Podcast Transcript

Laura PAVIN: Can I revisit the 19th century with you for a second? I just really need to make you understand how bad medical care used to be.

If you had appendicitis? You’re dead. Syphilis? Pain and disfigurement. And that was before they treated you with mercury.

And if you had a mental illness? Here’s how that might go.

[clip]

Everett GALLINGER: What in the hell happened?

Henry COTTON: It’s all part of the treatment. We … we pulled all of her teeth.

GALLINGER: Why?!

COTTON: My research has shown conclusively that all mental disorders stem from disease and infection polluting the brain. Sir, the teeth and gums are havens for bacteria and sepsis; thus, to cure the patient, we must rid the body of all sites of infection.

GALLINGER: She’s a beautiful woman.

COTTON: Who has gone mad …

[clip fades out]

PAVIN: This is a scene from a show called The Knick about doctors during the era. The plot’s fictional. The scenario was not. But practically nowhere in this 19th century plot will you hear about an insurance company. We didn’t need ‘em.

Jessica LOVE: Today, of course, healthcare has improved a lot. And the price reflects that—and then some. So we need insurance to help us out. The problem is that it really only helps some of us out.

PAVIN: I’m beginning to sense an economic-incentive problem?

LOVE: You’re listening to Insight Unpacked. I’m Jess Love.

PAVIN: And I’m Laura Pavin.

LOVE: And up until this point, we’ve talked about how hospital systems and doctors are driving up healthcare costs in this country. Each holds very tight to their piece of the spending pie, making it hard to reduce the size of that pie.

PAVIN: Today, though, we’re going to talk about everyone’s favorite villain, health insurance companies. Now, the story of health insurance in America is largely the story of employer-sponsored health insurance. You know, that whole thing where you can only really get good, affordable insurance from the company you work for? Well, it actually wasn’t destined to be.

LOVE: Which should be obvious, because it actually is kind of weird. Why should our insurance be so closely tied to our jobs, especially when losing your job means losing your insurance at exactly the moment you can least afford care without it?

PAVIN: We are going to tell you the story of health insurance in two parts today. Part one: How did we even get employer-sponsored health insurance in the first place? Jess and I are going to run you through that. It’s kind of fun!

LOVE: And part two: Why is health insurance so expensive for so many Americans? Isn’t health insurance supposed to make it easier to afford care?

The key throughline in all of this, as you’ll hear, is a certain incentive driving health insurance companies. And, at the risk of oversimplifying, that incentive is to pay out less money than they take in. How they achieve that, though, hasn’t always aligned with what’s best for everyone else.

That’s next.

[music]

PAVIN: So the 20th century was huge, as far as medical advances go. We emerge from the anatomical dark ages, and we get antibiotics. Germ theory. Survivable surgeries. And doctors are held to higher standards. They wash their hands. So, of course, more people turn to the medical system, looking for help with all that ails them.

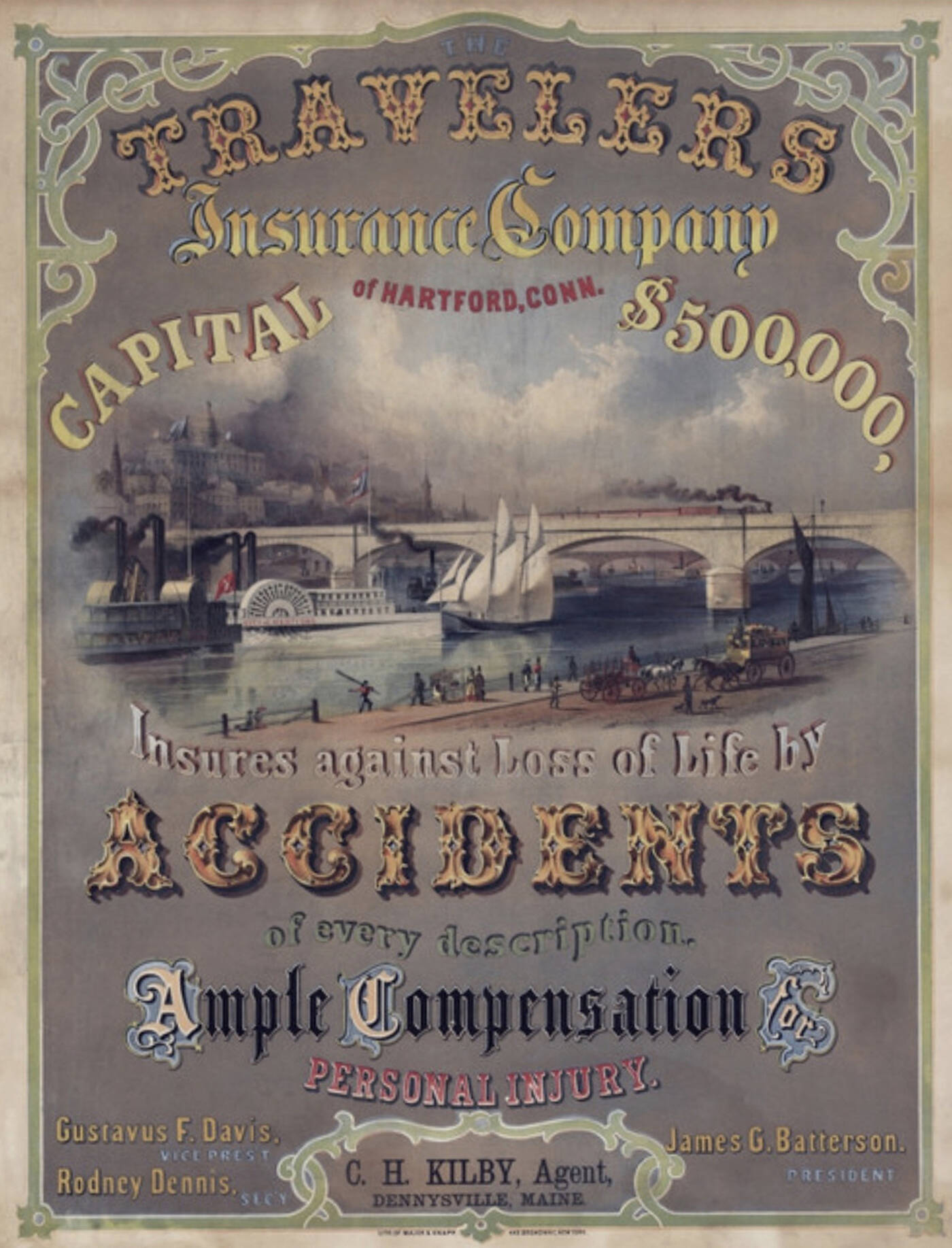

But people were mostly paying for this on their own. Health insurance wasn’t in the picture in the early nineteen hundreds. You see, insurance companies? They were around, but they were focused on other products: life, casualty, and maritime insurance. They considered health totally uninsurable. Here’s David Dranove, Kellogg professor and healthcare economist.

David DRANOVE: The commercial plans kind of stalled in part because in the individual market there was the concern that the only individuals who were going to sign up were the ones who were really sick, and the insurers would suffer from adverse selection. So they had to charge high premiums, and that killed that market.

LOVE: Ah, the adverse-selection problem. We’ll hear more about that later. Commercial insurance companies were scared that if they just dangled health insurance out there, only the sick people would buy it, and the healthy people wouldn’t. They couldn’t have a bunch of sick people tanking their product, so they opted out.

Healthcare wasn’t insanely expensive, anyway. So enough people got care—without the help of insurance—that doctors and hospitals were happy.

Until the Great Depression hits.

[Great Depression clip] It was panic. Sixteen-and-a-half-million shares of stock sold in a single day. Sold hopelessly. Desperately. At any price. It was the forerunner of depression and crisis.

PAVIN: Right. This is where we get our first taste of modern health insurance in America. It’s the ‘30s, the economy takes a nosedive, people can’t afford medical care anymore. But hospitals, looking for a consistent cashflow, they find a way to hack it.

So they come up with prepaid care—a monthly fee that guarantees you a certain amount of days in the hospital. And Baylor University Hospital, which pioneered this model, initially enrolled about twelve-hundred-and-fifty Dallas public school teachers. These were working-aged, healthy people who likely wouldn’t be hospitalized as much as other populations. So, the hospital would likely get to keep a good sum of these pre-payments. So, already, we’re starting to see this link between health insurance and employment.

This arrangement catches on, and before you know it, hospitals and doctors and commercial insurers are like, “wow, insuring mostly healthy employee groups is pretty viable.”

LOVE: So now you’ve got health insurance becoming more of a thing. But it’s still not a big thing. Less than 10 percent of Americans had health insurance by the end of the ‘30s. Dranove again.

DRANOVE: On the employer side, employers just didn’t even think about offering health insurance as a benefit.

LOVE: And then, some things happen that make employer-sponsored insurance a core part of healthcare in America.

[radio broadcast clip] This is John Daly, speaking from the CBS newsroom in New York. Here is the Far East situation as reported to this moment. The Japanese have attacked the American naval base at Pearl Harbor, Hawaii, and our defense facilities at Manila, capital of the Philippines.

LOVE: The U.S. is roped into World War II. It fully commits, but it needs some help.

[WWII men and jobs clip] … the president has designated the United States employment service a defense agency and has entrusted it with the responsibility of mobilizing the nation’s manpower for defense work. It is our task to locate for the government and for private defense industries the men and women who can make the ships, the guns, the tanks, the planes, and thousands of other kinds of materials and equipment needed to protect this country.

LOVE: Every working person is needed to help in the war effort—we’ve got tanks, ships, and armaments to make, after all.

And economists can just feel inflation coming around the corner. They’re worried employers will get caught in this cycle of constantly raising their wages to compete for workers, who were becoming pretty scarce because everyone was already working. To make sure that didn’t happen, President Franklin D. Roosevelt signed an executive order to freeze wages. And companies are like, “shoot! How do we attract workers now?”

As companies do, they discovered a little loophole.

PAVIN: They always do! Okay, so, this wage freeze? It did not include health insurance. Employers catch this and realize that if they can’t compete on wages, this is what they can compete on. The bennies! So they offer their employees these beefed-up benefits packages, and they include health insurance.

Here’s the grand finale, though, maybe the biggest ingredient in the stew that became employer-sponsored health insurance in America. So, for reasons that are actually still pretty unclear, the Internal Revenue Service says, “Guess what? Employer-provided health insurance is exempt from federal income tax.” Employers latch onto this tax break hard.

And the number of insured Americans just takes off.

Remember that before this point, less than 10 percent of Americans had it. After the war, almost a quarter of Americans have it. This percentage more than doubles by 1950. And by 1960, it approaches 70 percent.

[music]

LOVE: Now, we should point out that, throughout every step of this history, there is a parallel effort happening to make some version of national, or “single-payer,” health insurance happen. And we bring this up because, at this point, you might be asking: Why did single-payer catch on in Europe and not the U.S.?

A big reason is World War II. The war tore Europe up, and the only entity that could insure health was the government. Literally no one but the government could afford to do that, so they had to do single-payer.

Meanwhile, over here in America, we had a private system, and it was working for just enough Americans to keep the whole thing going. If you were among those with generous health insurance through your employer, as many of the most politically powerful Americans were, things were basically great. Why would you give that up for something unknown?

PAVIN: Right. And if you were the insurance companies, you were also loving it, because you were getting buy-in from all of these employer groups with their many young and healthy employees. The insurance companies didn’t have to pay out as much as they would for an older, sicker population.

So national health insurance never gets pushed through. And what we have now is a system that economic opportunity made. We are solidly a nation of employer-sponsored health insurance.

But why are health-insurance companies so often portrayed as the villains in our collective story of healthcare in America? Well, making health insurance a business—and not a public good—has created a set of incentives that are often at odds with everyone else’s incentives.

More on that, next.

[music]

LOVE: Pretty much, up until this point in our story, the ‘70s, people generally like their employer-sponsored health insurance. And as we discussed in a previous episode, Medicare and Medicaid have picked up some of the slack for the elderly, poor, and disabled. Now, people are definitely still falling through the cracks, but the insured are happy. And so are the insurers, with their lucrative pools of mostly healthy employees.

But, all the while, something is happening with healthcare in America that’s becoming a bigger problem.

From the ‘60s to the ‘80s, the percent of our GDP spent on healthcare about doubles. We were spending.

DRANOVE: Why were prices going up?

LOVE: David Dranove again.

DRANOVE: Was it due to the expansion of Medicare and Medicaid? Somewhat, because the dramatic increase in demand led to just kind of more healthcare providers, more specialists, more technology. Simultaneously—and maybe in response to this—the medical innovation sector just really just blew up. And medical technology, unlike many other technologies, always seems to be higher cost rather than lower cost.

LOVE: Healthcare gets better. Technology is better. We’ve got better drugs, facilities. We’ve got more people getting care. The costs are going up, up, up. And the payers—employers and the federal government—they were the ones left with the giant bill. And they feel like it’s all getting unwieldy.

PAVIN: So they do something about it. They turn to the health-insurance companies, and they tell them, “hey, we need some help keeping a lid on how much we’re spending on healthcare. Is that something you can help us with?” The health-insurance companies say, “sure.” And the thing that they do becomes a huge turning point in the story of American health insurance. Because their incentive is now, more than ever, to negotiate healthcare prices down. And they come up with a few ways to do that. But, the most consequential of these have acronyms we all know pretty well by now.

Robert Lawton BURNS: The HMOs, the health maintenance organizations, and the PPOs, the preferred provider organizations, are two different vehicles that the insurance companies use as they entered into what was then known as managed care.

PAVIN: That’s Robert Lawton Burns. He teaches healthcare management at the Wharton School, and he co-wrote a book about megaproviders with Kellogg Professor David Dranove.

BURNS: In other words, we’re no longer just paying your bills, whatever they are. Now, we’re going to manage all this. And what the HMOs and the PPOs did is they scrutinized the hospital bills, the doctor bills that were being submitted to them. They said, “you know, I don’t think so. I think we’re going to discount these fees.”

PAVIN: Those medical bills that went unquestioned before? Not the case anymore. At their simplest, HMOs and PPOs were contracts from insurers that basically said, “okay doctors, you’re going to offer us a lower price for your services, and if you don’t want to do that? Well, you can kiss our pool of patients goodbye!”

More than that, these two plans were part of a bigger movement that was gaining traction in the insurance space. And it was this idea that, if you paid people differently, you’d get them to behave differently. And what HMOs and PPOs did was they forced doctors and patients to think a little harder about what was actually worth spending money on, and what was just nice to have on someone else’s dime.

LOVE: The HMOs were the most maligned of the plans. The way that they worked was that they gave doctors a fixed amount of money to care for each patient regardless of how much care the patient got. It was basically a budget, so the more stuff a doctor did for a patient, the less money the doctor took home in the end. The thinking was that this would push doctors to focus on prevention, because a healthy patient was a cheap patient. But in reality, a lot of doctors saw it as a big headache because they couldn’t just practice medicine without thinking about money now.

And HMOs were wildly inconvenient from the patient’s perspective, too, because they now needed a referral from their doctor to do much of anything.

Paul Campbell, a clinical associate professor of strategy at Kellogg, used to work in insurance. He directed UnitedHealthcare’s state and local government market. And he thinks that this emergence of HMOs, and its strict cost-saving tactics, was when people really started hating their health insurance companies.

Paul CAMPBELL: Have you ever seen the movie John Q with Denzel Washington?

PAVIN: Mm-mm.

CAMPBELL: So it came out in 2002, and it’s basically about a father whose son needs a heart transplant.

PAVIN: The plot of this movie is literally this. From Rotten Tomatoes: quote, “when he discovers that his medical insurance won’t cover the costs of the surgery, and alternative government aid is unavailable, John Q. Archibald (Denzel Washington) takes a hospital emergency room hostage in a last-ditch attempt to save his child.”

CAMPBELL: There’s a scene, you have to pull it up in YouTube [Denzel Washington Emergency Room HMOs], where they have a discussion in that movie about the way HMOs make money.

John Q ARCHIBALD: You know, what I don’t understand is why they never found it, the doctors.

PAVIN: I found the scene. It’s a conversation John Q is having with the healthcare workers he’s holding hostage. That was John Q speaking a second ago. You’ll hear him speak next. The healthcare workers speak after.

[clip continues]

ARCHIBALD: My son has had clean checkups every year since the day he was born. How could the doctors not pick it up?

DR. TURNER: He might not have been tested thoroughly enough.

ARCHIBALD: Why not?

INTERN: You got an HMO, right?

ARCHIBALD: Yeah.

INTERN: Well, there’s your answer. I mean, HMOs pay their doctors not to test. That’s their way of keeping costs down. Let’s say Mike did need additional testing, and insurance says they won’t cover them. The doctor keeps his mouth shut, and come Christmas, the HMO sends the doctor a fat ass bonus check.

ARCHIBALD: Is that true?

DR. TURNER: Possibly.

[clip ends]

CAMPBELL: I think it entered the psyche of the American people. I mean, I think it drew on what were existing narratives around insurance companies. But I firmly believe it was a piece of sort of what led to the way people viewed insurance companies versus doctors.

LOVE: The John Q conversation is not how HMOs work. Well, not officially, anyway. There are always bad actors that pervert a framework intended for good. You can read more about that in our web version of this story. Anyway, the point is that this was the first really big swing at curbing healthcare costs, and it ended up with a reputation as this big, bad-faith effort to deny care. And that was pretty much the beginning of the end for the HMOs’ reputation. Which is a shame, if you ask Campbell.

CAMPBELL: It was a period in the 1990s when HMOs were actually controlling the cost. The cost curve was beginning to bend, but it was because of HMOs, and patients didn’t like the restrictions in terms of choice.

LOVE: And so, employers and insurers reverse course.

CAMPBELL: So I think there was a premature effort to, or a lack of intervention at that moment, to say, “Wait, this is only going to get worse, people. Let’s not give up on the HMO effort.” But insurance companies were happy to do it, because they could make more money without HMOs.

LOVE: So the insurance companies kind of walk those HMOs back. And the cost of healthcare keeps going up, and insurance companies keep trying to manage that, which makes their plans more confusing. This is where all those jargony words come in. Deductibles. Copays. Coinsurance. Max-out-of-pocket. And just so many other ways of saying, “hey, providers and patients, you gotta help us out here. You either need to cool it on the spending or take on more of the cost.”

And so you can kind of see how health insurance, as an industry, gets this reputation as the gatekeeper of money and care. People were mad at them.

LOVE: All the while, healthcare spending keeps rising. And it gets people asking, “Is now the time for universal healthcare?”

[music]

PAVIN: At this point in our story, it’s worth mentioning a thing that’s happening that’s coloring everyone’s feelings about health insurers. In the years since private insurance companies first got into the business of health, Americans’ ideas about who healthcare should be for and what it does has shifted. It’s gone from this nice-to-have perk of employment to more of a human necessity.

So when employers and the government tapped insurers to devise ways to slow things down a bit, they suddenly seemed very villainous. A greedy middleman standing in the way of our health. Questioning doctor decisions. Paying them less or nothing if they didn’t abide by their rules. Surprising patients when things weren’t covered. And exposing them to the real price of care that they hadn’t been privy to before.

And so it makes sense that people started to get louder about wanting some kind of solution that treated healthcare more like a public good than a commodity—Universal healthcare, in other words. But public opinion on that was divided. It was painted as socialized medicine by the right, so it didn’t get traction.

LOVE: Until March of 2010, when someone new takes a crack at creating a bit of a hybrid solution.

[President Obama announces signing of ACAclip] The bill I’m signing will set in motion reforms that generations of Americans have fought for, and marched for, and hungered to see. It’ll take four years to implement fully many of these reforms because we need to implement them responsibly. We need to get this right. But a host of desperately needed reforms will take effect right away [audience claps] this year.

LOVE: President Barack Obama signs the Affordable Care Act, or the ACA, into law. The idea was to approximate Universal healthcare with a capitalist twist. It would expand public insurance—mostly Medicaid, in this case—and then private insurance would capture the rest. Voila! Everyone would be covered. We’d technically have Universal coverage.

But taking part in that was a scary ask for an industry that’s tried to avoid covering just anyone for fear that it wouldn’t work financially. Remember, they didn’t want a bunch of sick people draining their funds.

But the ACA had an idea that it hoped would quell those fears. The exchanges.

LOVE: Paul Campbell again.

CAMPBELL: So the idea is, go to the insurance companies and say, “Listen, we’re going to require everybody in America to have insurance. So that means even the young and invincibles who aren’t really that sick are going to have to get the insurance.” So that means you’re going to get a lot more people in this insurance pool, and you’re going to be able to do what you do so well, which is spread the risk. As a result, you have to accept everybody that shows up, alright? You can’t deny anyone for preexisting injuries. And then [cuts] we’re going to offer subsidies.

LOVE: Insurance companies would theoretically have a decent way to cover sick Americans with this approach because they’d be mixed in with the healthy ones.

On the whole, the ACA sounded like it could be a promising compromise for insurers.

PAVIN: So the ACA gets launched, and a lot of it was instantly popular with people who couldn’t access healthcare before. But the rollout wasn’t exactly smooth, and Congressional Republicans kept trying to gut the whole thing. And, of course, the exchanges kind of fell flat. Americans didn’t sign up for them the way the Obama Administration had hoped.

CAMPBELL: So what you ended up having in 2014 when they launched the exchanges in ’15 was a smaller pool of super sick people, which means the premiums just go through the roof. So now the exchanges that were supposed to be this marketplace for competition to keep premiums low only have sick people, which leads to a death spiral, and they get branded as unaffordable.

PAVIN: Campbell thinks a few things went wrong. There were tech glitches that ended up scaring people away. But the biggest problem of all was that the penalties for not joining just weren’t high enough to convince the healthy and skeptical to hop aboard.

CAMPBELL: But the penalty was relatively low compared to the cost of the insurance. And there were still a lot of young people that just said, “I don’t care. I’m not going to.… It’s still a net loss for me. I’m not going to sign up for insurance.”

PAVIN: In the time since, the exchanges have been called a failure.

I have to say, this narrative always surprised me. Because way back when I was a freelance writer, I got health insurance on one of these exchanges. And my experience was pretty good. I didn’t encounter the tech glitches, luckily. And the plan I got had me paying far less in premiums than I would have with a non-exchange plan.

And not for nothing, as we record this, there are currently 21 million Americans on these exchanges.

So I decided to take a look at how things are going now on these so-called failed exchanges.

I happened to know a person who was very qualified to talk about this, so I forced him into a Zoom room with me.

PAVIN: Could you state your name and title and company?

Joe DAVERN: [laughs] Ohhhh, Joe Davern. What would my title be? President of? We can make this sound good. President of Insurance Made Simple Inc., because I am incorporated.

[fades under]

PAVIN: This is Joe Davern. He’s a health-insurance agent. My husband and I have been friends with him since college, when he sold T-shirts! Now he sells insurance.

[fades back up]

DAVERN: … I mean, if you want my technical, well actually hold on one second, that’ll build me up a little bit. Regional Director is actually my title, so.

PAVIN: Davern helps people find health insurance on the individual market. He’s been doing that for about a decade now. I figure he can help me with a fictionalized scenario.

PAVIN: Say I’m somebody. I’m a single mom with two kids. I make $80,000 a year. I have mental-health stuff, so I have to see a therapist every so often, and I have to take an antidepressant regularly, and I live in Chicago.

DAVERN: This is a pretty good example, and right now, everything you’re telling me, there’s several ways we can go. And I promise you, none of them are great for you.

PAVIN: The best he thinks I can get on the marketplace is this:

DAVERN: You’re probably starting for that group of three at like 900 a month, a thousand bucks a month, maybe. Yeah.

PAVIN: He says that this $900 a month is on the lower end of what I could get.

And that’s not all.

DAVERN: Here’s the problem. Here’s a big problem. I can tell you that your medication and mental health is covered on all of the ACA plans, but what that means for each plan is different.

PAVIN: I’ll have a super high deductible. Around $8,000. Which means I’ll be paying $200 out of my pocket for my psychologist visits every week until I hit that deductible. And I probably won’t ever hit it, he says. The same goes for the medication I take.

For most people, this is some brutal math.

My other options are also bad. Higher premiums and still-high deductibles. We do the math, and none of it is feasible.

But Davern says there is another route we can take. We could go with a non-ACA plan, which doesn’t really feel above board, I guess? But it is. I checked. I should note that insurance companies weren’t previously allowed to sell plans like this under the ACA, but the Trump administration rolled back those restrictions.

Basically, these plans can do all the things that the exchange plans can’t. Like, they don’t have to cover maternity care or protect you from major medical bills.

There’s actually an effort to restrict these kinds of plans again. But for now, they’re here.

And Davern says I can get a lower deductible with one of these plans. I can also get all these add-ons, like a bigger network of doctors to choose from, and it’s going to be less than half the price. That would put me at $400–$500 a month, which feels better. I think.

But of course, there are a lot of catches. For one, it would not cover my mental-health needs. Though, Davern says, there’s a way around that. More add ons!

DAVERN: And then, there’s supplements we can add, which is what a lot of people are doing now, where you can … 40, 50 bucks a month, and you can have unlimited telehealth mental-health visits. If the medications are reasonable, you can go through GoodRx and get those probably cheaper anyway. So you kind of patchwork to build the right plan sometimes, so people can at least afford it.

PAVIN: I’m just going to stop right here and say that this is crazy, right? The ACA exchange feels nice and safe and above board, but those prices are just not within reach for many Americans. And that takes you to the grittier underground: these plans that don’t have to comply with some rules I’d very much like my insurance company to abide by. But what other choice do I have? Maybe I take the risk on the non-exchange plans because it’s better than nothing? It all feels very overwhelming.

Davern agrees.

DAVERN: It’s so confusing. I don’t know how the hell they expect people to do it on their own. It wasn’t supposed to be like this, but that’s why I have a job, I guess [laughs sadly].

PAVIN: Confusing and often expensive. That about sums up the state of health insurance for a lot of people in America today, especially in the individual market. There are all these different little rules, and all this fine print that seems to elude people when they purchase some of these plans and go get care and later find out none of that care is really covered. Insurance companies have found ways to make the math work in their favor, but not always in the patient’s favor. People stay at jobs they don’t even like to avoid the individual market.

* * *

PAVIN: But okay, that’s just the exchanges. What do the incentives look like on the employer-based insurance side? Are things working a little better for everyone there?

LOVE: Well …

PAVIN: Ha!

LOVE: Yeah, so, when you get your health insurance through your job, there’s a different incentive problem you come up against, and it might not be doing our actual health any favors.

[music]

LOVE: You see, today, Americans do a lot of job-hopping. And that means they’re doing a lot of insurance hopping. This affects how insurance thinks about what it does and doesn’t cover for you.

GARTHWAITE: No one really has a long-term incentive to think about your health. No financial incentive.

LOVE: That’s Craig Garthwaite, another healthcare economist at Kellogg whom we’ve been hearing from throughout this series. He says that hopping from employer-sponsored insurance plan to employer-sponsored insurance plan makes it hard for insurance companies to want to cover things today. And that’s because they aren’t sure who will be picking up the tab tomorrow.

GARTHWAITE: Let’s imagine, I do a bunch of stuff today for you, right. The clearest example I can think of is when we cured Hepatitis C. We cured Hepatitis C in 2013 with a drug called Sovaldi. It was a hundred-thousand-dollar product. But it’s deemed cost effective.

LOVE: The actual amount is closer to $84,000 for an eight-week course of treatment. But still, very expensive. And even given how expensive this Hepatitis C drug is, it’s still less costly than managing the complications of untreated Hepatitis C, which could mean a transplant. The price tag on that could be more than ten times the cost of the drug. So it makes sense to cover the drug now, right?

GARTHWAITE: So for society, that’s cost effective. For the patient, it’s cost effective. For the person buying the drug, that insurer, it’s probably not cost effective. Because most of the spending you’re going to, you know, avoid is 45 years away from now. It’s like, giving it to a 40-year-old, so they don’t get a liver transplant when they’re 65. But Medicare is then going to get that savings, not the private insurer.

PAVIN: Now, to be clear, this problem doesn’t just pop up for big expensive drugs. This lack of a long-term incentive to keep you healthy extends all the way to basic preventative care.

Anran Li is a graduate student in the economics department here at Northwestern. And she noticed this when she moved to the states from China.

Anran LI: I’m not originally from the states. Like, back in my country, people really care about preventive care, and we have this type of program that the government really wants you to get a physical exam every year and wants you to take the prevention that you’re eligible for.

PAVIN: In the states, though, things were different.

LI: I find it so hard to get access to this type of care and this kind of makes me think why, like, the access is not as easy.

PAVIN: So Li decides to investigate why preventative care isn’t something insurers seem to prioritize as much. So she develops a model that essentially simulates how consumers and insurers would behave in certain situations, and she grabs a ton of public data to throw into it. And she learns some things.

LI: So one interesting feature is that consumers seem to not be super responsive to these preventive-care characteristics of the insurance plan.

PAVIN: What this means, she says, is that consumers aren’t attracted to plans that offer good preventive coverage. The reasons are not entirely clear. Like, do they just not care about prevention? Maybe. Do they just not understand the importance of prevention on long-term health? Maybe.

But whatever the reason, this contributes to the main finding: that when consumers change plans regularly, as many of us do, insurers actually decrease their coverage of preventative care. In other words, why would they want to spend a lot of money on consumers now if they won’t be their consumers in the long-haul? Why invest in someone’s long-term health if some other insurance plan gets the benefit?

* * *

LOVE: We know, we know. This is all starting to sound like national health insurance would be the solution to these misaligned incentives. Right? Now, we’ll talk a lot more about national health insurance in our final episode. But for now, I’ll leave you with this: Garthwaite says, “yeah, Universal Healthcare should help with these incentives. In theory.”

GARTHWAITE: That’s in theory, though. In reality, most national insurers have the same kind of budget pressure that everyone else has in politics. And so, now you’re not saying as a politician, well, 25 years from now, the National Health Service in Britain is going to save money because of what we paid today. That politician’s like, “Well, that’s great, but I have to raise taxes today, and so you haven’t solved my problem either.”

PAVIN: This does, unfortunately, sound like something a politician would say, though probably not explicitly. And, in a time when working across the aisle is not a popular way to govern, putting coverage decisions at the mercy of our lawmakers might make some people queasy.

GARTHWAITE: It’s a different problem. It’s sort of [more of] a political-economy problem than an economy problem, but it has the same underlying human condition, which is, are we willing to make investments today that pay off 20 years from now? I think most of us fail on that proverbial marshmallow test that one way or the other. This is where the health-insurance system fails at. Like, will I wait today to get more benefits in the future? Probably not.

LOVE: Okay, so then, what could solve this problem? Is there anything we can do to better align the incentives driving the healthcare system with our long-term health? But maybe … maybe we’re getting too ambitious here, at least for now. Maybe we should look at a part of the system that seems a little more fixable. Like the prescription-drug market. Surely that is one place where we can make some simple changes and get a lot more value for our money. Right?

STARC: The problem is that these drugs are kind of expensive for a reason.

LOVE: That’s next time on Insight Unpacked. Coming out next week.

* * *

[credits]

PAVIN: While you’re waiting for our next episode, you can check out links, supplementary materials, and images for this episode at kell.gg/unpacked.

This episode of Insight Unpacked was written by Laura Pavin and edited by Jess Love. It was produced by the Kellogg Insight team, which also includes Fred Schmalz, Abraham Kim, Maja Kos, and Blake Goble. It was mixed by Andrew Meriwether. Special thanks to David Dranove, Craig Garthwaite, Paul Campbell, Robert Lawton Burns, and Joe Davern. As a reminder, you can find us on iTunes, Spotify, or our website. If you like this show, please leave us a review or rating. That helps new listeners find us.