Featured Faculty

Elinor and H. Wendell Hobbs Professor of Management; Professor of Strategy; Faculty Director, Masters in Management Program

Why do some people in human capital intensive industries such as law and medicine decide to work together in firms? When do firms “extend their boundaries” by including a wider range of work and people with a broader variety of expertise? Why do some human capital intensive industries tend to generate these associations while others do not? According to research published by Thomas Hubbard (Kellogg School of Management), the answers to these questions are shaped in part by the value of sharing information about economic opportunities.

Hubbard and Luis Garicano (University of Chicago Graduate School of Business) investigated factors that determine firm boundaries in human capital intensive industries. They used confidential law office data collected by the United States Bureau of the Census. They examined information about how many lawyers in an office specialize in each of thirteen areas of the law. These data provide evidence about how lawyers specialize and how lawyers are organized into firms. By using this data, Hubbard and Garicano were able to examine central issues in the organization of human capital.

Their research findings suggest that the value of organizing lawyers into firms is to facilitate the exchange of information about economic opportunities. Hubbard explains: “What firms do is essentially weaken individuals’ incentives to withhold information from each other. Basically, the logic behind the theory is this: lawyers in the same firm share revenues. This weakens their incentive to withhold information from each other, because they know that if they give one another useful information and the firm benefits, then they themselves will benefit.”

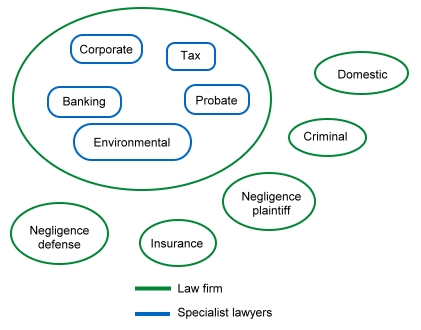

Figure 1: Segmentation in legal services

Lawyers doing transactional work tend to work in firms with lawyers in other fields. Lawyers in litigation intensive fields tend to work in field-specialized firms.

Among supporting evidence for the value of referrals, the researchers find that lawyers who work in litigation-intensive fields tend to work in field-specialized firms while lawyers in transactional fields tend to work in firms with multiple kinds of specialists. Hubbard and Garicano conclude that this pattern is explained by the relative value of referrals in each of these kinds of law. “If you’re a litigator, clients can self-refer pretty easily,” Hubbard said. “If I’m being sued for negligence, it’s pretty obvious that I need a negligence lawyer, and I don’t need an environmental lawyer.” Thus, there is not much value in having these two types of lawyers in a firm, because the referral patterns between them are so low.

On the other hand, for lawyers engaged in transactional work, the opportunity for referrals is greater. For example, if a client is buying a facility in the next county, the client may wonder about both the tax and the environmental implications of the deal. In this set of circumstances, the client can not easily identify the need and match the need to the appropriate expert. This results in the original lawyer having knowledge of a potential economic opportunity. Expanding the firms’ boundaries by affiliating the tax lawyer, the environmental lawyer, and the contract lawyer breaks down the barriers to sharing information about the opportunity. This is because the lawyer in possession of the information will benefit from the work of other lawyers in the firm.

Hubbard explains that risk sharing is a popular theory about why lawyers join together into firms. In fact, this theory explains why any firm diversifies: to insulate the firm from fluctuations in demand. However, the researchers found little evidence to support risk sharing as a motivator for collaboration in the context of law firms. Hubbard elaborates: “If you’re a corporate lawyer, you are usually working with someone in a related specialty, such as a tax lawyer. Those are demands that are positively correlated, not negatively correlated. If law firms’ boundaries were all about hedging their bets, corporate lawyers would never work with tax lawyers. They would work with lawyers in areas of the law where demands are not positively correlated, such as divorce lawyers.”

Hubbard points out that just because an industry is human capital intensive does not mean that large projects lead to large firms with many different kinds of specialists. For example, in the construction industry, it takes a variety of skill sets to build a house. If a house-building firm expanded its boundaries, it might result in a firm that consists of a carpenter, a plumber, a drywall installer, and an electrician. However, this is rarely the case. “The point being, that just because you need various specialists to produce something doesn’t mean that all these specialists will work within the same firm,” Hubbard said. “In fact, it happens all the time that they don’t.”

Examining the nature of referrals enables the researchers to apply their findings to other industries. According to Hubbard, a referral is an exchange of information about an economic opportunity. He explains that this type of collaboration transcends the realm of law and can be just as readily applied in other kinds of firms. The research and development arms of a pharmaceutical company provide one such example. Researchers in one division of the firm might make discoveries that could be more valuable in another part of the organization. If these were separate entities, the value of the discovery might be minimized due to the difficulties involved in sharing the information. When the researchers are in separate divisions of the same firm, it facilitates the exchange of information, and the entire firm reaps benefits from the shared information.

Hubbard and Garicano’s research has important implications for the way firms organize and do business. “The broad principles of what we found could apply generally to all human capital intensive firms,” Hubbard said.

Garicano, Luis and Thomas N. Hubbard (2007). “Specialization, Firms, and Markets: The Division of Labor Within and Between Law Firms,” Journal of Law Economics and Organization, forthcoming.