Economics Finance & Accounting Apr 1, 2020

The Unprecedented Stock-Market Reaction to COVID-19

A new analysis explains why this pandemic really is different.

Lisa Röper

This article was shortened and adapted from a longer analysis by the authors, available here. You can learn more about the model here.

As the novel coronavirus (COVID-19) spread from a regional crisis in China’s Hubei province to a global pandemic, equities plummeted and market volatility rocketed upwards around the world.

In the United States, recent volatility levels rival or surpass those last seen in October 1987 and December 2008 and, before that, in late 1929 and the early 1930s. Motivated by these observations, we consider the role of COVID-19 developments in recent stock-market behavior and draw comparisons to previous infectious-disease outbreaks.

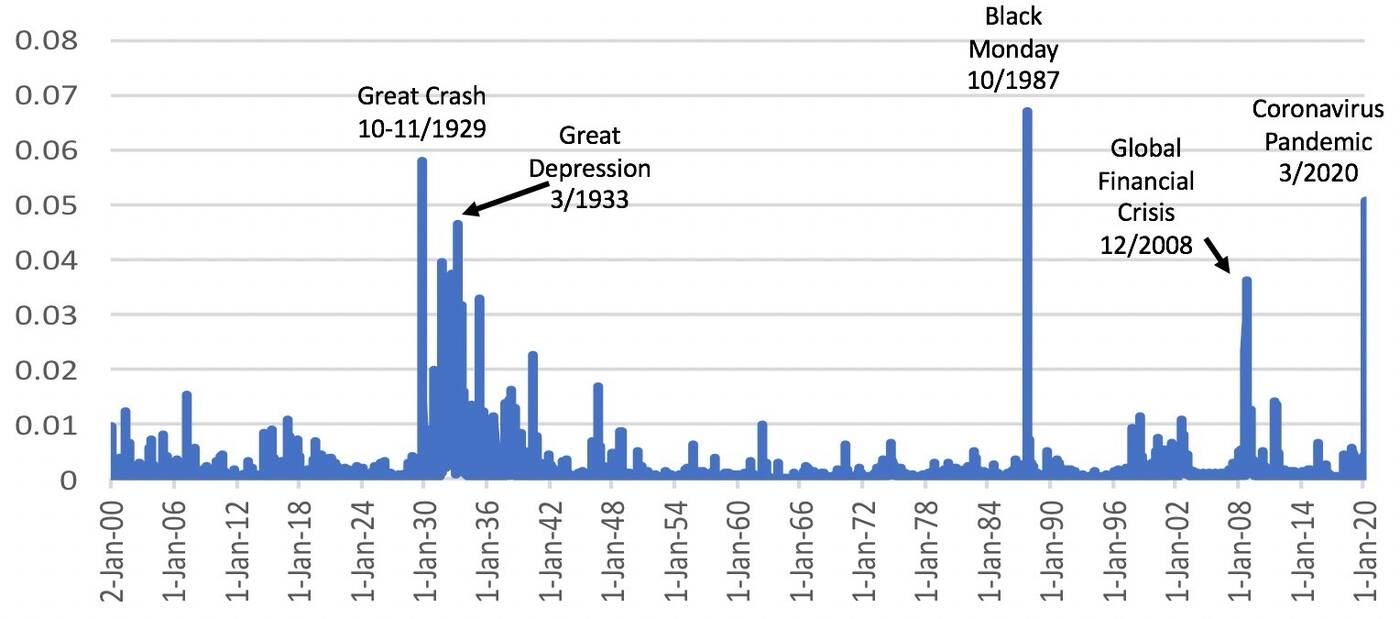

Our analysis suggests that, compared with other outbreaks, COVID-19 is having an unprecedented impact on markets. Below is 120 years of U.S. stock-market volatility (over 10 trading-day periods).

Using automated and human readings of newspaper articles, we find that, since 1985, no other infectious-disease outbreak has had more than a tiny effect on U.S. stock-market volatility. Looking back even further, to 1900, we find not a single instance in which contemporary newspaper accounts attributed a large daily market move to pandemic-related developments. That includes the Spanish Flu of 1918–1920, which killed an estimated 2.0 percent of the world’s population. In striking contrast, news related to COVID-19 developments is overwhelmingly the dominant driver of large daily U.S. stock-market moves since February 24, 2020.

Why? We consider a range of possible explanations, including the gravity of the pandemic, the richness of the available information about it, and the interconnectedness of the economy. But we determine that behavioral and policy responses, such as containment and social distancing, are responsible for the bulk of the volatility.

Characterizing Daily Stock-Market Jumps

In research published last year, we examined next-day newspaper explanations for each daily move in the U.S. stock market greater than 2.5 percent, up or down. By this criterion, there were 1,129 stock-market jumps over the 120-year period from January 2, 1900, to March 24, 2020.

For each jump, we read the lead article in next-day (or same-evening) newspapers to classify the journalist’s explanation into one of 16 categories.

The table below underscores the unprecedented impact of the COVID-19 pandemic on the U.S. stock market. In the period before February 24, 2020, contemporary journalistic accounts attributed not a single daily stock-market jump to infectious disease outbreaks or policy responses to such outbreaks. Perhaps surprisingly, even the Spanish Flu fails to register in next-day journalistic explanations for large daily stock-market moves.

Data for the past month tell a dramatically different story. From February 24 to March 24, 2020, there were 22 trading days and 18 market jumps—more than any other period in history with the same number of trading days. Jump frequency during this period is 23 times the average pace since 1900. Moreover, next-day newspaper accounts attribute 15 or 16 of the 18 jumps to news about COVID-19 developments and policy responses to the pandemic. In short, no previous infectious-disease episode led to daily stock-market swings that even remotely resemble the response in the past month to COVID-19 developments.

Quantifying the Contribution of COVID-19 to U.S. Stock-Market Volatility

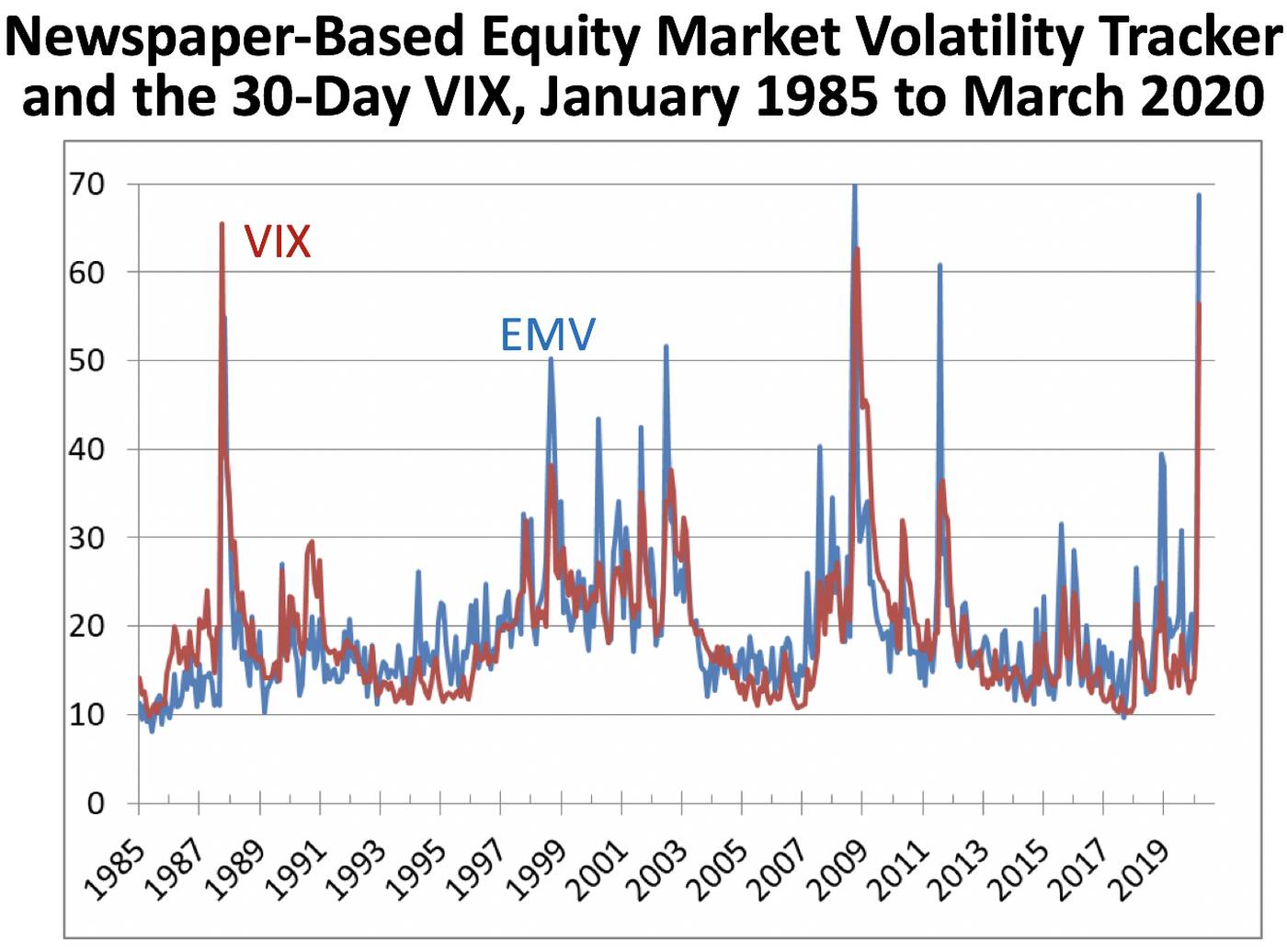

In a first step, we calculate the monthly fraction of articles in 11 major U.S. newspapers that contain (a) terms related to the economy, (b) terms related to equity markets, and (c) terms related to market volatility. We multiplicatively rescale this monthly series to match the mean value of the popular volatility index known as VIX since 1985 to create our Equity Market Volatility (EVM) tracker. (Below, it is shown alongside the VIX itself.)

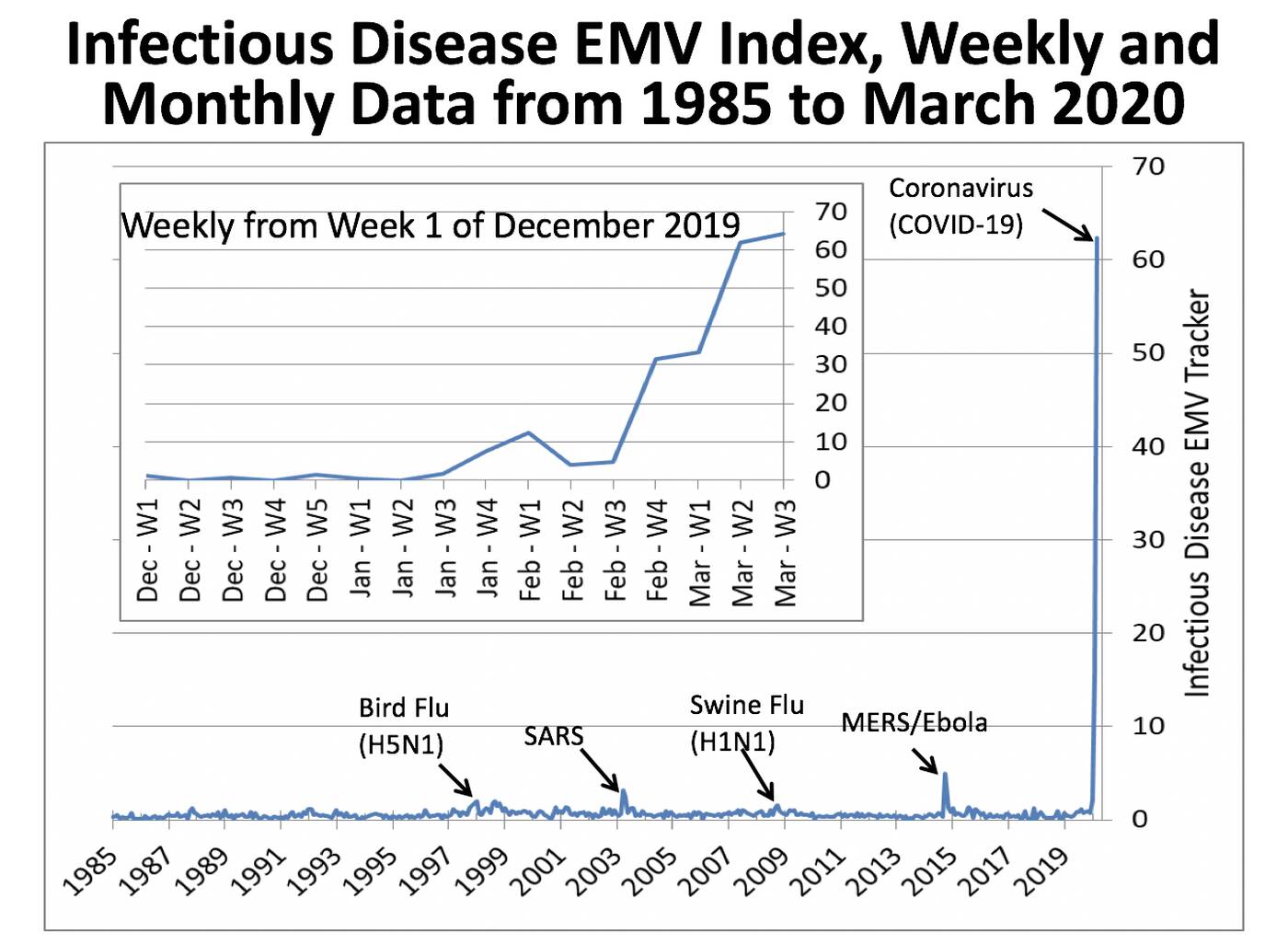

In a second step, we identify the subset of EMV articles that contain one or more terms related to COVID-19 or other infectious diseases, including epidemic, pandemic, virus, flu, disease, coronavirus, MERS, SARS, Ebola, H5N1, or H1N1. Multiplying the fraction of EMV articles that contain one of these terms by our EMV tracker yields our Infectious Disease EMV tracker displayed in the figure below. The inset portion displays the results of the same quantification exercise at a weekly frequency.

This figure establishes three points. First, before the COVID-19 pandemic, no infectious-disease outbreak made a sizable contribution to U.S. stock-market volatility. The 2003 SARS epidemic and the 2015 Ebola epidemic led to modest, short-lived spikes in volatility, and the Bird Flu and Swine Flu epidemics barely registered. Second, the COVID-19 pandemic drove the tremendous surge in stock-market volatility since late February. Third, the COVID-19 volatility surge took off in the fourth week of February 2020.

The table below provides more information about newspaper coverage of various infectious disease outbreaks since 1985. Note that the early phase impact of COVID-19 looks similar to the impact of other infectious-disease outbreaks in the past 35 years. By February, however, COVID-19 developments begin to dominate newspaper coverage of stock-market volatility (% EVM below) and figure prominently in newspaper discussions of economic-policy uncertainty (% EPU below). By March, COVID-19 developments receive attention in more than 90 percent of all newspaper discussions of market volatility and policy uncertainty.

Possible Explanations for the Stock-Market Impact

Why have COVID-19 developments exerted such powerful effects on the stock market since late February?

Clearly, the current pandemic has grave implications for public health and for the economy. So, part of the answer surely lies in the severity of the pandemic, the apparent ease with which COVID-19 spreads, and the non-negligible mortality rate among those who contract the virus. Still, we think this answer is highly incomplete. Mortality rates experienced during the Spanish Flu offer a worst-case upper bound on the potential mortality induced by COVID-19. Yet the Spanish Flu did not trigger even a small number of daily stock-market jumps.

A second potential answer is that information about pandemics is richer and diffuses much more rapidly now. According to this explanation, the stock-market impact of the COVID-19 pandemic is more temporally concentrated and more likely to trigger daily stock -market jumps and high stock-market volatility than Spanish Flu developments did a century earlier. Here as well, there may be something to this explanation, but it is also highly incomplete. The negative stock-market impact of the Spanish Flu was fairly modest even over time spans of several months. Hence, explanations that stress greater information availability and more rapid diffusion of that information do not take us very far in rationalizing the huge stock-market drop since February 24.

A third explanation stresses the interconnectedness of the modern economy: the commonplace nature of long-distance travel and, in Europe, cross-border commuting; decades of falling communication costs, falling transport costs, and, until recently, falling tariffs; dense, geographically expansive supply chains; and the ubiquity of just-in-time inventory systems, which are highly vulnerable to supply disruptions. In addition, the structure of the economy has shifted over time to services, many of which involve face-to-face interactions. An abrupt uptake of voluntary and compulsory social-distancing practices brings a sharp drop in demand for such services. Again, there is merit in this explanation, but it also strikes us as insufficient on its own to explain the stock-market reaction.

That brings us to behavioral and policy reactions to the COVID-19 pandemic. As the economist Richard Baldwin puts it, “COVID-19 and the containment policies have directly and massively reduced the flow of labour to businesses. The result has been a sudden and massive reduction in the output of goods and services.” Voluntary adoption of social-distancing practices has also played a significant role. Current containment efforts are much more extensive and widespread than similar efforts in the past, including during the Spanish Flu. They also have more potent effects in the modern economy for reasons sketched above. In our view, the policy response to the COVID-19 pandemic provides the most compelling explanation for its unprecedented impact on the stock market.

The healthcare rationale for travel restrictions, social-distancing mandates, and other containment policies is clear. These policies also bring great economic damage. Recent stock-market behavior is an early and visible reflection of the (expected) damage.