Featured Faculty

Professor Emeritus of Marketing

Member of the Department of Marketing faculty between 2006 and 2008

elenabs via iStock

What can your local grocer do to keep you from shopping at Wal-Mart? As Wal-Mart supercenters set up shop near traditional supermarket chains, you have more choices for where to buy groceries. Should you stick with the local chain where you have shopped for years or go to Wal-Mart, where the groceries are cheaper than anywhere else?

Professors Karsten Hansen (Kellogg School of Management), Robert Blattberg (Kellogg School of Management), and Vishal Singh (New York University; graduate of Kellogg’s doctoral Marketing program) set out to determine the impact of the arrival of a Wal-Mart on local customers’ grocery shopping habits. More specifically, they investigated what types of customers are most likely to switch to Wal-Mart.

Hansen, Blattberg, and Singh’s research suggests ways local retailers can meet the challenge of an incoming Wal-Mart supercenter. They cited a 2003 Wall Street Journal article that showed 25 out of 29 supermarket bankruptcies in the past decade had been caused by the arrival of a Wal-Mart. Wal-Mart is now the number one player in the grocery industry. It has been able to gain and maintain this position because it keeps its costs below the industry level; according to the same Wall Street Journal article, Wal-Mart grocery prices are 8% to 27% lower than those of Kroger, Albertson’s, or Safeway.

The authors collected point-of-sale data for 10,000 households from a single local supermarket in an East Coast suburban town. The data was gathered before, during, and after a Wal-Mart supercenter entered the area, from November 1999 through June 2001. Hansen, Blattberg, and Singh used these twenty months’ worth of store records to find trends in customer spending habits as a result of the new supercenter, which opened in August 2000.

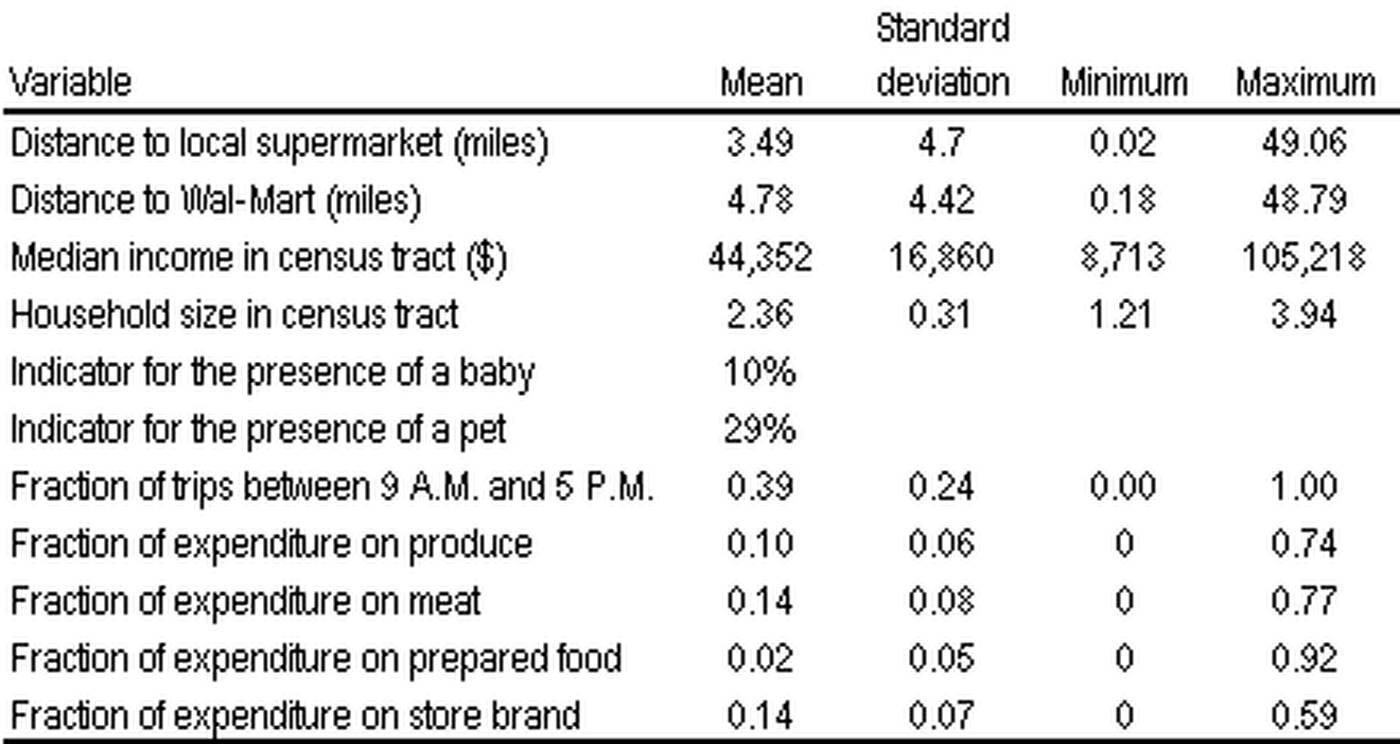

To investigate this question, the authors considered different factors that might explain household shopping behavior, including the following:

Table 1 shows some summary statistics for the sample.

Through their research, the authors found one major trend in the local supermarket’s losses, equivalent to 17 percent, or nearly $250,000 per month: shoppers visited the local supermarket less frequently after Wal-Mart opened. Hansen, Blattberg, and Singh had originally expected losses would result from fewer visits, fewer items purchased in a single trip, or a combination of the two. As Figure 1 shows, they found only the first was true: customer purchases remained relatively stable during any given grocery trip (b) while the number of overall visits decreased (c).

Figure 1: Daily sales, store traffic, and basket size for local retailer before and after Wal-Mart entry

This finding was particularly important when it came to customers who were already predisposed to abandon their local grocer. Households with a pet or an infant were more likely to switch over to shopping at Wal-Mart, as were larger households and those located close to the new Wal-Mart. In contrast, households that did the majority of their shopping between 9 A.M. and 5 P.M. during working days were less likely to defect to Wal-Mart.

If a supermarket can retain just 5% (10%) of its best customers after a Wal-Mart opens in the area, its losses would be reduced by 41% (64%).

There were other trends among the households that remained loyal to the local supermarket. These households were more likely to buy fresh produce, seafood, and meal replacements such as deli sandwiches or pre-made salads. This finding suggests that traditional supermarkets may be more successful than Wal-Mart at providing quality meat and produce, and could reduce losses by showcasing the types of groceries they provide best.

For supermarket managers, these are important findings. If a supermarket can retain just 5% (10%) of its best customers after a Wal-Mart opens in the area, its losses would be reduced by 41% (64%). In terms of advertising, it means that the main focus should be on external promotions that increase traffic to the store rather than internal promotions, which simply encourage customers to purchase more once they are inside. According to the authors, simply getting consumers to walk through the doors of a local store can prove paramount.

By understanding the demographics and purchasing habits of lost customers, traditional supermarkets can better equip themselves to compete when a Wal-Mart enters their area. Hansen, Blattberg, and Singh’s insights show that understanding the consumer can have far-reaching implications for the success of a local supermarket-even at a time when Wal-Mart’s giant supercenters threaten to upset the conventional foundations of the grocery industry.

Further reading:

“Price War in Aisle 3.” Wall Street Journal, May 27, 2003.