Finance & Accounting Jun 6, 2016

Your Investment Tool Is Failing You

A new tool offers smart investors an improvement over the CAPM.

Yevgenia Nayberg

The Capital Asset Pricing Model (CAPM) is the most commonly used tool for predicting stock returns. It is taught in business schools, and it has been used by investors for decades. In 1990, the economist William Sharpe won a Nobel Prize for helping to create it.

But the curious thing about the CAPM is that, for all its influence, it does not actually work.

“We’ve known for a long time that the CAPM doesn’t really predict stock returns and that, empirically, the model is somewhat of a failure,” says Matthew Lyle, an assistant professor of accounting information and management at Kellogg.

In their recent work, Lyle and his coauthor, Charles C.Y. Wang of Harvard, address this long-standing problem by proposing a model that relies on different information than the CAPM. They tested both models against data from the 1970s to 2013 and found “no evidence whatsoever that the CAPM can predict stock returns,” Lyle says. “That, in and of itself, says that essentially there’s nothing there. And we did the exact same exercise using our model and found that we could robustly forecast stock returns up to three years ahead.”

Lyle’s model is also straightforward enough to be useful to portfolio managers and individual investors, drawing on data that is easily available in corporate financial statements.

Risky Business

One reason for the CAPM’s persistence is that there has not been a significantly better model to replace it, despite many attempts. CAPM also persists because it gives formal expression to a piece of common wisdom about investing: there is a connection between risk and reward.

A stock’s price movments (or volatility) in relation to the broader market—or “beta”—is central to the CAPM. A stock with a beta of 1 is expected to move one-for-one with the market. Stocks with a low beta (i.e., under 1) tend to be less volatile and move less with the overall market. That is, they tend not to gain as much as the market during an upswing in stock prices, or lose as much during a downturn. Stocks with a high beta, by contrast, are highly sensitive to market swings, losing more than the market during downturns and gaining more during upswings.

“The biggest insight CAPM delivers is that the more exposure a stock has to market-wide upturns and downturns—the more the risk—the higher the expected stock return will be,” Lyle says. “Most people can wrap their heads around that idea. CAPM says you should have higher expected returns if you buy a high-risk firm.”

Back to Basics

While CAPM focuses on a sensitivity to the overall market, Lyle’s model focuses on how accounting fundamentals predict a stock’s performance.

“Most models are based on things that we can’t see,” Lyle says. “We can’t see risk. We know it’s there, but it’s hard to measure. What I’m interested in is: What role does accounting play in coming up with the price of a stock? We can see reported income. We can see reported book value. We can see market value. If you want to try to understand expected returns, or how investors set expected returns, accounting information [is] a fruitful place for future exploration.”

“Lo and behold, when you do it in a rigorous way, out pops this thing that you’ve been trying to figure out for a long time.”

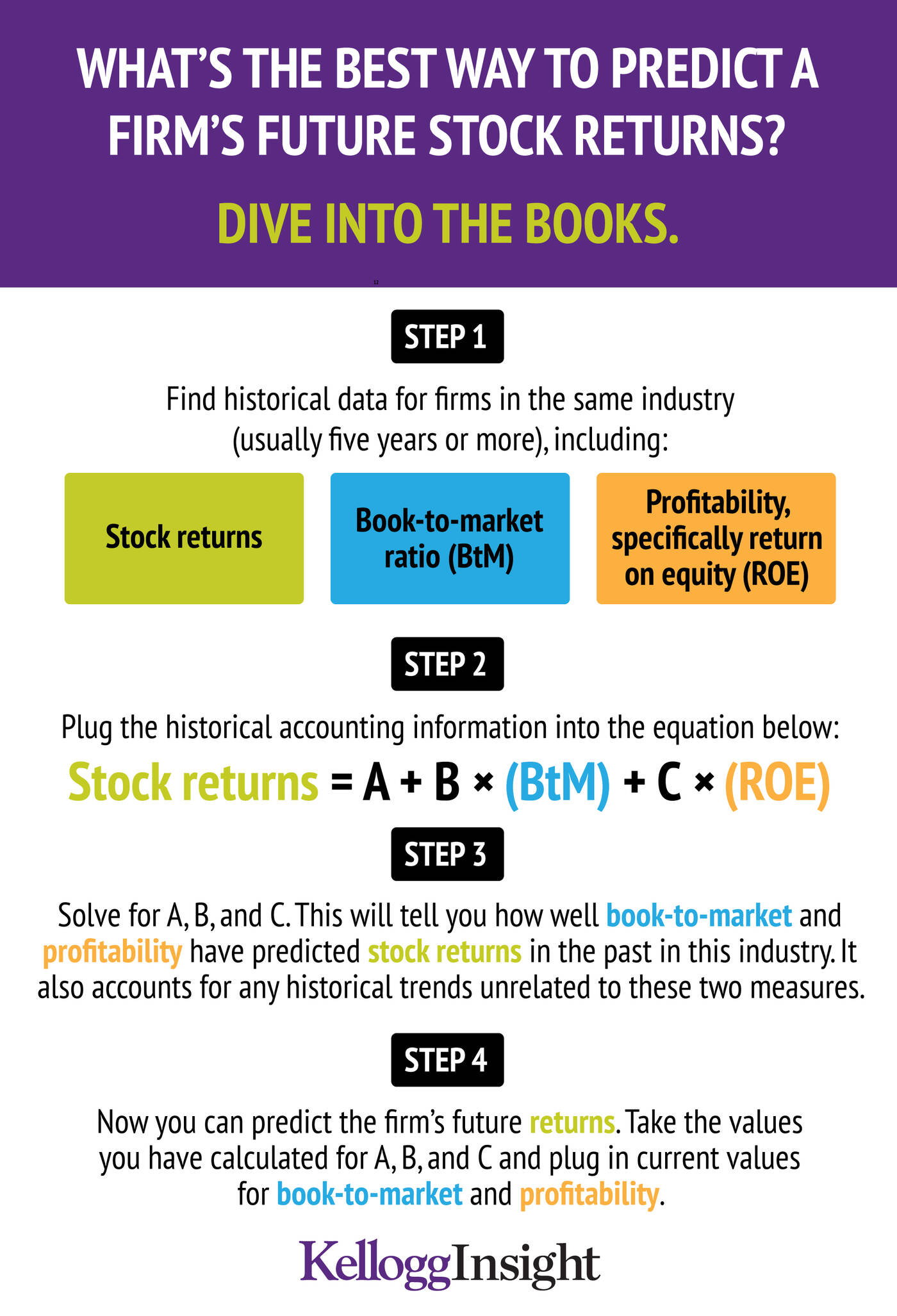

In addition to a stock’s current price, the model’s formula for calculating expected returns depends on two variables: a firm’s book-to-market ratio and its return on equity (ROE).

The book-to-market ratio is calculated by dividing a company’s book value (assets minus liabilities) by its market capitalization (the outstanding shares multiplied by the current price per share). ROE measures how efficiently a company generates profits with shareholders’ money. It is calculated by dividing net income by shareholders’ equity.

Investors have long known that such information is relevant to the performance of a stock over time. But they have lacked a systematic method for applying that intuition to forecasting stock returns. Lyle’s model helps fill that gap.

“People talk about things like the price-to-earnings ratio and earnings growth,” Lyle says. “Our model says, that’s right. Yes, you should be looking there. And here’s a way of combining that information that you’ve been thinking about, along with a couple of other things in the accounting system. And lo and behold, when you do it in a rigorous way, out pops this thing that you’ve been trying to figure out for a long time.”

Minimum Requirements

The model’s performance depends in part on the quality of the accounting data, as well as how far back the numbers go. The ideal is to have several years’ worth of accurate data.

“Essentially, you have to run a regression, or fit the model to historical data,” says Lyle. “Now, an average investor could probably do that. But that is where things get a little more technical. In order to calibrate or fit the model to those inputs, you do need approximately five years of historical data. If you don’t have that, then you would run into some issues, but, with that said, data is also required to estimate the CAPM.”

The Power of (Global) Foresight

The payoff is a tool that can predict expected returns with greater accuracy than the standard model. And it can do so for any firm, provided there is sufficient data to work with.

“Most published models similar to ours are focused on predicting the S&P 500 index or ‘The Market,’” Lyle says. “But if you want to start doing firm-level investments—if you are a fund manager—you’re not going to invest in just the S&P 500.”

Investors can also apply the model to international equities. In a follow-up to their original research, Lyle and Wang (along with a third author, Akash Chattopadhyay of Harvard) tested it in international markets and found that expected returns lined up well with actual returns.

Unlike the CAPM, the model is also able to reliably predict returns at varying time horizons up to three years out. Having a reliable estimate of expected returns from quarter to quarter is “critical in assessing investment opportunities,” as the researchers write, “which can guide investors in tailoring their portfolios to match their desired investment horizons.”

What it all adds up to seems to be the best of both worlds: a relatively easily applied model that delivers a reliable and sophisticated tool for investors.

“In the end,” Lyle says, “I think the big takeaway of the paper is that a relatively simple model that just combines book value, present stock prices, and the profitability of the firm—that tells you a lot about where future stock prices are going. And the CAPM and other CAPM-related models don’t.”

Lyle, Matthew R., and Charles C.Y. Wang. 2015. “The Cross Section of Expected Holding Period Returns and Their Dynamics: A Present Value Approach.” Journal of Financial Economics. 116 No. 3 (June): 505–525.

Chattopadhyay, Akash, Matthew R. Lyle, and Charles C.Y. Wang. 2015. “Accounting Data, Market Values, and the Cross Section of Expected Returns Worldwide.” Harvard Business School Working Paper No. 15-092.