Finance & Accounting Apr 23, 2021

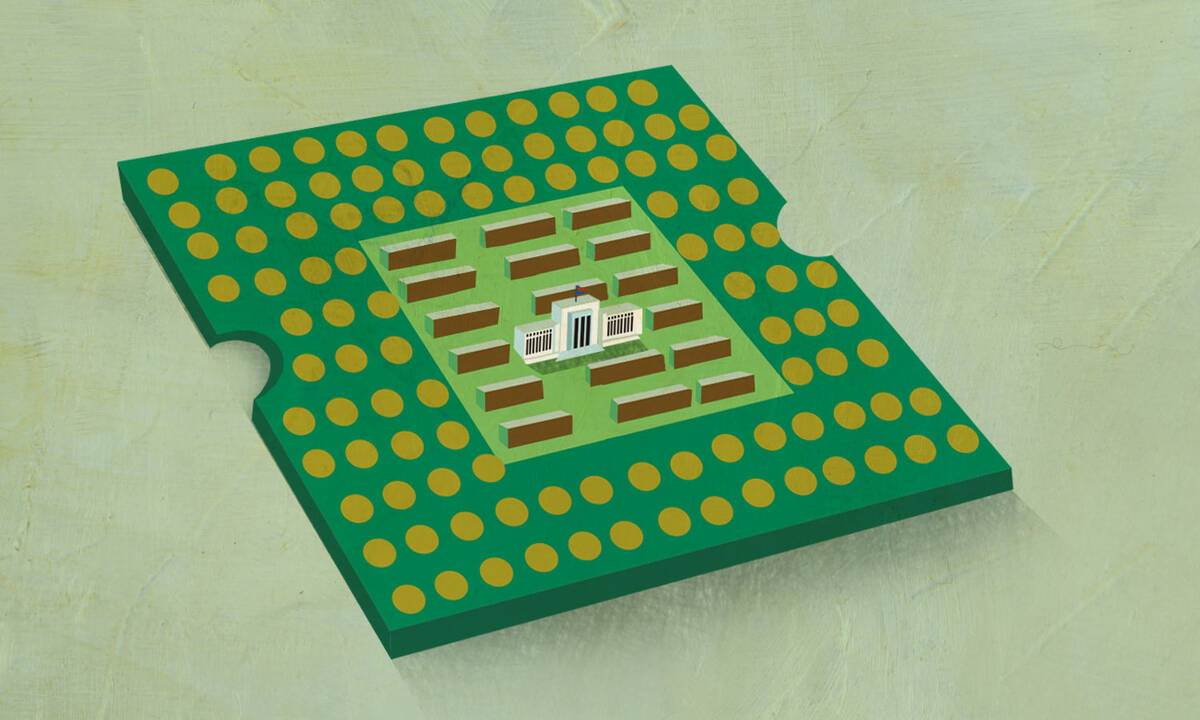

It’s Time for Central Banks to Start Issuing Their Own Digital Currencies. Yes, Even the Fed.

The case for why central banks and policymakers must jump in the race now or risk getting left behind.

Yevgenia Nayberg

As the Covid-19 pandemic continues to fuel the rise of noncash payment alternatives, central banks around the world are facing increasing calls to introduce their own digital alternative to cash.

To be clear, these calls are not for government-sponsored versions of PayPal or Venmo, which are ultimately transferring balances from one bank account to another, but for currencies that are fully digital and that can be accessed and stored independently from the current banking system.

If central banks do not adapt to a rapidly digitalizing economy, they will get left behind—as will the economies they are supporting. The question is no longer whether to introduce central bank digital currencies (CBDCs) at all, but when and how to introduce them without jeopardizing the stability of the banking system and slowing down innovation in payment technology.

In light of competition from China, the European Central Bank (ECB) and the U.S. Federal Reserve System (Fed) need to up their game.

The Technology Is Already Here

Cryptocurrencies such as Bitcoin and Ethereum were the first to show what is possible with blockchains and distributed ledger technology.

Bitcoin, launched in 2009, was originally conceived as a “peer-to-peer electronic cash system” by its pseudonymous creator Satoshi Nakamoto. It operates on an open-source cryptographic protocol, a blockchain, and allows for online payments to be sent directly from one e-wallet to another e-wallet without going through a financial intermediary.

These characteristics come with a lot of advantages over traditional payment systems: e-wallets are protected by public-to-private key encryption, and they can be accessed via the internet from anywhere in the world, making them just as convenient for international payments as for domestic ones. Bitcoin transfers are most of the time performed without fees and typically settle within a few hours, as opposed to bank transfers, which often do have fees attached and can take several days to complete.

Ethereum, the next generation blockchain launched in 2015, adds a programming layer and allows for the automation of payments through so-called “smart contracts” and decentralized applications. This system, in which a transfer of tokens is recorded on the Ethereum blockchain, is compatible with a programmable, autonomous, and automated flow of goods and services—exactly what’s needed to support machine-to-machine or pay-per-use payments in the future “internet of things.”

In recent years, private firms have introduced “stablecoins,” which combine the advantages of a public blockchain-based payment infrastructure with the stability of a fiat currency like the U.S. dollar.

[Central banks] have to realize that, unless they want to cede a tremendous amount of control over their own national currencies and economies, they must actively compete with privately distributed cryptocurrencies and stablecoins.

Take USDC, a stablecoin launched in 2018 by a consortium called Centre, which consists of Coinbase, the crypto-exchange, and Circle. The USDC smart contract only creates USDC tokens if equivalent amounts of U.S. dollars have been wired to the issuers bank account. It runs on the Ethereum blockchain. And USDC is regulated: all issuers are required to report their holdings on a monthly basis through Grant Thornton LLP, the audit firm. Recently, Visa announced it will accept USDC for transaction settlement—a step that puts stablecoins on the verge of becoming mainstream.

Banks are following suit. The Office of the Comptroller of the Currency (OCC) recently allowed U.S. banks to use stablecoins and operate computer nodes in blockchain networks. J.P. Morgan, the largest U.S. bank, has even created its own permissioned blockchain called Quorum, built on Ethereum, to issue its proprietary JPM Coin, a stablecoin backed by USD deposits with J.P. Morgan.

And then there’s the Diem project (formerly known as Libra), which was announced by Facebook, though it has not yet been launched. Diem is designed to run on a private, permissioned blockchain that runs on independent nodes operated by a limited number of member organizations of the Diem foundation. Diems will be issued into the e-wallets of Facebook customers against USD deposits with the Diem foundation. The Diem foundation will then manage the Diem reserves like a fund through investments in short-term bank deposits, as well as in sovereign bonds. With 2.8 billion average active monthly users, Facebook is the largest social-media network in the world: if even a fraction of its users or merchants were to adopt this stablecoin, the impact on the global financial system could be substantial.

Central Banks Still Have a Role to Play

Still, it’s important to recognize that neither cryptocurrencies nor stablecoins like USDC or Diem could ever be a substitute for central-bank-backed fiat currencies—at least not a desirable substitute.

For instance, only 7 transactions can be processed on the Bitcoin network per second—a tiny fraction of the 24,000 transactions per second processed by Visa. While Bitcoin is in principle a low- or no-fee alternative for otherwise very expensive cross-border remittances, Bitcoin’s volatility, the low number of merchants accepting it, and the limited number of exchanges that can convert Bitcoins back into local currencies still make it a poor alternative to, say, a bank transfer.

Ethereum’s capacity to run smart contracts and process token transfers from one e-wallet to another is also limited as long as it relies on the same computationally intensive consensus mechanism (or way of authorizing and synchronizing a transaction) as Bitcoin does. Even if the capacity of the Ethereum blockchain is finally increased through the switch to a less computationally intensive consensus mechanism, there still remain a significant number of cryptocurrency-specific technological, legal, regulatory, and reputational risks.

While stablecoins like USDC introduce the stability of fiat currency into the cryptocurrency space and allow cryptocurrency investors to realize their speculative gains by instantly exchanging them for stablecoins instead of going through the cumbersome process of selling them for cash, they also introduce new risks. Who oversees the minting and burning of USDC? What happens if there is a run on USDC? Do holders of USDC benefit from the same deposit insurance and lender-of-last-resort backstops as bank depositors do? What happens if Centre or its backers declare bankruptcy?

And even Diem, although it has fully subscribed to the concept of a regulated, single-currency, centralized stablecoin arrangement running on a permissioned private blockchain, with strong protections built into the reserve management system, still raises many questions regarding consumer data protection, reserve management, and financial stability: How can consumers be sure that Facebook will not use the transaction data for advertising purposes? Where is the reserve actually held and invested? And what does it mean for financial markets if a large portion of the reserve needs to be liquidated to meet liquidity demands if holders all of a sudden lose faith in Diem?

It’s Time to Compete

There is a broader issue at play, though. Even if all of these questions were satisfactorily resolved, central banks can hardly stay above the fray and leave their citizens alone in the sea of private centralized and decentralized payment. They have to realize that, unless they want to cede a tremendous amount of control over their own national currencies and economies, they must actively compete with privately distributed cryptocurrencies and stablecoins.

Central banks in less-developed countries with weaker currencies will need to issue CBDC if they want to provide their citizens with an efficient payment system without sacrificing the sovereignty of their currencies. Central banks in developed countries are typically less worried about financial inclusion. But they still need to introduce a CBDC option to ensure their citizens have access to fiat currency better suited to the digital age. And their sophisticated manufacturers and merchants would not want to miss a fiat-currency anchor as they begin to transition towards a more programmable and automated economy and the internet of things.

Therefore, it is hardly surprising that most central banks are at least exploring CBDCs—and some are doing more than exploring.

The Bahamas have emerged as a front-runner with the launch of the first retail CBDC, the digital B$ or sand dollar, which is pegged in value to the U.S. dollar. A system of authorized financial institutions was created to provide identification, wallet, and safe-keeping services.

In terms of the larger central banks, the People’s Bank of China (PBOC) seems to be the most advanced. In 2020, the PBOC confirmed that it had been testing a digital yuan in four cities, involving the largest state-owned banks as providers of mobile wallets.

In the Western world, Sweden’s Riksbank has been at the forefront. Last year, Riksbank launched an e-Krona pilot to test payment, deposit, and transfer functionalities in a distributed ledger environment. Meanwhile, the ECB has been experimenting with virtual currencies for quite some time and recently published a report on a digital euro. It is now finally expected to embark on a digital euro project this summer.

In the U.S., the Fed has begun conducting research on CDBC and recently announced a multiyear research collaboration with the Massachusetts Institute of Technology. While it is investing heavily in understanding the technology and policy questions, the Fed does not seem to be in any rush to issue a digital dollar anytime soon.

Getting Ready for a World with CBDC

Still, it is conceivable that we will see ECB, the Fed, and other major central banks follow the PBOC’s lead and issue CBDC during this decade. This will require national governments to create the appropriate legal frameworks for the issuance and usage of CBDCs. It will also require international cooperation, as true efficiencies in payments can only be achieved if CBDCs are interoperable. International cooperation will also be required to safeguard CBDCs from cyberattacks.

The journey won’t be easy. Central banks around the globe will need to navigate new technologies, rethink the role of financial intermediaries such as banks in the payment system, and also be ready to engage with critics who question whether they “should” be issuing CBDC in the first place—as opposed to relying on continued private-sector innovation and merely regulating payment providers. They will also need to determine how to address consumer privacy in a cashless world.

Central banks are finally recognizing that a new era of digitalization is upon us. The ECB and the Fed in particular would be wise to push themselves to move more quickly than they might otherwise move—without compromising on due diligence and care. Meanwhile, banks and private payment-service providers should prepare their infrastructure and service offerings for a world with CBDC. And all of us should be following these developments very closely, because our economic future depends on this transition going well.