Featured Faculty

John L. and Helen Kellogg Professor of Managerial Economics & Decision Sciences; Director of the Center for Mathematical Studies in Economics & Management; Professor of Weinberg Department of Economics (courtesy)

What does the illegal drug market look like to an economist?

This research recently won Kellogg’s Stanley Reiter Best Paper Award.

This is what the Kellogg School’s Nicola Persico set out to learn. A better understanding of the key features of the market for illicit drugs, he reasoned, could lead to more effective policies and enforcement practices.

Persico, a professor of managerial economics and decision sciences at the Kellogg School, developed a new model of the drug market that accounts for the fact that buyers do not know a drug’s purity before purchasing it, as well as the fact that they cannot contest sales of impure drugs.

The model provides a fuller picture of the drug market, and it includes some surprising implications. For one, police presence may actually increase buyer loyalty to specific sellers. And if policymakers choose to impose more lenient sentences on sellers of impure drugs, overall demand for drugs could decrease.

The United States’ war on drugs is tremendously costly—not only in terms of money spent, but also with regard to police manpower, legal proceedings, and long-term incarceration. “Illegal drugs arguably represent the number-one law enforcement issue in the U.S.,” Persico says, “so figuring out how to make progress in this area is very important.”

Persico’s previous work on racial profiling by police brought him to a criminology conference where drug scholar Peter Reuters discussed the issue of price dispersion in the illicit-drug market—that is, how drugs of the same type sold for very different prices in different places and at different times.

That observation got Persico thinking about the drug market in general: How did its structure differ from markets for legal products and services? Which economic models explained it best? And, importantly, what implications for policy and enforcement could be derived from a better understanding of the drug market?

Past efforts to characterize the drug market relied on standard supply-and-demand models. “It’s Econ 101,” Persico says. “The demand curve slopes down and the supply curve slopes up, and where they meet is the equilibrium point, or market-clearing price.” He acknowledges that this basic model has virtue, but wished to take a “Drug Market 2.0” approach, as he called it, to gain a better understanding of market structure and dynamics.

“If there’s a lot of police enforcement, buyers take more risk switching sellers because the next seller could be an undercover police officer.”

Part of that approach was the recognition that while illicit drugs share some economic qualities with agricultural commodities like coffee, drugs sell at a much higher price. And, more importantly, drug transactions are not enforceable through the legal system.

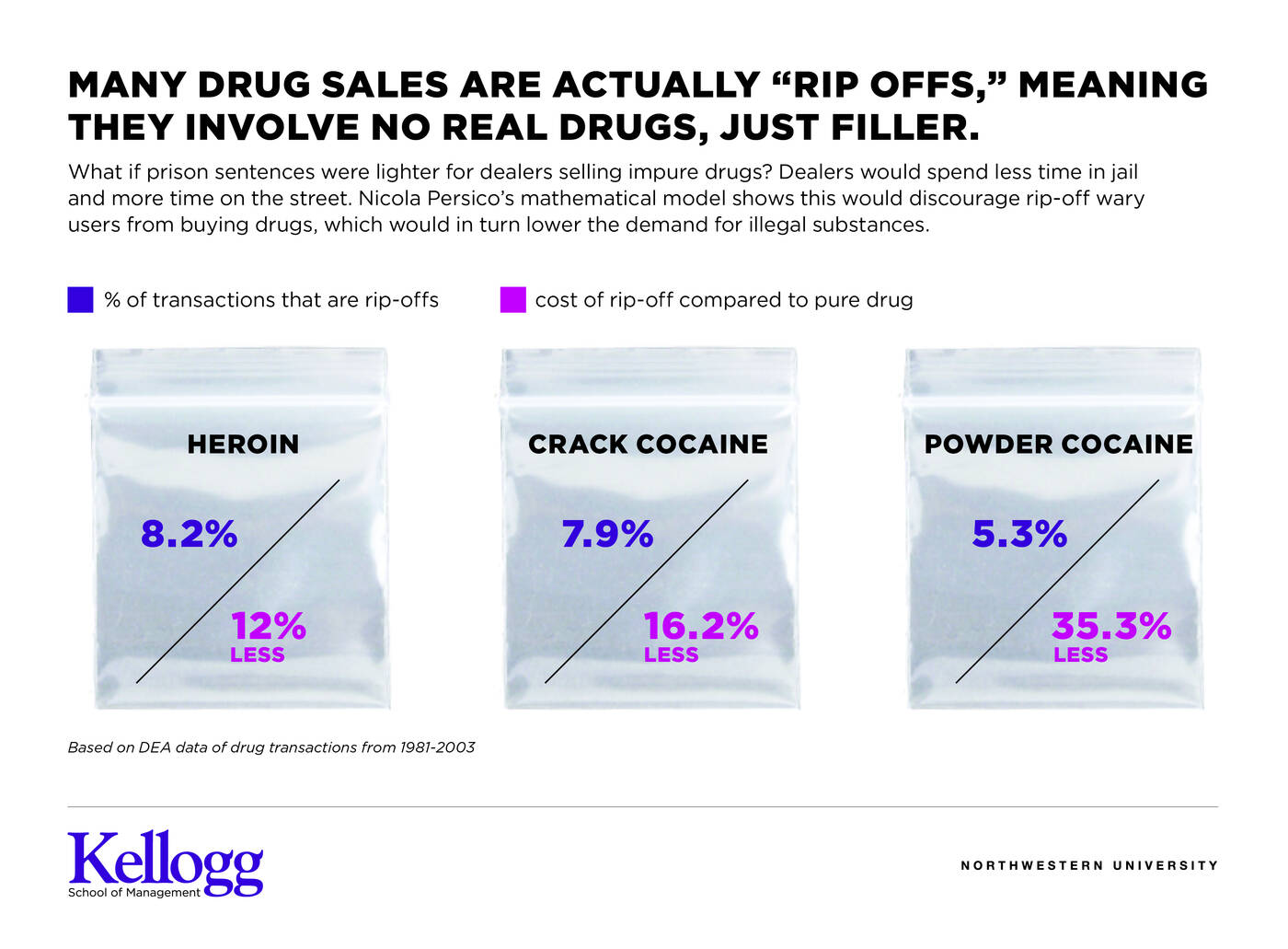

Persico and coauthors Manolis Galenianos of Royal Holloway College and Rosalie Liccardo Pacula of RAND Corporation used Drug Enforcement Administration information on drug transactions (heroin, cocaine, and others) in the U.S. from 1981 to 2003. The data the DEA supplied came from informants, undercover agents, and technicians, and included price, location, and purity of the drugs. An additional data set provided information on those arrested for buying and using drugs, and included demographics, number of dealers transacted with, difficulty locating dealers, and price paid.

Preliminary data analysis highlighted the unenforceability issue in a big way. “We saw the price dispersion, as expected, but also that about 5–10 percent of the transactions were completely fake,” Persico said. “Those transactions—‘rip-offs’—involved no drug content at all, but buyers paid the same average amount for the product as they did for real drugs.” For example, 8.2 percent of all heroin transactions were rip-offs. “If someone sells me coffee that’s actually dirt, I can take them to court,” Persico says. “I can’t do that with heroin or cocaine.”

If you are buying an illegal drug, you only learn its purity after the sale is made. Why does that matter? “The inability to know the quality of drugs before purchase, combined with the unenforceability, means the drug market is always on the brink of collapse, as there will be incentive on the part of sellers not to make good on the product quality expected,” Persico says. Recognizing this “moral hazard” on the sellers’ part is critical for understanding the drug market—and addressing it more effectively.

One question raised by Persico’s line of thinking was how the drug market could continue to exist in the first place—and even flourish—given the incentive for rip-offs. He believed there was a simple explanation: repeated interactions between the same buyers and sellers.

To explore this mechanism, the researchers turned to labor economics models pioneered by former Northwestern University economics professor and Nobel Prize winner Dale Mortensen—models originally developed to understand when and why workers switched from one employer to another. “The labor models assume that quality of the work—or the ‘product’—is consistent,” Persico says, “but that’s not a fair assumption in the drug market.” So the researchers adapted their model to account for the reality that a drug buyer will not be able to know the product quality when dealing with a seller for the first time.

When the researchers included the moral-hazard component in the models, they could see that having buyers who repeatedly patronize the same seller helps keep the market sustainable. In other words these frequent shoppers keep their dealers honest by discouraging rip-offs. For example, 76 percent of frequent heroin users reported buying drugs most recently from their regular dealer. “Where quality can’t be enforced by courts, the only thing that keeps it at a reasonable level is repeated interactions,” Persico says.

On this point, Persico speculates that greater police presence—including the undercover variety—actually makes repeated interactions more likely, thus increasing drug purity. “If there’s a lot of police enforcement, buyers take more risk switching sellers because the next seller could be an undercover police officer,” he says.

And that helps keep the drug market going.

Out of Persico’s research emerges a logical but controversial enforcement recommendation: less harsh sentences for those selling less pure drugs.

Using tougher penalties for drug convictions has not reduced drug affordability; cocaine and heroin prices have fallen significantly, despite stronger enforcement. Less harsh sentencing for sellers of impure drugs will result, theoretically, in a higher proportion of rip-offs, because such sellers will spend less time in jail and face less deterrence than their pure-drug-selling counterparts. A higher rate of rip-offs would, the model shows, encourage more buyers to exit, leveraging the moral hazard to erode demand for illicit drugs.

Carrying this logic to the limit, Persico believes there should be zero penalty for a 100 percent-impure drug sale. “If someone’s selling sugar under the pretense of selling cocaine, let’s celebrate this guy!” he says. “The penalty should be for the actual amount of illicit substance sold, not the amount purportedly sold—let the punishment fit the actual crime.”

Persico’s enforcement suggestion potentially addresses an important social issue as well, given that those incarcerated for drug offenses tend to be from minority and low-income populations. “A more lenient sentencing policy would get people out of jail faster, save taxpayer money, and keep the percentage of rip-offs higher,” he says. “Who could be against that?”

Persico acknowledges the challenge of implementing his policy suggestion. “It’s not clear if the government would take our sentencing recommendation seriously,” he says.

Drug markets will continue to evolve. Some markets, like that for marijuana, have even moved from illicit to legal in some US states. The key takeaway from Persico’s research, then, is that to address any drug market and develop effective policies related to it, we first have to understand its dynamics and unique features.

That is a prescription well worth following.

Galenianos, Manolis, Rosalie Liccardo Pacula, and Nicola Persico. 2012. “A Search-Theoretic Model of the Retail Market for Illicit Drugs.” Review of Economic Studies. 79(2): 1239–1269.