Featured Faculty

Adeline Barry Davee Professor of Management & Organizations; Executive Director of the Center for Executive Women

Michael Meier

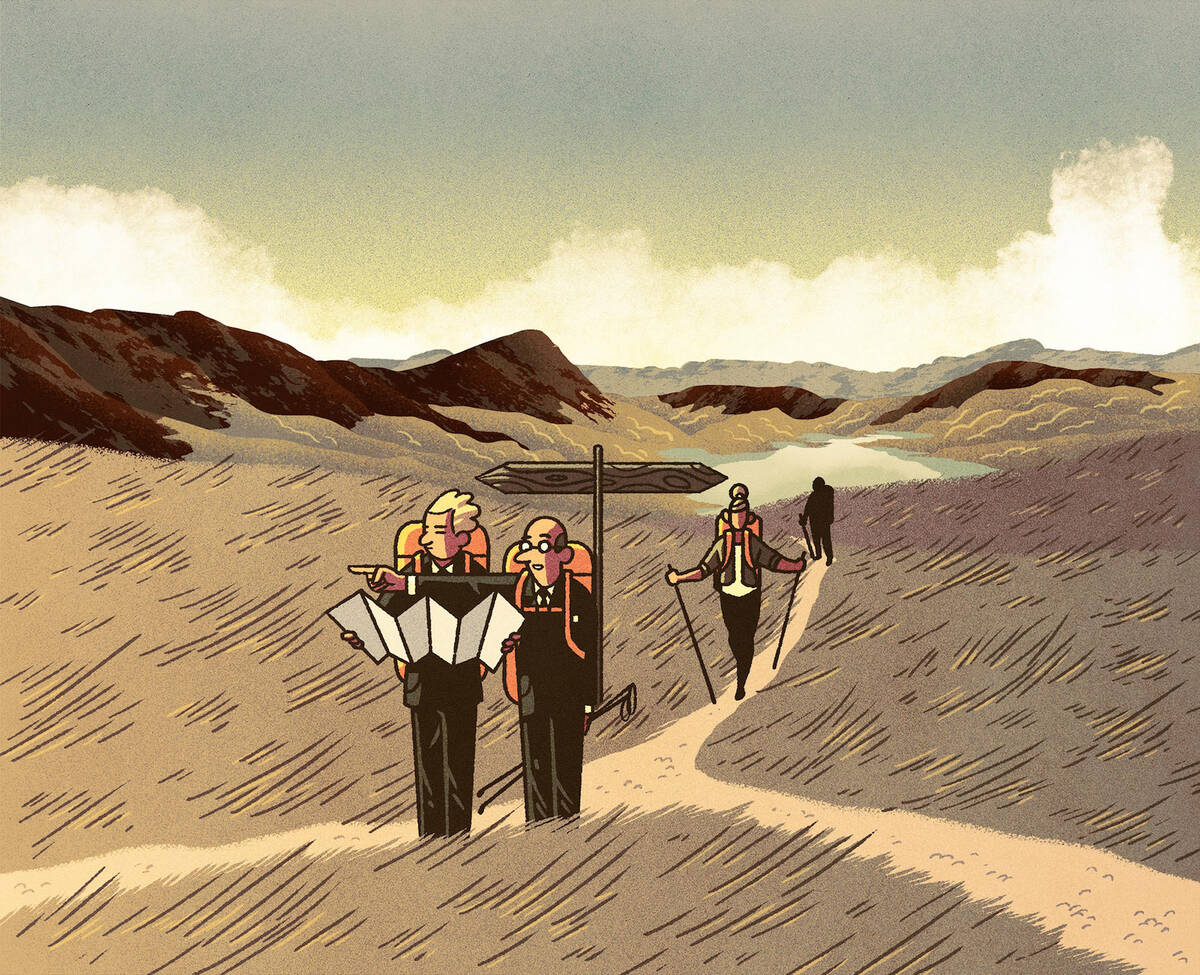

Leaders earn their keep by making smart decisions. But sometimes the smartest decision is to delegate that decision to someone else.

Every decision fits somewhere along a risk continuum. An ugly shade of green in the hallway is not necessarily going to damage the brand, but an ill-timed acquisition might—just as hiring a single underwhelming employee will have fewer consequences than the decision to outsource a functional area for twelve global offices.

I encourage leaders to approach decisions by first considering the riskiness of a decision and allowing that assessment to determine (1) who is involved in making the decision, (2) how much time should be spent, (3) how much certainty is required, and (4) what your tolerance is for error. These questions can help leaders make better use of their time—and empower their organizations in the process.

A well-run company has the right people focused on the right risks. Ideally, the CEO and board of directors should only make decisions at the extremely high end of a risk continuum, leaving mid- and low-risk decisions to those further down the corporate ladder.

Unfortunately, this does not always happen. Too often, low-risk decisions get escalated up to the leadership team. This can happen for a couple of reasons. Sometimes CEOs act like vacuum cleaners, “hoovering” even the smallest decisions upwards. Other times, though, the problem is that the people below the CEO are unwilling to be accountable for mid-risk decisions and push them up to the top.

I once advised a CEO who was being asked to decide when his company should launch a product in New York. He was not even in New York and the riskiness of the decision was relatively low—it was not his decision to make. He concluded that this decision was on his desk because his team was unwilling to make the call and did not want to take accountability.

When I talked to his people, I heard a different story. They said that if you made a decision that was not what he would have decided, he would just re-decide anyway, so it was more efficient to let him decide in the first place. Regardless of whether the decision is sucked up to the top by the senior leader or pushed up from below, this escalation results in a number of predictable problems.

First, this type of escalation makes decisions take much longer. Time is wasted because decisions have to climb their way up through the org chart, and then back down. Time is also wasted because the senior executives being pulled into the decision often have very busy schedules, so it takes time to get the decision in front of them and provide adequate briefing on the topic.

Decisions that are escalated also tend to be more error-prone, as the people making the decision are further away from the data required to make the call.

Moreover, when the most senior leaders make every decision, they fail to empower people at the lower rungs of the organization and fail to develop their team’s decision-making skills. By pushing decisions down instead escalating them, leaders can build the decision-making muscles of their employees while making people feel more valued and trusted in their roles.

The reality is that every individual, including the CEO, has limited cognitive resources—resources that should be reserved for addressing the most fundamental issues facing the company at any given time. The biggest mistakes often occur when those at the top are using their mental energy on decisions that are not that critical.

In my experience, many organizations spend a disproportionate amount of time making low-risk decisions. I call this “inverting the risk continuum.”

Inverting the risk continuum can lead a company to lose focus of core business questions. I recently spoke to a group of leaders whose company had made a significant acquisition, one that doubled the company’s size. When I asked them to write down the most important decision they were making at that moment, 180 out of 200 said they were making a staffing decision.

“Most people tend to overestimate the risk of making a bad decision and underestimate the risk of inaction.”

To me, this was surprising. Staffing decisions—unless they involve positions at the highest levels of management—typically fall somewhere in the middle of the risk continuum. But this company was spending more time on staffing issues than they had spent making the much riskier decision of whether to go through with the acquisition.

To be clear, I am not saying that hiring is not important but rather pointing out that a hiring mistake of a single low- to mid-level executive is unlikely to take down a company or rock its share price. On the other hand, a single large acquisition that goes badly could destroy the business. So, more time should be allocated to these decisions than to less risky ones.

Some leaders by nature tend to be more cautious than others—and there is nothing inherently wrong with caution. But it is easy to overanalyze mid-risk and low-risk decisions. To avoid paralysis by analysis, the level of risk should drive how much certainty is required: When is 70 percent enough? When is 50 percent sufficient? When should we just make the call based on our gut because the risk is so low that it would be better to revise the decision if needed later than to analyze it upfront? You want to save your analytic rigor for the important stuff.

It is critical to consider the level of certainty required because there is a cost to the analysis. There is the cost of completing the analysis and the cost of postponing the decision. Postponing a decision is a decision in itself. Most people tend to overestimate the risk of making a bad decision and underestimate the risk of inaction, and this can have real consequences in a competitive business environment. Postponing a certain decision might be the right call for a company, but it is never completely risk-free; there is always a risk to not acting, and sometimes the consequences are as dramatic as making the wrong decision. For example, a company may spend months analyzing whether a new product should be launched and in the time they spend deciding, their competitor launches a very similar product.

Most companies today claim to value innovation. We can find it in their mission statements or posted in large letters in their corporate lobbies. But innovation is only possible when you are willing to take risks. And in order to take risks, you have to be willing to get things wrong.

Leaders have a choice when it comes to tolerating error. Some choose to punish errors and reward overanalysis. Others actually celebrate mistakes. At 3M, it was hard to get promoted without having made a highly visible mistake that was widely discussed. That is not because 3M loved mistakes, but because they valued risk-taking, which they knew was the spark for innovation.

Instead of being universally cautious, leaders should focus on “de-risking” decisions by actively working to push decisions down the risk continuum. There are many ways of doing this. If a company wants to de-risk the launching of a new product, for instance, it can launch it in a smaller market, where its bugs will be less visible. Many startups live by the mantra “fail often, fail fast,” which makes perfect sense when dealing with low- and mid-risk decisions. But it may be less applicable to the higher end of the risk continuum. You do not want to fail often or fast at the core of your business.

What you do want is a company that encourages innovation and empowers its people to make decisions appropriate to their position. No amount of analysis will ever completely eliminate risk. But when leaders learn to assess that risk and focus on what really matters, they are far more likely to succeed.