Featured Faculty

Associate Professor of Management & Organizations (2013-2021); Associate Professor of Sociology, Weinberg College of Arts & Sciences (Courtesy)

Michael Meier

No fuss, no fanfare: that appeared to be IBM’s philosophy when, in 2011, it quietly named the first female CEO in its 100-year history.

Some consider this low-key appointment simply part of the company’s dislike of drama, as well as its penchant for keeping the spotlight on the company, rather than on a specific executive. But the Kellogg School’s Ned Smith has a different theory.

Maybe, he thinks, IBM simply figured out something Smith has suspected for a while: companies that appoint female leaders are better off if they avoid announcing those CEO appointments with anything approaching pomp and circumstance.

Smith, an associate professor of management and organizations, got the idea for this research while contemplating the following conundrum: A growing body of research has found several advantages associated with female leadership, such as more collaborative work environments and more innovation. Thus, as Smith and his coauthors, Kevin Gaughan, a Kellogg PhD student, and Jason Pierce of Universidad Adolfo Ibáñez, write, “investors should respond favorably to the appointment of female executives.”

Yet other research shows that when a company announces it is appointing a female CEO, many of that company’s investors react unfavorably. For example, one paper found that firms that name female CEOs see a 2 percent decline in stock price on the day the appointment is announced.

“I said, ‘You know, that doesn’t really make sense,’” Smith recalls. If female leadership comes with significant benefits, then why would investors respond negatively? Are those investors simply unaware of the benefits of female CEOs, biased against women in leadership positions, or both?

Smith figured there was something else going on.

“One of our initial predictions, which does not take a rocket scientist to make, was that when a woman is appointed as CEO, it’s likely to generate a lot of buzz in the press,” he says. “So we had the suspicion that maybe it’s what’s happening in the media [that affects investors’ reactions], as opposed to the woman herself.”

Plus, an important factor in investor decision-making was being ignored in the existing research on the topic: an investor’s ability to make money, at least in the short term, depends in large part on the actions of other investors.

“If the problem is that we have pessimistic views about what other people think, we may be inclined to act as if we are biased ourselves.”

Meaning, Smith says, “When investors are responding to appointments, they are doing far more than just giving their opinion on a particular woman or particular firm. They’re gleaning information from all around them. We thought that would be worth looking into.”

So the researchers conducted an extensive analysis to test their ideas.

They used one of the largest media-coverage databases ever assembled to measure the amount of media attention garnered by each of the 8,179 CEO appointments made by publicly traded American firms between 2000 and 2014.

The team also collected information such as stock price and market capitalization, as well as board- and CEO-level data.

As for the media mentions, the authors looked only at coverage issued the same day as the CEO announcement. That was to rule out reverse causality, Smith explains: “These events trigger media attention, and we want to focus on how people are responding to that attention, as opposed to the other way around,” whereby media might respond to movements in the market.

The bad news: of those 8,179 appointments, which were associated with 2,573 firms, only 84 were women. “I knew it was one-sided, but I didn’t realize it was still quite that bad,” Smith says.

The good news: those 84 women represent more than three times as many female CEO appointments as have been examined in any previous research. Previous studies relied on data from places like the S&P 500, which is a much more limited sample size. So this data is able to give a more accurate picture of what is really happening.

On analyzing the data, Smith and his coauthors made four important discoveries:

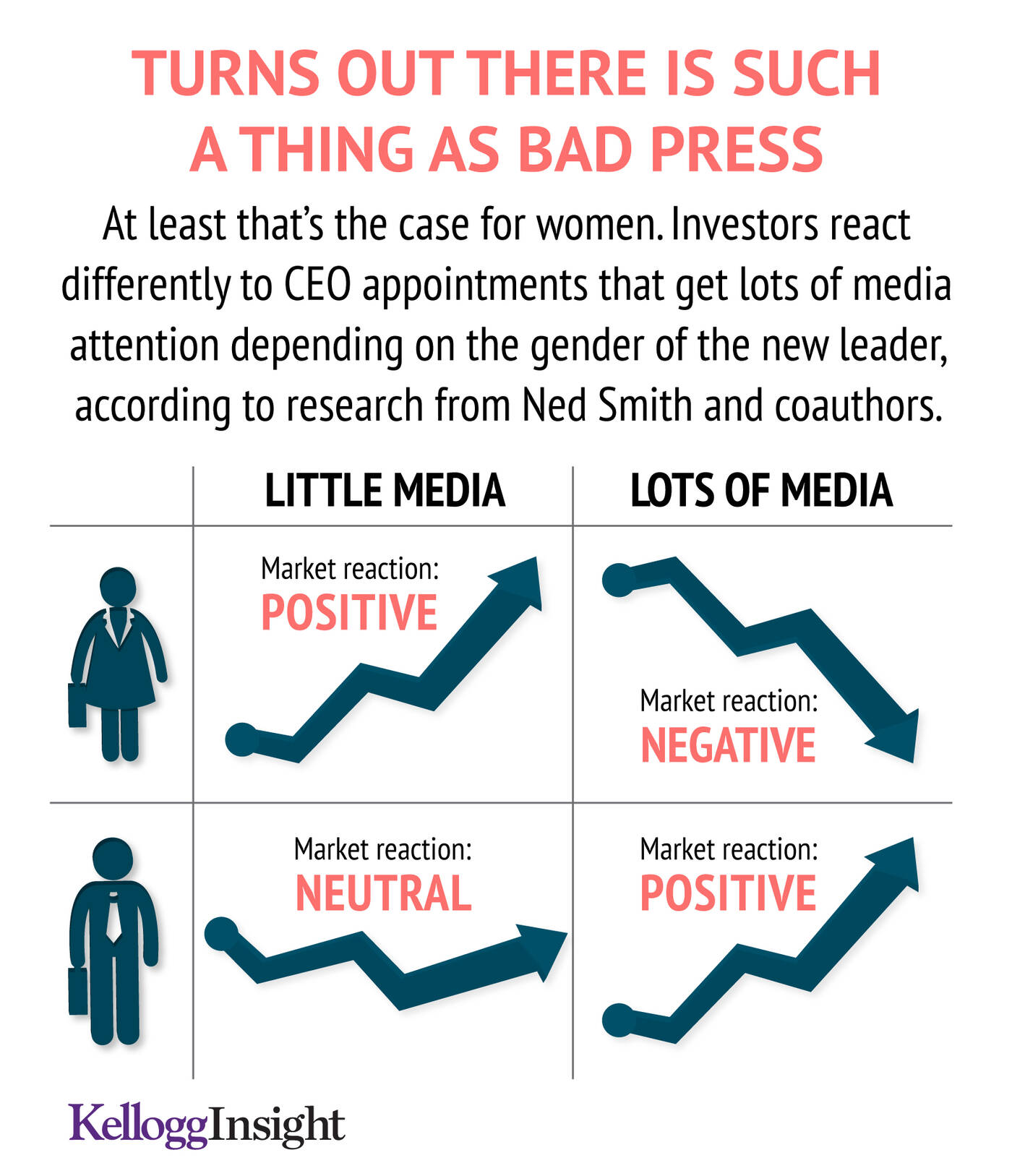

• When companies appointed female CEOs and received lots of media attention for it, they were likelier to experience negative market reactions.

• Companies that appointed male CEOs and received similarly large amounts of media attention were likelier to experience positive market reactions.

• Companies whose female-CEO announcements garnered small amounts of media attention were likelier to experience positive market reactions, compared with companies appointing male CEOs receiving limited attention and companies appointing female CEOs receiving significant attention.

• There were no major differences in the tone or sentiment of media coverage associated with male versus female CEO appointments. This helps to rule out the possibility that the media is directly responsible for any bias through differences in the way it reports on executives of different genders.

In other words, investors can reward the appointment of a female CEO, but only if Ms. Chief Executive Officer does not get too much press.

“It’s one of those things that makes you realize just how depressing some of your findings can be,” Smith says.

Given the data, Smith and his coauthors theorize that these market reactions hinge not just on investors’ beliefs about a particular CEO, but also on investors’ beliefs about other investors’ beliefs.

So when the appointment of a female CEO receives a lot of attention, even investors who are not biased against women in leadership positions may base their responses on the expectation that other investors will be. Increased attention, in other words, triggers what the authors refer to as “second-order sensemaking” whereby investors interpret not only the meaning of the executive appointment but also the meaning of the increased attention surrounding the appointment. Conversely, when a female CEO appointment does not get much attention, these same investors are more likely to respond based on their own unbiased—and according to the data, positive—beliefs.

That, Smith says, makes bias a much stickier and more troublesome issue than it would otherwise be.

“If it’s just that investors themselves are biased, that problem’s ideally going to go away over time, as there are more women in CEO positions, and with more education,” he points out. “Whereas if the problem is that we have pessimistic views about what other people think, we may be inclined to act as if we are biased ourselves, so this becomes a much more thorny problem to deal with, and it will stick around for a much longer time than it otherwise would.”

In the meantime, how should companies that are planning to appoint female CEOs handle media coverage?

“It’s a double-edged sword,” Smith sighs. “A lot of companies want to appoint female CEOs, not only because they realize this is a hugely untapped resource, but because there’s also a potentially beneficial signal to the market: ‘Look, we are doing something new and different.’ So the knee-jerk reaction would be, ‘Yeah, let’s get lots of attention for this! It’s going to make us look good!’ But given our findings, the somewhat pessimistic recommendation is: It would seem that companies appointing female CEOs would be better off doing that quietly.”

Gaughan, Kevin, Edward Bishop Smith, and Jason Pierce. 2016. “Better in the Shadows? Attention, Media Coverage, and Market Reactions to Female CEO Appointments.” Working Paper.