But how rational were the COVID-related actions we took?

That’s a question driving recent research by Sergio Rebelo, a professor of finance at the Kellogg School. “A big theme in economics is: How do people react to risk?” he says. “Even in the face of a well-publicized risk, people might not always act rationally.”

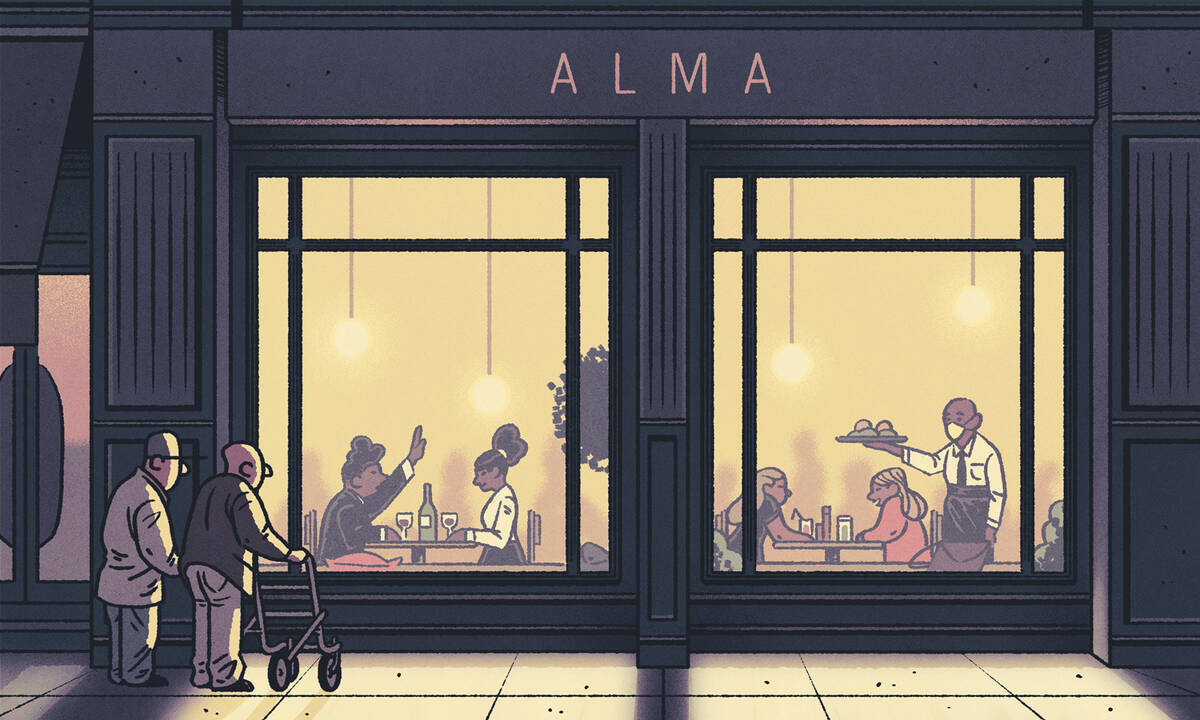

Rebelo and collaborators studied whether consumers changed their spending habits in order to lower their risk of contracting COVID-19. Did people disproportionately avoid consuming “high-contact” goods and services such as restaurant meals, movies, and sporting events, which involve significant exposure to others?

The researchers used data on Portuguese consumer-spending patterns before and during the pandemic and showed that people acted to reduce their individual risk. Overall, people reduced purchases of high-contact goods and services. Even more strikingly, older individuals and people who are likely to have health problems decreased that type of spending much more than younger, healthier consumers.

“Overall, we saw people act in a way that is consistent with the models of risk-taking behavior commonly used in economics,” Rebelo says. “And that’s encouraging.”

Spending in the Time of COVID

To examine these changes in consumer behavior, Rebelo teamed up with Martin Eichenbaum, an economics professor at Northwestern University, Miguel Godinho de Matos at Católica Lisbon School of Business and Economics, Francisco Lima at Universidade de Lisboa, and Mathias Trabandt at Freie Universitat Berlin. They studied consumer spending in Portugal from January 2018, well before the pandemic hit, to May 2020, after the first peak in global cases.

Beyond the fact that Portugal is Rebelo’s home country, they chose to focus their study there because the country’s statistical authority gave them access to a treasure trove of data: an anonymized monthly summary of electronic value-added-tax (VAT) receipts for purchases of goods and services. The data includes consumers’ anonymized identifiers that proxy for fiscal numbers, which are similar to Social Security numbers in the U.S. These identifiers are integrated with individual characteristics, including age and annual income. The final sample includes anonymized data for close to 100 million transactions undertaken by 400,000 Portuguese consumers.”

“In Portugal, people have an incentive to put their fiscal number on the VAT receipt because they get some tax deductions and can be entered into lotteries,” Rebelo says. “Pretty much everybody knows their fiscal number by heart and gives it even when making small purchases like buying a sandwich.”

Rebelo and collaborators focused on the purchase patterns of civil servants and retirees. This enabled them to control for the effects of COVID-related income fluctuations. “We know that civil servants have stable jobs, so losing jobs wasn’t an issue for them. It was obviously also not an issue for retirees,” he explains.

The researchers examined how spending for high-contact goods and services, like food in restaurants, and for low-contact purchases, like legal and accounting services, changed for different age groups and for healthier and less-healthy people, after the pandemic started.

Evidence of Rationality

As expected, the pandemic affected spending in ways that reduced the risk of getting infected with coronavirus.

For one, spending declined in general once COVID hit. “In Portugal, as in much of the rest of the world, that first wave peaked in April, with the largest number of infections,” Rebelo says. “So that’s when there was the highest risk of infection.” In line with this timing, spending dropped across all age groups during April.

But the pattern of spending cuts differed by age. While older individuals cut spending significantly, younger people, who face a lower risk of dramatic health consequences, cut spending by much less. For example, in April, consumers age 20 to 49 cut their total expenditures by about 29 percent, while those in their 70s reduced spending by more than 50 percent. Strikingly, the response of consumers by age mirrors the probability of dying from COVID-19.

These patterns hold for the purchase of high- and low-contact items, as well: while spending fell for both categories, there was a greater drop in purchases of high-contact goods and services—which involved greater risk of infection—and that reduction was more pronounced for older individuals. In April, consumers in their 70s cut expenditures on high- and low-contact goods by 62 percent and 28 percent, respectively, while those under 49 decreased spending by 26 percent and 19 percent.

“Older people were much more careful than younger people,” Rebelo says. “They reduced their consumption of high-contact items by much more.”

The researchers also wanted to understand how spending changed for people with health conditions. They implemented this analysis by observing how much money people spent on pharmaceuticals. The idea is that those who spend more at the pharmacy are more likely to have health conditions. They then compared the overall spending of those in the top 10 percent of pharmaceutical spending with that of everyone else.

“For every age group,” Rebelo says, “those likely to have health conditions cut their spending a lot more than those less likely to have health conditions.” That was true for purchases overall—and especially for high-contact items.

It Starts at the Top

Overall, the results suggest a great deal of rationality in the way people responded to COVID, with those at greater risk taking larger measures to reduce their exposure to infection.

“It’s always easy to find examples of people who do not act rationally,” Rebelo says. “But here we see people acting to protect their self-interest.”

However, he cautions that the behavior observed in Portugal may have been linked to how that country’s leadership handled the early days of the pandemic.

“Portugal had a coherent nationwide containment and communication strategy,” Rebelo says. “That strategy is likely to have helped people make sounder decisions. Had communication been less cohesive, with different voices supporting different policies, we might have seen less prudence on the part of the consumer.”