Healthcare Economics Jul 3, 2018

Even for the Insured, a Hospital Stay Has Surprising Costs

The long-term financial toll extends far beyond medical bills.

Michael Meier

Health insurance is not really about insuring your health. It’s about insuring you from the negative financial consequences of potential health problems, particularly those that require hospitalization.

That is how Kellogg associate professor of strategy Matthew Notowidigdo often describes health insurance. But, he wondered, how well does it actually work? Does it indeed shield policyholders from financial harm when an accident or illness strikes? And, if not, how far-reaching is that harm after a hospital stay?

In a study that analyzed consumer credit-report data alongside hospital records, Notowidigdo and his coauthors found that even insured patients get hit hard by hospitalization. And the consequences stretch well beyond out-of-pocket costs to include impacts on credit and long-term earnings.

“We could really see how a person’s financial picture evolved after they spent time in the hospital,” says Notowidigdo, who is also a professor in Northwestern’s department of economics.

The research also refuted earlier studies by finding that hospitalization rarely leads to bankruptcy. Still, it highlighted the limits of health insurance in helping to cover the broad financial consequences of health shocks.

Determining the Costs of Hospitalization

The research initially set out to explore the financial consequences of hospital admission for insured people versus those without insurance, says Notowidigdo, who teamed up with Carlos Dobkin at the University of California, Santa Cruz, and Amy Finkelstein and Raymond Kluender at MIT, for the study.

The team focused only on those ages 25 to 64 who were actually admitted to the hospital, as opposed to just visiting an ER or undergoing outpatient treatment.

They merged consumer credit-report data with California hospital records to examine how hospitalization affected the subsequent financial health of hundreds of thousands of individuals. Specifically, they were able to estimate the financial effects of being admitted to the hospital by analyzing credit scores, credit limits, borrowing history, unpaid medical bills, bankruptcy filings, and other data for millions of people.

The team’s original hypothesis was simple: that the financial consequences of a hospital admission would be more severe for uninsured people than for those with insurance. They set out to document the magnitude of the difference and understand how it played out across financial dimensions.

What they found went well beyond that.

Beyond Out-of-Pocket

The study found that, indeed, people without insurance did face more severe financial impact than those with healthcare coverage. For example, those without insurance ended up, on average, with $6,000 more in unpaid debt four years after being hospitalized than if there had been no admission. That is 20 times higher than those with insurance, who averaged a $300 increase in such debt four years post-hospitalization.

“That’s a startling difference,” Notowidigdo says.

“There are people who experience medical bankruptcies, but these represent only a very small share of the total number of bankruptcies in any given year.”

But the more surprising set of findings had to do with how widespread the financial impact of hospitalization was for both those with and without insurance.

For one, the research shows that a hospital stay has consequences for a patient’s income. On average, people’s pre-hospitalization earnings declined about 20 percent within four years.

“That’s a lot larger than we would have predicted,” Notowidigdo says.

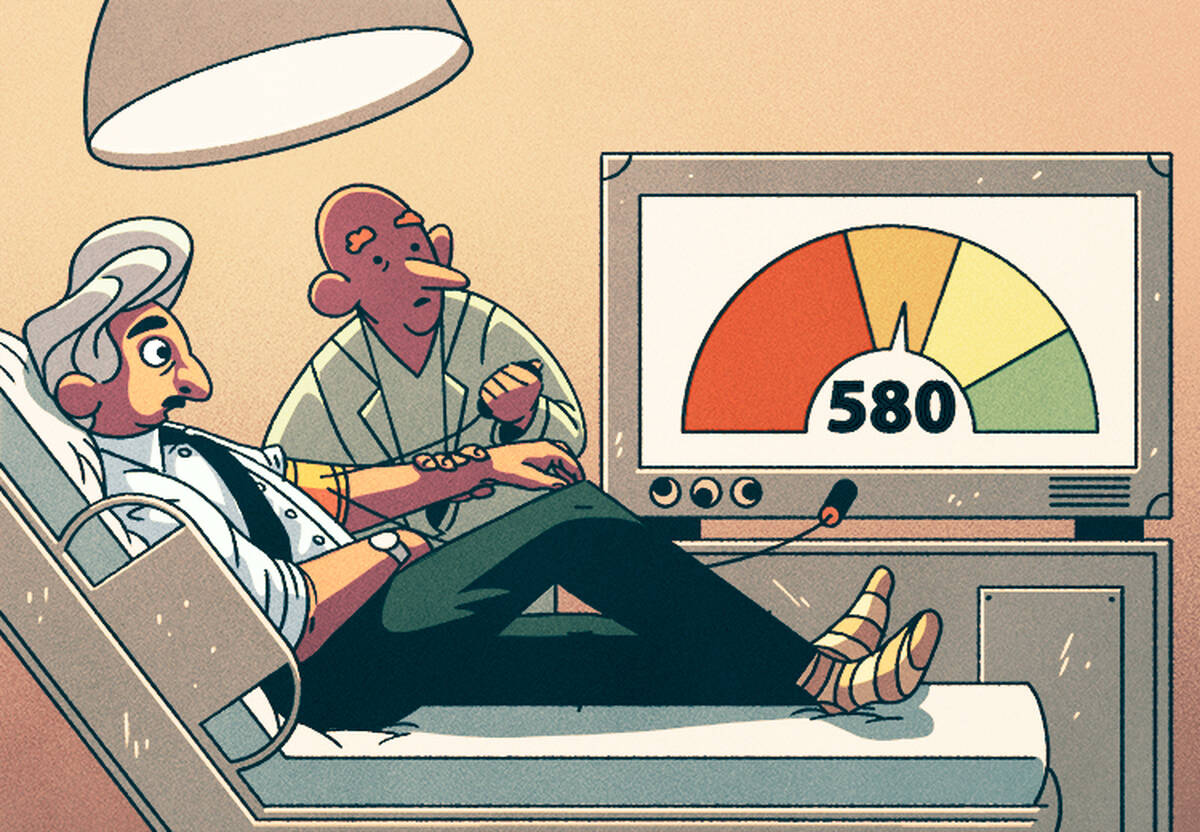

The researchers also found that hospitalization among both the insured and uninsured was associated with decreases in all types of borrowing, including credit-card balances, auto loans, and second mortgages.

This may seem counterintuitive, because people, especially those without insurance, may need to borrow to cover medical costs. Yet this is consistent with the idea that people’s earnings go down post-hospitalization, which makes them less eligible for credit. Indeed, for people who were hospitalized, credit limits declined by $2,125, on average, four years post-admission.

Far-Reaching Health Shocks

There are a number of reasons this may happen, Notowidigdo says.

For one, hospitalizations are typically for serious conditions. “It may seem obvious, but being admitted to the hospital may mean you won’t recover quickly or return to work easily,” he says. “That has implications for people’s earnings.”

Compounding the problem is that people facing consequences of hospitalization often have a minimal safety net, if any.

“Insurance covers you for healthcare-specific expenses,” Notowidigdo says, “but not against these broader earnings consequences, and most people don’t have short-term disability insurance.”

The problem looms especially large in the U.S.

“A similar analysis in Denmark showed that labor earnings also fall as a consequence of hospitalization there,” Notowidigdo says, “but their system has lots of other ways of replacing lost income.” Indeed, about 50 percent of lost income in that country was covered through some form of insurance.

Short of Medical Bankruptcy

As dire as this may sound, the study did have some more optimistic findings: the rate of medical bankruptcy has been largely exaggerated in public debate.

“Being admitted to the hospital is a serious event,” Notowidigdo says, “but we found that the rate of going bankrupt from hospitalization isn’t as high as many thought. There are people who experience medical bankruptcies, but these represent only a very small share of the total number of bankruptcies in any given year.”

While up to 1 percent of households may experience bankruptcy in a given year, only a very small percentage of those will be medically driven. The researchers calculate that only about 4 percent to 6 percent of personal bankruptcies could be attributed to medical expenses. Previous studies have estimated that as much as 60 percent of bankruptcies are medical.

Notowidigdo cites methodological issues with past research as part of the problem.

“Asking people why they went bankrupt may not be a very reliable approach,” he says, because people may not want to admit they overspent or under-saved; it’s easier to blame it on unexpected medical bills.

The differences between past research and this study are not related to the introduction of the Affordable Care Act, Notowidigdo explains, since the data he and his coauthors used came from before the new healthcare law was enacted.

The research finding adds dimension to the ongoing policy debate about the best approach to healthcare.

“We felt like medical bankruptcy was given disproportionate attention in policy discussions relative to other financial consequences like unpaid medical debt, which can linger over you and affect your ability to get a mortgage or car loan,” Notowidigdo says.

For example, Senators Elizabeth Warren and Sheldon Whitehouse cited medical bills as leading causes of bankruptcy when introducing the Medical Bankruptcy Fairness Act in 2014. In response to this new research, Warren and two researchers wrote a rebuttal that defends the idea that medical bankruptcies are more common than Notowidigdo and his coauthors find.

In terms of his study’s findings, Notowidigdo summarizes: “Hospital admissions have both financial and labor market consequences that go well beyond out-of-pocket costs but may stop short of bankruptcy. Health insurance, while beneficial, doesn’t cover all of these well enough. Individuals and policymakers need to understand that.”