Featured Faculty

DeWitt W. Buchanan Jr. Professor; Professor of Accounting Information & Management; Chair of the Accounting Information and Management Department; Co-Director of the Accounting Research Center

Jesús Escudero

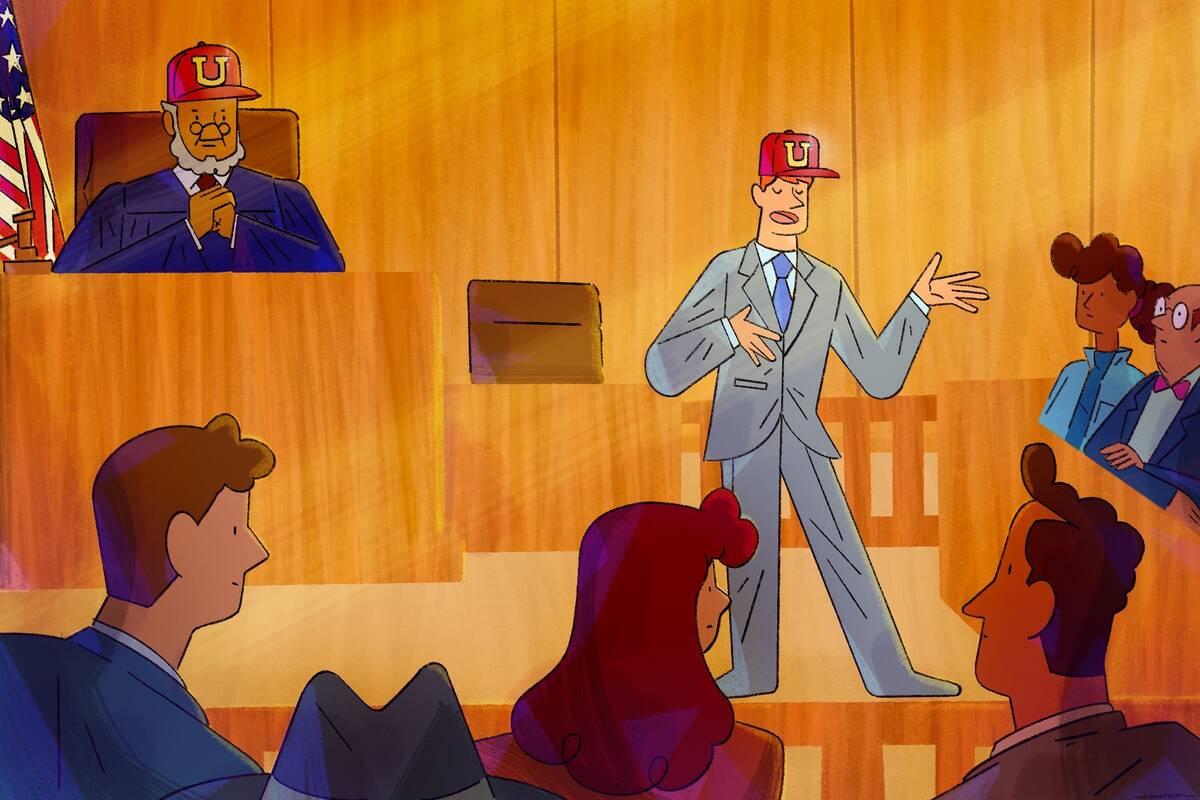

The Code of Conduct for U.S. Judges is clear: judges should not allow family, social, political, or other relationships to influence their judicial conduct or judgment.

Despite this mandate, recent reports have uncovered numerous instances of judges unwilling to recuse themselves from cases involving financial conflicts of interest. A 2021 The Wall Street Journal investigation, for example, identified more than 130 judges whose stockholdings pointed to conflicts violating the Code of Conduct.

But unlike financial conflicts of interest, social ties between judges and defendants have been subjected to far less attention and systematic research. So Sugata Roychowdhury, a professor of accounting information and management at Kellogg, set out to address this gap in new research investigating the role of social connections in corporate-law rulings.

“Social ties shouldn’t matter in the setting of corporate-law rulings if judges are adhering to the Code of Conduct,” Roychowdhury says. “We thought, ‘Let’s see if they do matter. Unlike financial holdings of judges, they are often not as obvious.’”

Alongside coauthors Sterling Huang of NYU Shanghai, Ewa Sletten of Fisher College of Business at The Ohio State University, and Yanping Xu of Sun Yat-sen University, Roychowdhury found striking evidence that social ties between judges and defendants do, in fact, matter. The research showed that, in cases involving firms subject to securities litigation, the outcomes were overwhelmingly favorable for firms with executives who attended the same academic institution as the judge at overlapping times.

Specifically, cases in which the judge and company executive shared this social connection across a range of public and private institutions were 24 percent more likely to be dismissed, were resolved about 21 percent faster, and were associated with 49 percent lower lawsuit payouts. And the more direct the connection was between a judge and executive, the more favorable was the outcome.

The findings raise questions about the impartiality of the judicial system.

“Consider everything that’s been in the news about the financial connections of judges, and how they have influenced court rulings,” Roychowdhury says. “Our paper is saying, ‘Well, that’s just one source of outside influence. There are others—like family, social, and political ties—and many of those are going to be very difficult to chase down.’”

Roychowdhury’s initial spark of interest in the ties between judges and corporate executives emerged when he learned about wide discrepancies in how judges ruled in civil and criminal cases in part due to biases related to a defendant’s race, gender, or religion. He wanted to know whether similarly wide and unfair discrepancies existed in business law.

“We figured, on the one hand, if judges can have these disparate outcomes in settings like civil law and criminal law, why would we not expect that in the business setting?” says Roychowdhury. “On the other hand, in business, we have this concept of arm’s-length relationships, and most parties understand the sanctity of contracts. And so we thought maybe there’s good reason not to expect similar results in a business setting.”

The researchers narrowed their area of focus to a sample of 1,647 class-action lawsuits filed between 1996 and 2017 that allege misleading corporate disclosure or fraudulent financial reporting, in line with the Securities and Exchange Act of 1934 Rule 10b-5.

“A requirement of transparency would go a long way in assuring the public, assuring plaintiffs, and assuring defendants that what they’re witnessing is at least transparent, and possibly fair.”

—

Sugata Roychowdhury

The judges in these cases are defined as having a “social connection” with the defendant if they had overlapping attendance at the same undergraduate or postgraduate institution as at least one senior officer or director from the defendant’s firm.

Roychowdhury points out that casting back to relationships formed in the college era reduces the possibility of transactional, opportunistic friendships.

“If you go back far enough, you can assume that these connections must have formed way before anybody knew they were going to get sued, right?” he says.

The researchers’ analysis of longtime social ties between judges and defendants revealed a startling pattern: well-connected defendants received significantly more-lenient litigation outcomes.

The initial findings were so striking that Roychowdhury’s first instinct was to question them.

“I said, ‘If we’re getting such big discrepancies, we’re probably doing something wrong,’” he says. But additional tests and controls only sharpened the findings and bolstered their persuasiveness.

For example, the researchers ran one subsequent test to determine whether the likely strength of a connection (based on the size of an educational program) predicts more-favorable treatment from judges—and they found that it did. What’s more, the connection between judges and company executives who shared an alma mater did not yield significantly favorable outcomes if they did not attend the institution at the same time, suggesting that it is direct acquaintance, rather than school pride or a similarly shaped educational mindset, that yields preferential treatment.

They also found that when a company executive was socially connected to the judge and personally named as a defendant, there was a greater likelihood of favorable outcomes. This points to the possibility that when judges are more aware of their personal connection to a case, their ruling changes accordingly.

Finally, the research team examined whether the biases demonstrated by the judges emerged as a result of unconscious thought processes or conscious (likely strategic) ones. They found, concerningly, evidence pointing to the latter. In cases subjected to media scrutiny and public attention, judges were less likely to offer defendant-friendly outcomes, suggesting that judges weighed the optics of their connections and leniency.

“We were a little disturbed when we found deliberately attenuated bias,” Roychowdhury says. “This suggests that the judges are actually tempering their favorable outcomes based on whether the media is involved or not, which suggests the dismissal rate is too high for connected judges. Otherwise, why would outcomes go down for cases that receive wide media coverage?”

Though the Code of Conduct for U.S. judges prohibits the influence of personal relationships, it does not currently require the disclosure of social ties; Roychowdhury believes that needs to change.

“Judges should be transparent about the existence of any possible outside influence,” he says. He points out, for example, that this is how the policy works for peer-reviewing academic articles; if a reviewer knows an author, they must disclose it to the journal before reviewing, so it’s a matter of record. “A requirement of transparency would go a long way in assuring the public, assuring plaintiffs, and assuring defendants that what they’re witnessing is at least transparent, and possibly fair.”

He also emphasizes that more research is needed to explore the potentially corrupting influence of other forms of judicial bias.

“The Code of Conduct mentions family, social, political, financial, and other relationships,” Roychowdhury says. “Thus, these must be sources of bias that the Code has already identified as potential problem areas. So as researchers, we should at least be paying more attention to those.”

Katie Gilbert is a freelance writer in Philadelphia.

Huang, Sterling, Sugata Roychowdhury, Ewa Sletten, and Yanping Xu. 2024. “Just Friends? Managers' Connections to Judges.” Journal of Accounting Research.