Featured Faculty

MUFG Bank Distinguished Professor of International Finance; Professor of Finance; Faculty Director of the EMBA Program

Michael Meier

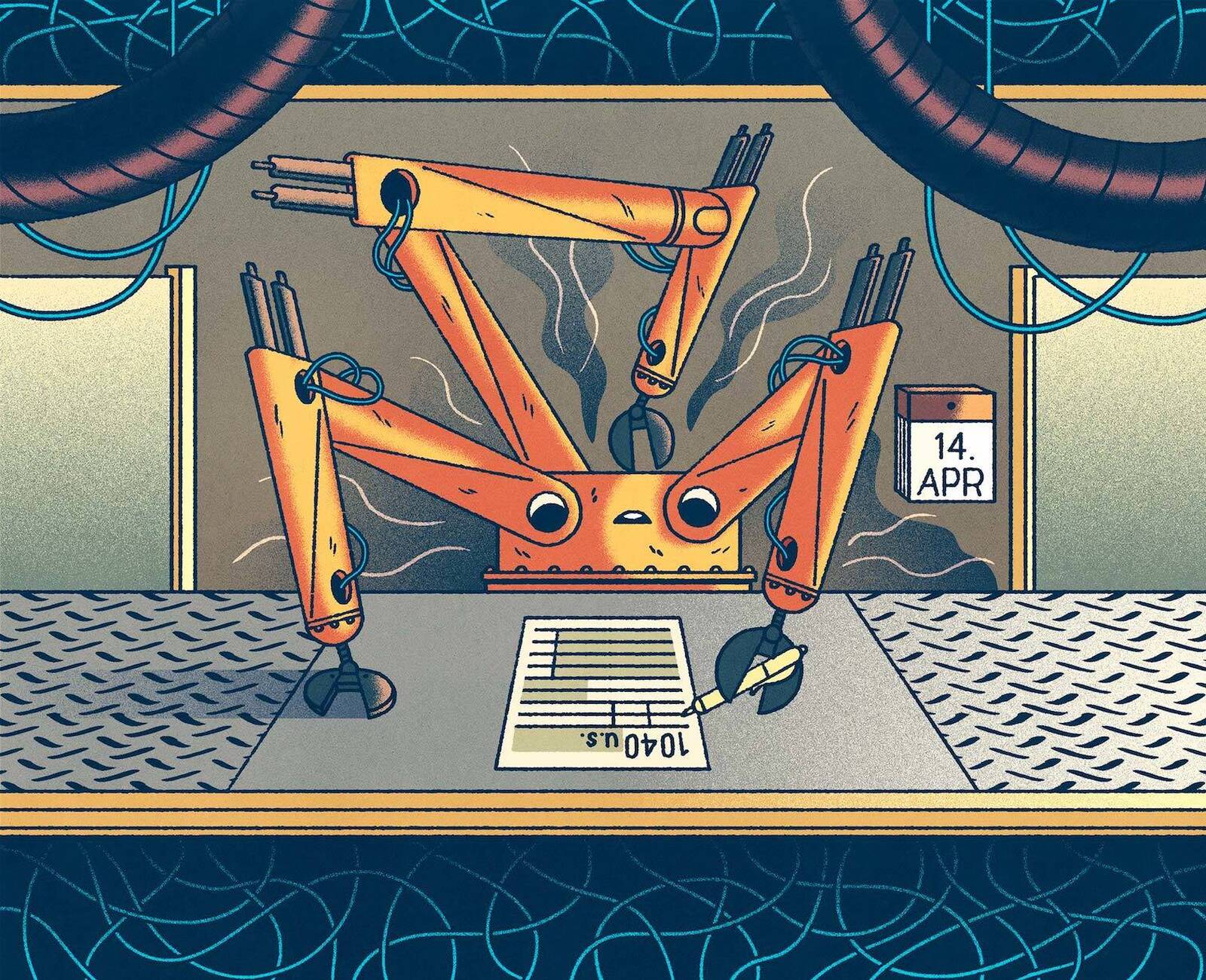

Earlier this year, Microsoft founder Bill Gates threw his support behind a controversial policy: a robot tax. As workers in many sectors are replaced by machines, the government is losing huge amounts of income tax revenue. Taxing the companies that employ robots, Gates reasoned, could help slow the pace of automation, and the revenue could be used to retrain employees.

Sergio Rebelo, a finance professor at the Kellogg School, had serious doubts when he heard Gates’s argument. For decades, economists have known that taxing so-called “intermediate goods”—goods that are used to make other goods, like the bricks used to build a house, or the robots used to manufacture cars—can make it harder for suppliers to create and sell their products.

“When you do that, you reduce the level of production in the economy,” Rebelo says.

Nonetheless, Rebelo thought the robot tax made for a compelling research topic. So he teamed up with Joao Guerreiro, a graduate student at Northwestern, and Pedro Teles of Universidade Católica Portuguesa.

They figured their study would confirm what prior research suggested: that a robot tax created more problems than it solved.

“Maybe there would not even be a paper to write,” Rebelo says.

So it was quite a surprise when they found they were wrong—that a robot tax could be part of a policy agenda that staved off income inequality and improved the economy overall.

“Because I can be replaced by a machine, my opportunities are worse and worse.”

In fact, the study suggests, if robots continue displacing people without any policy intervention, those displaced might suffer large decreases in income, creating a potentially large rise in income inequality. At the same time, automation produces a large increase in total income.

“This is not a fanciful scenario,” Rebelo warns. “It’s already happening.”

“A Very, Very Tough Scenario”

Today, more and more work is being automated, without much of a safety net for the people whose jobs evaporate. The authors first wanted to understand how the economy will continue to evolve on its current path.

They imagined an economy in which half of the labor force was engaged in what economists call “routine” work—any job consisting of programmable tasks that can be automated (such as workers on an assembly line, or at a call center where a script is followed). The other half of the labor force did nonroutine work that cannot be automated (such as firefighters or scientists.)

The researchers used this model to see how incomes of the two groups would change as machines grew ever cheaper.

The upshot: “It’s a very, very tough scenario for routine workers,” Rebelo says.

Many people assume that if automation is allowed to continue unchecked, then eventually machines will take over all of the routine work in the economy. But the researchers found that routine laborers will likely continue working—and their circumstances will get worse.

“If I’m a routine worker, I’m going to have to put food on the table for my family,” Rebelo explains. So over time, as machines become cheaper and more efficient, routine workers will have no choice but to accept lower and lower wages so they can compete with the robots.

“Because I can be replaced by a machine, my opportunities are worse and worse,” he says.

Meanwhile, the other half of the workers prosper. Those who cannot be replaced by robots are able to use machines to their advantage, allowing them to work more efficiently, which increases their incomes. For example, a doctor using a robot to help complete surgeries can treat more patients in a day than a robot-less doctor.

Thus, the gap between rich and poor stretches ever wider.

However, the model also reveals that under the present system, robots will never entirely replace routine human labor. Eventually, machines will reach a point where they cannot get any cheaper, and wages for routine workers will bottom out at the same level. This scenario is problematic not only for routine laborers (who will have to work for peanuts), but also for nonroutine workers, since the overall economy is producing less output than it would if everything routine could be automated.

Could a tax on robots prevent this dystopian future?

Although the researchers’ model is theoretical, Rebelo says that, at least so far, it captures trends underway in the US. He points out that the only group whose median wage has increased since 1979 is college-educated workers, who are disproportionately likely to do nonroutine work. Less-educated employees, on the other hand, have generally seen their real wages decline.

Testing the Robot Tax

Could a tax on robots prevent this dystopian future? The authors had their doubts.

The notion that taxing intermediate goods should be avoided comes from an iconic 1971 paper by Nobel laureates Peter Diamond and James Mirrlees. The duo concluded that such a tax made the economy less efficient, which negated any net benefits of the tax. Going in, Rebelo and coauthors expected that, from the perspective of maximizing the overall welfare of the economy, a tax on robots would be undesirable.

But when they added the tax into their model, they found a surprise. “We discovered that under some circumstances, it actually is optimal to tax robots,” Rebelo says.

Because robots can be substituted for routine workers, anything that makes robots more expensive will also increase routine workers’ wages. A tax on robots offers an indirect way to tax nonroutine workers and more equitably distribute income in the economy.

“That’s what changes completely the picture, and makes it optimal to use a robot tax,” Rebelo says.

South Korea, which recently introduced tax penalties for companies that automate jobs, is now the first, and so far the only, country to have implemented such a tax.

Letting Everyone Reap the Benefits

Still, while slapping a tax on robots is better than the status quo, it can only do so much.

The robot tax would have to be extremely high before it began to alleviate inequality, Rebelo says, since the tax has to counteract the strong downward pressure of machines on routine worker wages. Such a high tax would deter nonroutine workers from using machines to increase their productivity, distorting overall production in the economy.

The researchers determined that the best option in terms of increasing overall welfare would be to simply transfer income from nonroutine to routine workers without distorting production and other decisions. In this idealized scenario, it is not optimal to use robot taxes.

But this plan would be difficult to implement in the real world. The government cannot easily distinguish between routine and nonroutine labor—and workers would have plenty of incentives to try to be categorized one way over the other.

Which is why the authors tested an alternative plan: a robot tax paired with a minimum income payment for everyone. They concluded that issuing all workers regular government payments resulted in an economy where everyone would benefit from automation.

It is worth noting that, in this scenario, the robot tax would slow the pace of automation, but not stop it entirely. Unlike in the status-quo projection, all routine workers would eventually be replaced by robots. (Since routine workers in this scenario now receive a minimum income, they no longer need to work to survive. So once automation drives their wages below a certain level, they will relinquish their low-paying jobs to the robots altogether.)

As Rebelo explains, the efficiency that robots provide is good for the economy as a whole.

“What tends to get forgotten is that, when you’re using robots, you’re increasing the productivity of the economy,” he says. “You want to get that high level of efficiency—but then you want to redistribute the bounty that comes from technology so that everyone can reap the benefits.”