Featured Faculty

Professor Emeritus of Managerial Economics & Decision Sciences; Director of the Center for Games and Economic Behavior

Associate Professor of Marketing; Bernice and Leonard Lavin Professorship

Yevgenia Nayberg

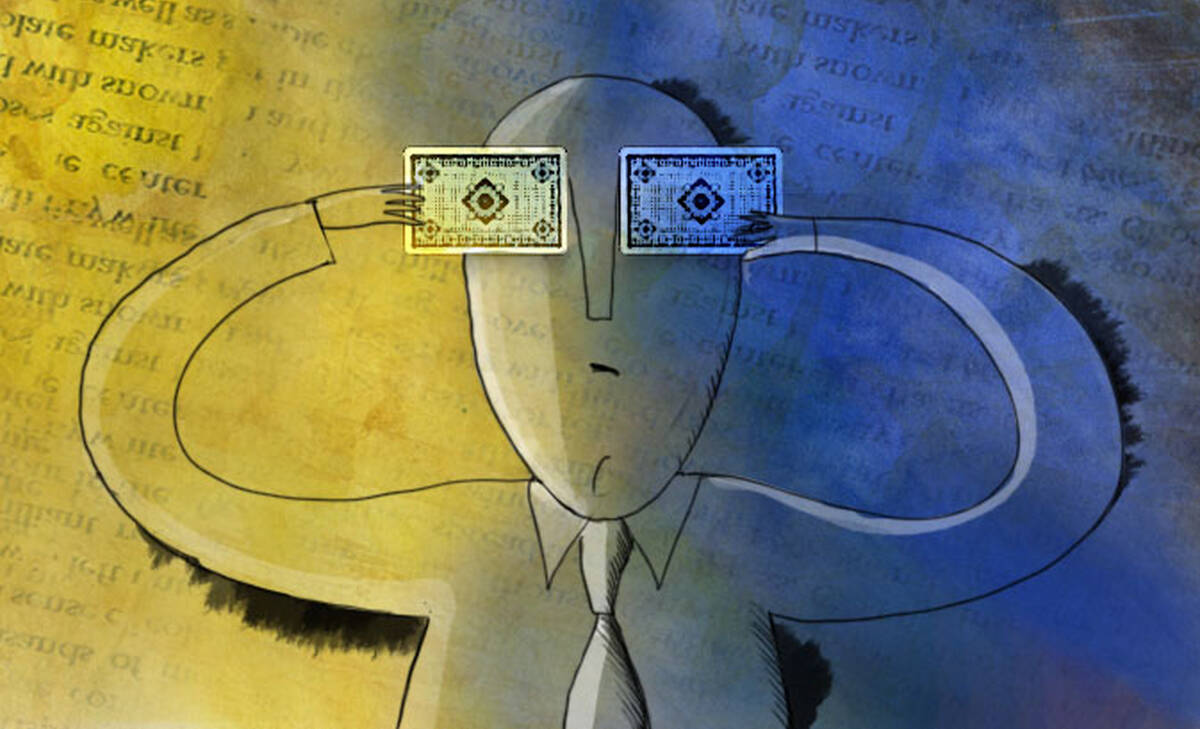

From Texas Hold’em to nuclear deterrence, the bluff is a common strategic move, and one that we often think of as a kind of improvisation—a clever psychological ploy when the odds are stacked against us.

Game theorists take a different view on bluffing. For Ehud Kalai, a professor of managerial economics and decision sciences at the Kellogg School and founding editor of Games and Economic Behavior, bluffing is primarily computational, not psychological. To win in any strategic game, it pays to be unpredictable, and game theory offers models for how to keep one’s opponent guessing.

“It’s straight mathematics,” Kalai says. “If I bluffed all the time, obviously my bluffing would be ineffective. But it’s not effective to under-bluff, either, because then I’m not making enough use of my reputation as a non-bluffer. If you never bluff, or bluff very rarely, you can use this reputation to bluff more effectively and increase your long-term winnings.”

As Kalai defines it, games of skill are those that require strategic moves, with each move ideally serving to maximize unpredictability. In 1984, he had an opportunity to prove this in court. When the city of Chicago forbade a bar owner from putting computerized poker and blackjack machines in his establishment—claiming that these are games of luck, not skill—the owner sued, and Kalai testified as an expert witness on his behalf.

“If you’re going to bluff, you have to be clear about what kind of game you’re playing.”

In front of a judge, he played the games in strategic and nonstrategic ways. “The point was to show that it is possible for someone to play these games with skill,” he says. The judge was ultimately convinced—though he did require a brief tutorial—and the games were deemed to be legal. A crucial part of the skill was bluffing—or playing unpredictably enough to challenge the machine’s algorithms.

Kalai has also applied his expertise to professional football. He once had a conversation with Michael McCaskey, former president of the Chicago Bears, about using game theory calculations to call offensive plays. At the time, computers were banned from the skybox, but he still thinks the Bears could have paid more attention to probabilities.

“Just like in poker, you don’t want to be known for doing certain things in certain situations—in this case, always passing or always running. Even if the situation calls for running the ball, every once in a while you want to pass the ball to keep the other team unsure. I would randomize between passing the ball and running the ball in different situations, but for each situation I would randomize with different probabilities. So, for example, if it’s fourth down and we need ten yards, I would assign a high probability to passing the ball.”

Game theorists call this a mixed strategy. “It’s a standard game theory procedure to deal with two-person, zero-sum games,” Kalai says, and it works for playing poker against a machine or running an offense. It is based on the assumption that your opponent is thinking (or computing) as strategically as you are. It also assumes, of course, that a team is able to assess its own advantage.

In a mixed strategy, bluffing is constant, sustained, and systematic—it takes one’s advantage into account but randomizes just enough to keep that advantage working effectively. Randomization is common practice in any number of “games,” from the predator–prey scenario of a squirrel fleeing a hawk to a government’s approach to airport security or tax auditing. In most cases, success depends on more than a single dramatic bluff. For game theorists, the way to win is to guarantee long-term unpredictability.

In business as in poker, it can pay to be unpredictable, but this is only true for certain competitive scenarios. “Think of two fashion companies,” Kalai says. “One company is a trendsetter and one is an imitator. If each has to commit to the next season’s line without prior knowledge of the other’s style choices, then neither the trendsetter nor the imitator wants to be predictable.”

Still, he says, it is important to recognize that not all competitive games call for the same strategy. A mixed strategy might work best in a two-person zero-sum game, but there are also many kinds of nonantagonistic games—in other words, those that require full or partial cooperation. “It gets complicated when you cross into different strategic relationships,” Kalai says. “If you’re going to bluff, you have to be clear about what kind of game you’re playing.”

You also have to be clear about your own reputation. Kent Grayson, a professor of marketing at the Kellogg School who has studied trust and deception, says that bluffing is only effective when it is done with a measure of self-awareness. A good reputation might allow a company to bluff periodically—by, for example, ostensibly moving the date of a product launch, and thereby rattling competitors—but only if that company has a clear sense of how it is perceived.

“A company might want to capitalize on its reputation for being innovative,” he says, “but the bluff would only work if they actually have that reputation—and also if they have a reputation for telling the truth. In general, too much unpredictability is likely to decrease people’s confidence in what you are saying.” In other words, whether through bluffing or outright deception, overcapitalizing on your reputation can damage your reputation. A well-respected bank can introduce hidden fees for a while—just as a popular car salesman can sell the occasional lemon—but eventually devious practices will lead to a serious erosion of trust.

Our concept of trust, Grayson says, is comprised of three components: competence, honesty, and benevolence. In other words: Do I believe in this person’s ability? Do I think he or she is telling the truth? And finally, am I sure that he or she has my best interests at heart? In poker, football, and war, only the first two categories are in play. When it comes to the marketplace, bluffing becomes a much riskier business, because a company has to consider exactly whose trust it is manipulating—and whether the payoff is worth the cost.

It is also not a natural move to bluff when the stakes are extremely high. Game theorists say a mixed strategy has been proven to yield the best results, but there are times when strategic randomization feels like the wrong approach. People under pressure tend to be more risk-averse. They also have to deal with the psychological and political fallout if their bluff does not succeed.

Take for example the final play of this year’s Super Bowl, when the Seattle Seahawks had the ball on the goal line against the New England Patriots. Despite having the best running back in the league, the Seahawks chose to pass on second down, and when the ball was intercepted there was an outcry among the team’s fans. Sometimes even the best strategy is deemed incorrect in hindsight—that is, if it fails. But if it had worked and the Seahawks had won, fans might have thought the play was brilliant.

Randomization is especially tough when it comes to warfare and politics—something Kalai, who is Israeli, has witnessed himself. In 1967, during the Six-Day War between Israel and its Arab neighbors, the Israeli military approached a fellow game theorist with a problem. They knew that some Egyptian convoys were using Israeli symbols on the roofs of their trucks to fool the Israeli bombers. This posed a predicament for the Israeli pilots, who could not tell the true identity of such convoys before making a decision about whether to bomb.

“My friend, being a game theorist, told them that you can compute it. You bomb according to such-and-such probabilities. Of course, there was no way the general was going to do that, even if it was the right decision, because to bomb people by the flip of a coin would be political suicide.”

The British faced a similar dilemma during World War II. When Alan Turing broke the wartime German code, Enigma, the military used a math formula to determine how many interventions the Allied forces could plausibly make without revealing their secret advantage. This, of course, was classified.

So while game theory has a lot to teach about strategic deception, there are limitations. Sometimes the math is too complex to recommend a course of action. “If we take a restricted poker game,” Kalai says, “I can compute the optimal bluffing probabilities. But if it was a full poker game as played by a group of players in the casino, I could not compute the absolutely optimal strategy. The same goes for other situations. Sometimes it is a solvable problem, and sometimes it is just an estimate.”