Finance & Accounting Sep 1, 2025

Big Goals, Small Steps—Why Most Corporate Green Initiatives Fall Short

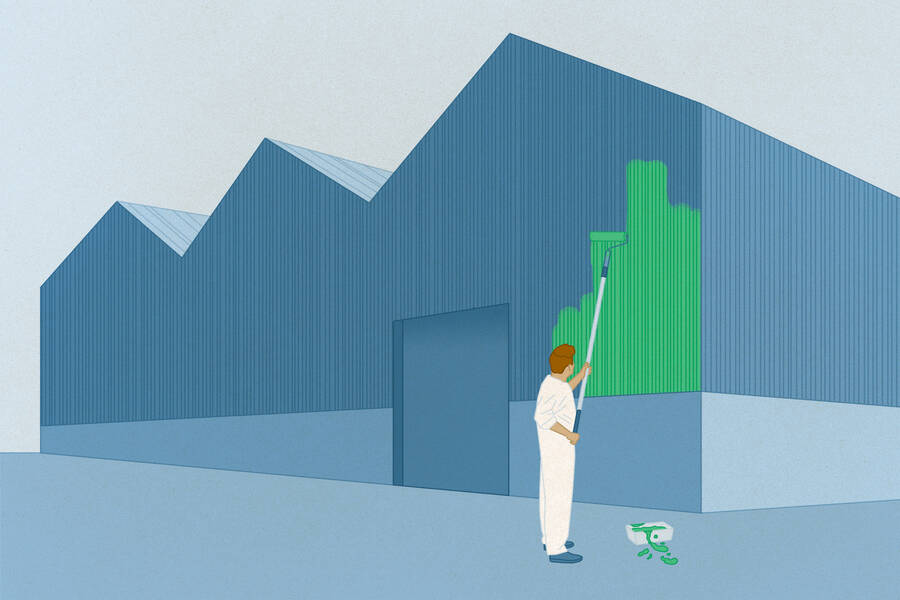

Despite making commitments to cut emissions, many companies are acting in the short term and underfunding projects.

Yifan Wu

Facing pressure from investors and the government to reduce their carbon emissions, many firms have committed to net-zero emissions targets. In order to meet these lofty goals, one might assume that companies are making costly long-term investments in transformative technologies.

But when Kellogg’s Aaron Yoon and his colleagues examined data on thousands of emission-reduction initiatives at large companies, they found that the majority were projects with a quick payoff (that is, with a short payback period). Most projects were about improving energy efficiency in buildings. That doesn’t exactly scream transformative.

If you imagine ambitious emission-reduction projects, “you would think about blue hydrogen or wind farms,” says Yoon, an associate professor of accounting and information management. “You wouldn’t think of LEDs and switching lightbulbs.”

The median investment per project was $127,000, they found, much lower than the roughly $10 million to $20 million that Yoon expected a project might need to truly help a company hit its goals.

“It was an unexpected finding,” he says. “The companies are not actually doing all that much.”

The results counter a common argument among researchers and policymakers that people need to give companies some slack because they’re investing in big, complex projects that take many years to pay off.

“Contrary to popular belief, firms’ emission-reduction initiatives are not focused on the long term,” Yoon says. “It’s generally the very quick-and-dirty type of stuff.”

These relatively easy fixes aren’t likely to lead to the most lifetime-emission-reductions overall. To make a major dent in emissions, companies will instead have to incorporate projects with longer time horizons into their strategy, which is an important implication of the study.

“In our paper, we found that firms with a combination of both short-term as well as long-term projects achieved the most CO2 savings,” he says.

Short-term thinking

Unlike firms’ financial statements, which are audited and filed with regulators, details on firms’ emission-reduction efforts are largely not audited or assured.

“We are in the nascent stages of carbon accounting,” Yoon says. “Generally, people are just taking companies at their word.”

Some firms do report their activities voluntarily to independent organizations that manage environmental-impact disclosures, such as the CDP (formerly called the Carbon Disclosure Project). The reports include details such as the amount firms invest in each project and the expected reduction in emissions.

“We have to think carefully about whether [companies] are incentivized to make longer-term investments.”

—

Aaron Yoon

Yoon and his colleagues, Catrina Achilles and Michael Wolff at the University of Göttingen and Peter Limbach at Bielefeld University, trawled through the CDP data to gain insight into the types of projects firms were pursuing and just how effective they were. The data included information on 9,937 emission-reduction projects from 2011 to 2021 reported by 455 large U.S. companies, many of them in the S&P 500.

For part of their analysis, the researchers focused on the projects’ payback period: the amount of time it would take for a project to allow a firm to recover its initial investment. For instance, a project designed to improve a firm’s energy efficiency might cost a certain amount up front, but the increased efficiency would presumably enable a firm to recoup those costs over time.

Yoon and colleagues found that 63 percent of the projects in which firms invested had a payback period of 3 or fewer years, while only 10 percent of projects had a payback period exceeding 10 years. In other words, firms mostly selected projects that offered short-term gains.

The researchers also found that most firms’ investments in emissions reduction projects were relatively small.

Sixteen percent of all projects required no investment at all. Among projects that required an investment, the average amount was about $9 million, driven mostly by a small fraction of projects that required a substantial investment. But the median amount, which represented a more typical investment, was only about $127,000.

Overall, firms’ total annual investment in emission-reducing projects amounted to less than 1 percent of their previous year’s profit.

Many of these companies “may have a tough time meeting their net-zero commitments,” Yoon says. “We have to think carefully about whether they are incentivized to make longer-term investments.”

LEDs and air leaks

The researchers then analyzed the types of projects firms chose.

About three-quarters fell into the category of energy efficiency in buildings or production, usually related to lights such as LED upgrades. Other projects commonly focused on leak detection and process optimization, such as reducing the run times of manufacturing production.

For the most part, these types of projects offered companies affordable and immediate carbon savings. And they tended to help firms save more carbon annually per dollar of investment than longer-term projects did—at least during the brief investment period.

“It’s just a quicker way to reduce a reasonable amount of emissions,” Yoon says. These projects also had a higher average net-present value, meaning that they were expected to generate more cash flow. “From a financial perspective, short-term payback projects are much more attractive, especially given that most CEOs are worried about the next year’s return,” he says.

But the picture shifted when the team looked at lifetime carbon savings. On this metric, long-term projects outperformed short-term ones.

The researchers estimated that the sweet spot to optimize emission reduction is to invest in a mix of 48 percent short-term and 52 percent long-term projects. Based on the CDP data, the average ratio at each firm was 61 percent short-term to 39 percent long-term.

A collective effort

Pushing firms toward long-term efforts may require a different mindset from the government and investors, according to Yoon. But that could mean shareholders must be willing to accept lower returns, at least in the short run. And members of society who purchase goods and services from these firms would also need to give up some luxuries and conveniences.

“We live in an interesting world,” he says. People say, “‘Hey, climate change is important,’” and firms say, “‘We must get to net zero.’ But then when you look at the firms, they’re not really doing much. And when you look at investors, they’re generally not willing to forgo any sort of return.”

For example, consider fast-food companies that use a lot of beef, which is highly climate-unfriendly. Are consumers and investors ready to pressure their favorite hamburger chain to switch to veggie burgers so that it can lower emissions? Or are people willing to stop using generative AI models like ChatGPT that require excessive quantities of water to cool down data centers?

“How much are we willing to forgo? And do we have the right incentives in place to encourage firm managers to take on projects that could lead us to net zero?” Yoon says. “Those are the big questions that we have to ask ourselves.”

Roberta Kwok is a freelance science writer in Kirkland, Washington.

Achilles, Catrina, Peter Limbach, Michael Wolff, and Aaron Yoon. 2025. “Inside the Blackbox of Firm Environmental Efforts: Evidence from Emissions Reduction Initiatives.” Working paper.