. Imagine that a company has a set amount to spend on CSR for the coming year and can choose between two options: support safe-water projects in Africa or simply give money away on a street corner. The choice seems ridiculous on its face. After all, the former would seem to confer reputational benefits, while the latter could result in derision or even serious misgivings about the judgment of the executive leadership. However, both choices provide comparable information about the company’s future cash flows: it would not engage in either activity unless it expected to have excess cash in the future. In simple terms, CSR is what “rich” companies can afford to do and “poor” companies cannot.

We recognize that our findings highlight a contradiction: while CSR expenditures do not create value for the typical business, investors expect that corporations will engage in a basic level of CSR, and deviations from this level will be interpreted as an indication of health and profitability. As executives reexamine their approach to CSR, they should keep the following lessons in mind:

Recognize the signaling power of CSR expenditures. Many executives have operated under the impression that CSR expenditures are indicators of their company’s virtue and progressive priorities and that investors would interpret these qualities as a sign of a high-functioning organization. Instead, these expenditures appear to be another channel through which a business communicates its financial prospects. Therefore, executives should be aware of how investors will perceive their organization’s level of CSR expenditure.

Become more strategic about CSR. Since our results indicate that CSR, on average, does not increase shareholder value, executives have the responsibility to be even more strategic about which CSR efforts to pursue. Some companies have made inroads in integrating CSR into business strategy. For example, when expanding into international markets, executives might choose to support causes or programs in these countries. Since investors expect successful companies to maintain CSR investment, corporate leaders should determine where these expenditures will make the greatest impact.

Our findings highlight a challenge around CSR: investors perceive it as discretionary spending unrelated to operational performance. Proponents of CSR cannot rely on general associations between financial performance and CSR expenditures in promoting these activities. Rather, they must clearly demonstrate the impact of specific initiatives in measurable terms to advance the merits of CSR.

“Signaling Through Corporate Accountability Reporting,” SSRN Working Paper, Social Science Research Network, February 2013.