Politics & Elections Sep 5, 2017

When Corporations Donate to Candidates, Are They Buying Influence?

The surprising result suggests the need to rethink the role of money in politics.

Michael Meier

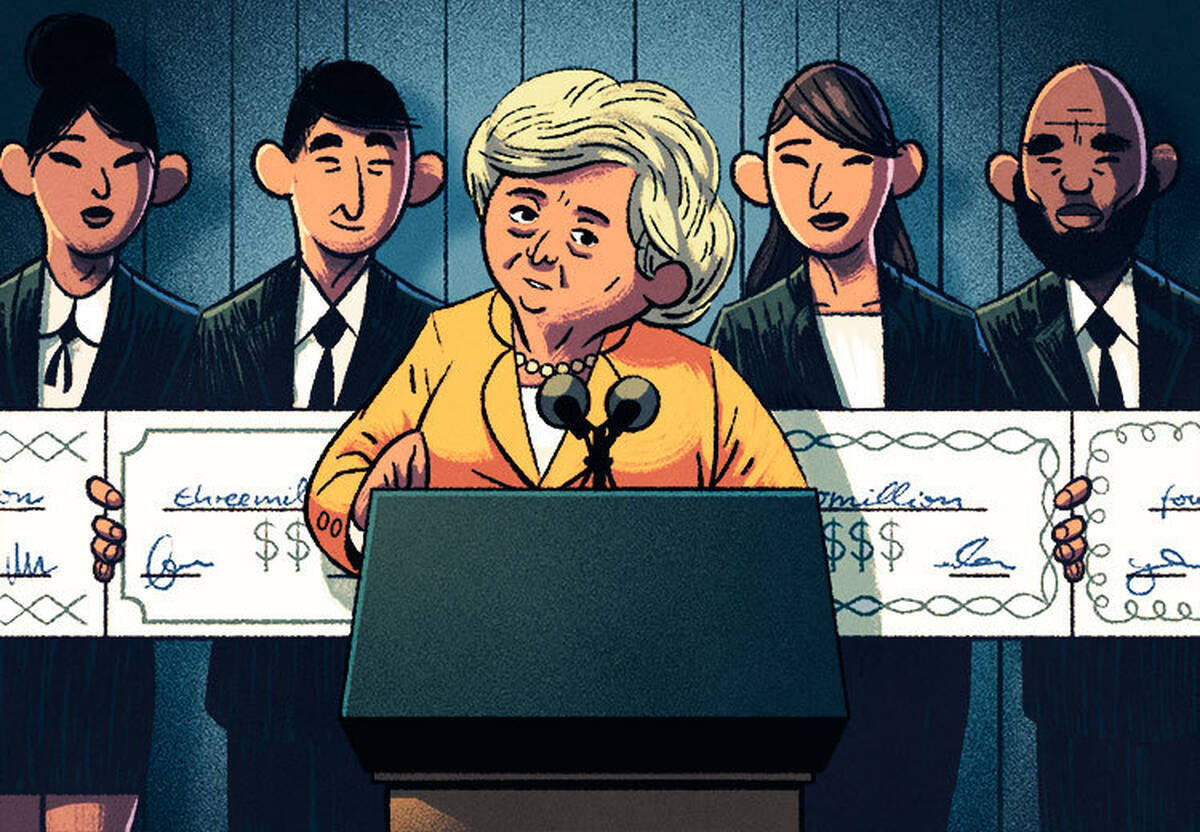

Two months after taking office, President Donald Trump approved the construction of the controversial Keystone XL oil pipeline. The project had been halted by President Obama. But Trump made reversing that decision a priority.

Did campaign donations impact Trump’s decision?

“During the 2016 presidential campaign, oil companies gave a lot of money to Donald Trump,” says Jörg Spenkuch, an assistant professor of managerial economics and decision sciences at the Kellogg School. The energy sector had contributed nearly one million dollars to Trump’s campaign. Now that he was in office, the speculation went, he had to pay those companies back for their support.

Spenkuch, however, hesitates to draw a clear line from the donations to the president’s decision. From the very beginning of his candidacy, Trump had vigorously supported the energy sector. So, Spenkuch wonders, did their money actually change Trump’s mind in any way?

“It’s not clear,” he says. “What we don’t know is what would have happened if these corporations hadn’t donated.”

In a new study, Spenkuch and two coauthors, Northwestern economics doctoral student Haritz Garro and University of Chicago political scientist Anthony Fowler, use an inventive approach to put the quid-pro-quo narrative to the test. To their surprise, they find no evidence that campaign contributions in the U.S. produce big benefits for corporations.

“These political connections that are forged by donating to politicians don’t seem to be reflected in the company’s value.”

That result poses a challenge to the common refrain that American democracy is for sale to the highest bidder.

“Just tabulating the amount of money in politics does not tell us anything about what the political process would be like if corporations weren’t allowed in,” Spenkuch says.

What Stocks Say about Buying Influence

To understand whether companies are impacted when they back a winning candidate, the authors turned to U.S. Congressional, gubernatorial, and state legislative elections and used a tried-and-true metric: the company’s stock price.

“We know that stock markets respond nearly efficiently to all kinds of information,” says Spenkuch. “When a company releases an earnings statement, stock prices react within seconds.”

The authors wanted to see whether, in the days following an election, the stocks of companies that gave money to winners performed better, across the board, than those that gave money to losers.

Their reasoning was that shareholders would know which candidates companies had supported and how that would impact the companies post-election. Therefore, shareholder expectations are a good proxy for how an election will affect the company’s future success.

If a company’s stock price rose meaningfully following the election of its favored candidate, it meant that shareholders believed that the company would do better as a result of the election—and that they were willing to put their own money behind that belief. This would be strong evidence that shareholders truly expected the company to receive benefits of some kind, such as direct favors, high-level insider information, or policies favorable to their industry, from the newly elected official.

But there was a catch.

As Spenkuch explains, larger and more successful companies tend to bet on winning candidates, while smaller, weaker companies are more likely to support losing candidates. The reason for this is not entirely clear—it could be that more successful companies are simply better at foreseeing future events, or that executives at larger corporations have more leeway to throw corporate funds behind their own pet causes.

Whatever the reason, the companies that give to winners are likely to have higher-performing stocks than the companies that give to losers, elections aside. Simply comparing the post-election price changes of companies that picked winners versus losers could be a red herring, Spenkuch says. “We’d be comparing apples and oranges.”

So the scholars devised a workaround. Instead of looking at all elections, they would look only at extremely close elections—those where the candidates’ vote tallies were within five percent of a tie.

Because these races were so close, the thinking went, big and small companies alike would have roughly a fifty-fifty chance of picking a winner.

“It’s like flipping a coin on whether their investment pays off or not,” Spenkuch says.

Coauthor Anthony Fowler had created a dataset of these close elections for an earlier study. Meanwhile, data on donations from corporate political action committees (PACs) was readily available from the Federal Election Commission. (A 1907 act of Congress prohibits corporations from donating directly to political campaigns, so corporate executives and shareholders instead create PACs, which funnel company money to a particular candidate.)

The final dataset included information on nearly 150,000 contributions from corporate PACs, which allocated money to candidates in 18,744 races between 1980 and 2010.

With the data in hand, the researchers analyzed how campaign-contributing companies’ stock prices changed following an election.

“Our expectation going into this was that companies derive significant favors from these donations,” Spenkuch says.

They were in for a surprise.

The Impact of Corporate Campaign Contributions

On average, the victory of a company’s preferred candidate led its stock price to increase by just 0.05 percent. But this small result was statistically insignificant, meaning it could be a fluke.

The takeaway, according to Spenkuch: “Our results suggest that donations do not buy meaningful political favors.”

If contributions offer companies so little in return, why do they continue to donate at all?

This is especially remarkable because even in the absence of direct political favors, you might expect the victory of a favored candidate to boost a company’s stock price. After all, companies are likely donating to the candidate they think will back their priorities. This in itself could encourage investors, regardless of any quid pro quo from company donations. Yet the data showed no stock market benefit to financially backing the winning candidate.

For the median company in the dataset, worth about one billion dollars, a 0.05 percent bump in firm value would translate to around $500,000. While that may seem like a substantial sum, Spenkuch argues that it is small change for a billion-dollar company—and any favors that would reverse a regulation or alter a critical policy in the company’s favor should be worth far more.

That does not mean the contributions are necessarily wasted. Spenkuch notes that the median firm spends only $3,750 on campaign donations in a given election cycle, and spreads that small sum between different races. For an investment so small, $500,000 is a rather hefty return.

“So from the perspective of the company, it might be a good, albeit very small, investment,” he says. However, he notes that both the investment and the return are well under a million dollars—extremely small potatoes for a billion-dollar company.

“Given the size of these investments, they’re not as large as pundits would make you believe,” he says.

Taking Another Look at Political Donations

While the data—and, thus, the findings—span a wide range of places, years, and offices, Spenkuch points out a shortcoming: since they only included extremely close elections, it could be the case that political favors are simply more prevalent in less competitive races.

“You could for instance imagine that political donations only generate returns if they’re given to a powerful candidate,” he explains. “Say, the chair of the Ways and Means Committee—that guy is not in our dataset. He’s going to be reelected with near certainty.”

To address this concern, the researchers performed a second analysis, this time using a dataset from the now defunct online betting market InTrade. The website let speculators place bets on the outcomes of elections—and those bets, in turn, reflected who was expected to win, and with what probability.

They gathered InTrade data from 119 Senate races between 2004 and 2010, which charted how each candidate’s odds of victory fluctuated leading up to Election Day. The researchers then examined how the stock of a company reacted when their candidate’s probability of winning changed.

Once again, they found no significant relationship.

“These political connections that are forged by donating to politicians don’t seem to be reflected in the company’s value,” Spenkuch says.

A New Puzzle Emerges

Enlightening as these findings are, they pose another vexing question: If contributions offer companies so little in return, why do they continue to donate at all?

Spenkuch and his coauthors can imagine a few plausible explanations.

Other scholars have suggested that campaign contributions might send a signal—to convince investors that the company will oppose new regulations, perhaps. Alternatively, executives could simply be using company money to support candidates they like personally under the guise that it will benefit the firm.

In future research, Spenkuch wants to test which of these explanations is most likely. “I don’t think anybody knows at this point.”

For now, he hopes that the paper’s findings will not be overstated.

“I don’t want to go as far as to say there’s no corporate influence in politics,” Spenkuch says, noting that financial contributions are only a sliver of the ways a corporation could exert influence. In order to get the full picture, one would also need to consider the role of the multi-billion-dollar lobbying industry, he insists.

That said, he thinks the new evidence will challenge spectators, pundits, and social scientists alike to think harder about their claims regarding money in politics. For example, in light of the study, a policy move like the Keystone XL decision suddenly looks less like a nefarious corporate bargain. Spenkuch thinks that challenging this narrative is critical.

“To sensibly discuss the topic of corporate money in politics,” he says, “we need to evaluate the whole picture—not just the outliers and anecdotes.”