Featured Faculty

John L. Ward Clinical Professor in Family Enterprise; Executive Director of the John L. Ward Center for Family Enterprises

Lisa Röper

In 1917, John D. Rockefeller was worth about $25 billion—adjusted for inflation—thanks to his stake in Standard Oil, the predecessor of ExxonMobil. He gave his son roughly half that fortune, and in 1934 John Jr. established trusts for his six children. Twenty years later, another set of trusts was left to his grandchildren. With each generation, trusts divided, splintering the fortune.

“That’s how inheritance used to work,” says Jennifer Pendergast, a clinical professor at the Kellogg School and director of the Center for Family Enterprises. Either members of the succeeding generation working in the business bought out their parents; shares in the business were gifted across dozens, even hundreds, of family members; or the business itself was liquidated. “Create a trust company, manage a balanced portfolio, and spend no more than four percent of your assets year-over-year,” she says.

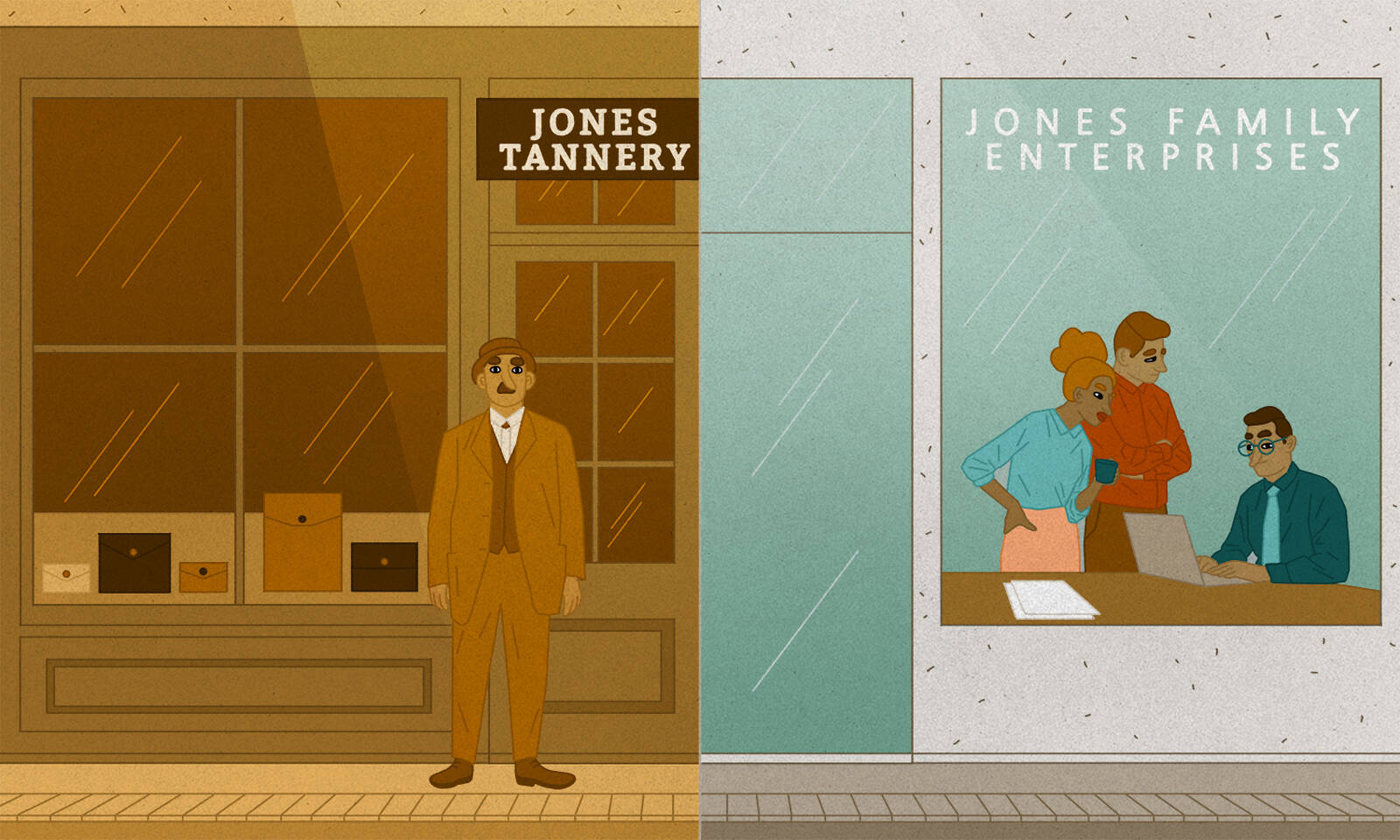

While these legacy models are still an option, today’s investing families are considering a range of different approaches to managing and enhancing their wealth, including ones that allow family members to actively pursue new opportunities. Pendergast describes this approach as becoming an “enterprising family.”

“Enterprising families are open to the idea of expanding beyond the legacy business,” Pendergast says. “Instead of keeping cash in the bank, you create the next entrepreneurial engine and retain the capital within the family. Businesses might come and go, but you can sustain that wealth across generations.” These families move beyond defining themselves as owning a family business to being a family in business together.

The benefits—such as the ability to pursue opportunities that align with family members’ values, as well as engage the next generation—can be huge. Not to mention that families can survive beyond a legacy business that may no longer be relevant to the marketplace. So how does an enterprising family find its footing? Prendergast offers five steps.

The most important step for a family business transitioning to the “enterprise” model is agreeing on a common purpose and shared vision of the future. Diversification into new businesses and industries for its own sake is not enough; there has to be a coherent set of values, goals, and principles that guide the process.

“The family needs to ask itself: What is the purpose of this wealth? How do we want to use it for the next several generations?” Pendergast says. “The goal, after all, is continuity—one of the great benefits of a family enterprise is that you can think longer term.”

Families stand to gain huge financial and psychic benefits from adopting the enterprise model—but only if they’re united. Establishing a shared vision allows a family enterprise to bring its unique vision to the marketplace. So families need to proactively set their own parameters before considering the more practical and financial concerns.

One agricultural and real estate development family sums up its vision as “Growing together.” While simple, this phrase holds a wealth of meaning for them: as the family grows, its members will stick together; they will continue to grow things on the farm, and they will consider other opportunities to grow the business. A frank discussion of purpose and priorities might also lead families to conclude the opposite: that it’s better not to stay together. After all, families bring their complicated histories to the enterprise.

FAMILY WEALTH CONTINUITY CONFERENCE

Kellogg hosts the Family Wealth Continuity Conference: Enterprising Family Investment Approaches on Friday, September 27, at the Kellogg Global Hub. This invitation-only event focuses on leading edge practices in achieving financial and family continuity through wise family investments.

“Sometimes it can make more sense to sell your chips and go home. That’s why it’s so important to ask: Why do we want to be in business together? You need a good answer to that before you step down this path.”

One benefit of becoming an enterprising family is finding a way to move beyond the legacy business and invest in more promising ventures.

“Families have rich histories, of which they are understandably proud, and sometimes they hold onto legacy assets simply because they’ve been in the family forever and shaped its identity,” Pendergast says. “But to succeed as an enterprising family, you have to be relevant in the marketplace.”

Pendergast sees the transformation of Carlson as an example of continued relevance. Founded in 1938 as a gold bond stamp company, Carlson evolved into a travel, restaurant, and hotel business, with Radisson and TGI Friday’s among the brand portfolio. After selling off the restaurant group and, more recently, the hotel group, the family created its own private equity fund, Carlson Private Capital Partners, which they use to invest in newer, promising businesses.

Family enterprises looking to make these kinds of transformations are advised to incorporate outside counsel. Once a family has determined the basic parameters of its strategy, a mix of family and nonfamily advisors can help them leverage their assets, skills, and expertise to expand their current holdings.

“Being good at running a manufacturing firm doesn’t mean you’ll be good at running a service business,” she says. “Those who follow this path have to think of investing as their new business, and the ones who do it well usually find someone who can help guide them in the right direction.”

Such transitions can also be an opportunity for next-generation leaders to build their own reputations, rather than live in their ancestors’ shadows. “People want to make their own mark, which can certainly be more fulfilling. But they need to do it with purpose and strategy.”

With a family business, however, the criteria for success isn’t only financial. This is especially true as young leaders take ownership of legacy companies.

“Millennials view family business differently. For them, it’s not just about making a good return. It may be about investing in environmentally sustainable, socially acceptable businesses, building a company with more flexible workplace policies, and so on. Ultimately, it’s their capital, and they’re not going to invest it in something they don’t believe in,” says Pendergast.

As families decide how to transform themselves, and which opportunities to pursue, they should think about what it will take to achieve consensus on these nonfinancial factors.

“The family needs to ask itself: What is the purpose of this wealth? How do we want to use it for the next several generations?”

“It’s important to have the whole family on board,” Pendergast says. “It’s kind of like doing a roadshow before an IPO. Your job is to convince the owners why they want to stay owners—why they should want to go on this journey of being an enterprising family.”

In some cases, this may require having difficult conversations about family priorities. Families may struggle to reconcile generational priorities. For example, members of elder generations are often more risk adverse, whereas the younger generations may be interested in making bets on new technologies or new business models. These differences need to be resolved before the family can move forward.

Pendergast describes a family that owns a large agriculture business. They recognized that the best financial move for them would be to grow marijuana, but they decided against it because they felt it sent the wrong message to their kids.

“Sometimes achieving family consensus can take a lot of patience,” Pendergast says. “But it’s worth it.” The process of achieving consensus helps the family get to know each other’s priorities, educates the family on opportunities, and presents family members with options they may not previously have considered.

Once the family has achieved that consensus on which business opportunities to pursue, it needs to determine how to govern this new enterprise. Some families move to a holding company structure, with a board that oversees all activities and capital allocation; others govern entities separately.

Pendergast advises families to think carefully about two things: where the family’s voice will reside in the chosen structure, and how best to incorporate independent expertise. Some families choose to have a family-only board at the holding company level. Others want independent directors to support them.

Some prefer to have independent directors at the entity level, but no formal governing mechanism over the larger enterprise, a move Pendergast advises against.

“The problem with having family members oversee each business without independent advice is that no one is able to make fully informed decisions,” Pendergast says. “They may not see the whole picture, so it can be hard to assess risk or know how to allocate capital.”

While building a strong board is critical, successful family enterprises also need to find a way to engage all members who want to play an active role, even those who are not on the board or leading a business. Whether that means creating a family council or another advisory body, titles should matter less than the fact that family members feel that their voices are being heard.

“It’s important to move beyond thinking that the only way the family adds value to the business is through management,” Pendergast says. “That’s not the ‘enterprising family’ mentality. The governance structure is important, of course, but people shouldn’t worry about the org chart before they have a sense that everyone’s in it together.”

Enterprising families are always works in process, so dynamic decision-making processes should be built into the organizational model.

“It’s an evolution,” Pendergast says. “Market realities constantly change, so the more flexible, adaptive, and reactive you are, the better.”

Meeting as a group once or twice a year allows families to get updates from management and consider new investment opportunities. When these enterprises begin diversifying into new opportunities, sharing the strategy with the broader family can eliminate surprises, manage expectations, and engender family support.

“The best owners are informed owners,” Pendergast says. “And to achieve that kind of transparency, you need to proactively educate the broad family ownership group on the opportunities and challenges at hand, so they can decide how the enterprise should evolve.”

And because every family enterprise is only as strong as the next generation, the company needs to find ways to keep its young members engaged.

For example, one enterprise took the opportunity to survey its broader family about how they would like to see cash from the sale of a resort redeployed. While building out industrial parks with warehouses for companies like Amazon promised the best returns, next-generation family members wanted investments they could point to as their own. So management turned to more visible retail and hospitality properties.

“Twenty years ago, people didn’t really think about whether the legacy business they inherited was ‘engaging,’” Pendergast says. “You either stuck with it, or you sold the shares. But this new generation has different ideas about work and purpose, and the factors that make the business relevant to them are very different.”