Featured Faculty

IBM Professor of Operations Management and Information Systems; Professor of Operations

Riley Mann

Most businesses would eagerly accept a crystal ball that forecasts their future expenses. And, in some ways, that’s what online retailers get in the time period between receiving an order and delivering it to their customers’ doors.

For example, take mattress retailers that offer one-week delivery. That week-long window lets the business see its own transportation needs one week into the future—that is, what it will have to spend in order to get its mattress to everyone who ordered one on a specific day.

Then again, a crystal ball that can only see one week in advance may not seem very powerful. So is this limited visibility into the future—known as “partial information”—actually worth much?

To Sunil Chopra, a professor of operations at Kellogg, this is a high-stakes question. “The costs incurred in outbound shipping, given that we are getting more and more stuff for home delivery, is just a huge number,” he says. “So even small changes can have a huge impact on profitability.”

Furthermore, business supply chains are evolving to be more flexible, Chopra says. That means that a mattress retailer that once might have had to book its transportation capacity months in advance can now commit to shorter-term contracts that last mere weeks. “In this case,” he says, “does this little bit of information about the future change how you behave?”

To find out, Chopra partnered with two Northwestern coauthors— Karen Smilowitz, a professor of industrial engineering and management sciences at Northwestern Engineering, and Pol Boada-Collado, a PhD candidate in the same department. The researchers created a mathematical model of how a company’s short-term transportation costs could change depending on how it responded to partial information.

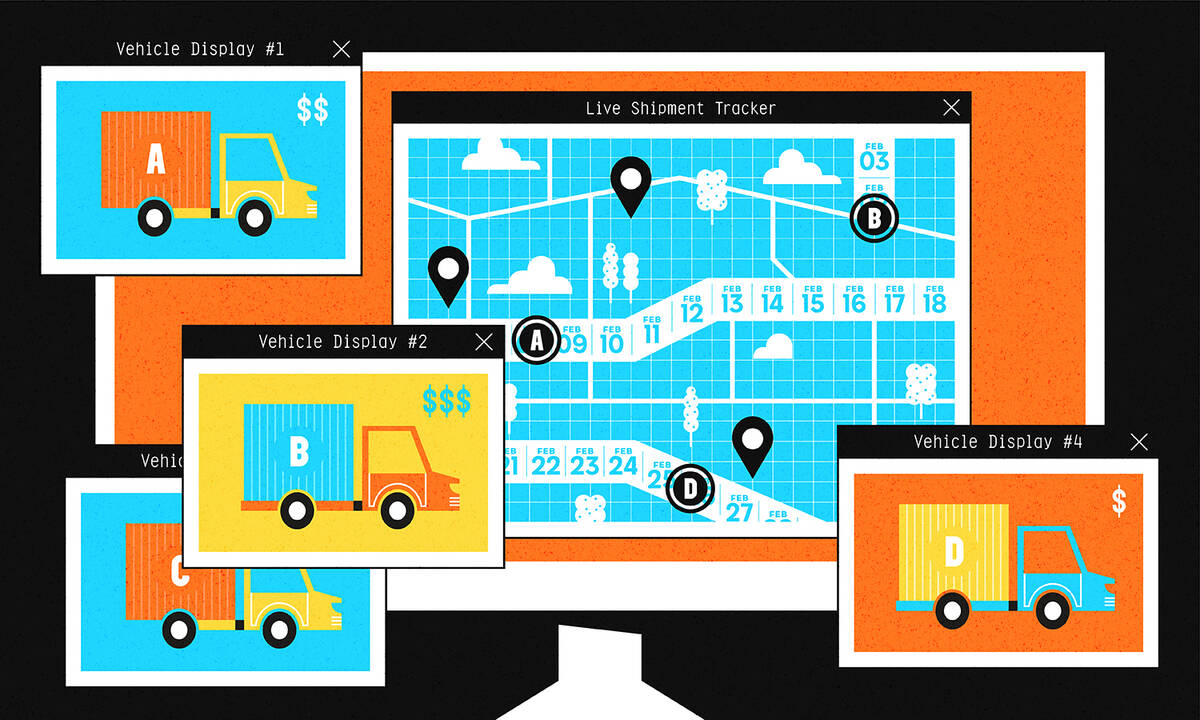

They found that partial information is surprisingly valuable for reducing costs in two scenarios: when seasonal variation causes surges in demand and when the same transportation capacity (say, a group of five trucks) can service multiple locations instead of just one.

When the researchers plugged in trucking costs from a real-world mattress company, they found that his model’s optimizations could reduce the company’s costs by about four percent.

The implications extend beyond shipping and mattresses, Chopra says. The crystal ball of partial information affects any business that must decide how to optimize short-term commitments.

“In the past, if I were signing a contract to supply my business for the next two years, observing a week or two into the future would hardly matter,” he says. “Now, when I’m making commitments that last only four weeks out, observing a week ahead is incredibly valuable.”

Researchers have previously studied how companies take advantage of partial information—but usually in the context of long-term supply contracts. In those cases, partial information may affect how much capacity a company commits to, but it won’t make or break the company’s decision to sign the contract in the first place.

“When you’re committing for years’ worth of a supplier setting up machines to make parts for you, you’ll always commit—whether you have the partial information or not,” Chopra explains.

Transportation, however, is an inherently more flexible resource than a manufacturing line—and is becoming increasingly flexible over time. These days, transportation contracts tend to cover weeks rather than years.

Even so, contracts generally last longer than the shipping period that provides companies with partial information. So the researchers designed a mathematical model to see what would happen if a company could see its transportation demand one week in advance but had to sign transportation contracts for four weeks’ worth of capacity at once.

”When I’m making commitments that last only four weeks out, observing a week ahead is incredibly valuable.”

When future demand fluctuates randomly, the model predicted that an optimal strategy would simply be to commit to as much or little capacity as the partial information signals. For example, if the partial information dictates that five trucks will be necessary a week from now, the company should commit to four weeks’ worth of that capacity. If a company accidentally under- or overcommits itself, the short-term nature of the contract ensures that the situation will reset quickly.

But when a company faces predictable surges in transportation demand—like seasonal spikes for a retailer—then partial information becomes even more valuable. It can predict not just how much capacity to commit to, but whether to commit to a four-week contract at all. “It’s doubly valuable,” Chopra says.

Specifically, the model indicated two optimal strategies for dealing with a predictable surge in demand—either of which could make sense to use, depending on when a contract becomes available.

The first, which he calls “wait and see,” applies when a company expects that a surge is coming sometime within the next four weeks, but hasn’t actually experienced the surge yet.

In this situation, a company with an opportunity to sign a four-week contract should abstain from committing, and instead rely on so-called “spot markets,” where transportation is arranged in real time. This exactly matches capacity to demand, but at greater expense. Only when the surge actually registers in the partial-information crystal ball—and delivers a concrete signal about the potential magnitude of additional transportation demand—should the company commit to a four-week contract based on that signal.

The second strategy, called “now or never,” reverses this logic. If an opportunity to sign a four-week contract arises near the end of a surge—when seasonal patterns suggest that demand may start to decline soon, but partial information hasn’t shown evidence of it occurring yet—it’s still optimal to commit.

“The idea is that you want to make the commitment during the surge,” not before or after it, Chopra explains.

Indeed, the researchers tested these two strategies with transportation costs from a real-world mattress retailer that promises one-week delivery. “We could have improved their costs by about four,” he says.

Partial information is valuable because it reduces uncertainty. But there are other ways of reducing uncertainty, such as having the flexibility to pool and repurpose resources, known as “capacity pooling.” With capacity pooling in transportation, a truck that drives a dedicated route to Chicago, for instance, can be easily repurposed to do additional jobs, like deliver goods to Chicago and St. Louis in one trip.

Researchers have traditionally believed that the more capacity pooling you can rely on, the less partial information you need in order to manage uncertainty—that the two, in other words, act as substitutes for one another. But the researchers wondered if the conventional wisdom still held when applied to the short-term commitments.

“This is a direction we seem to be generally headed, with the way technology is evolving. It’s a relevant problem for everybody.”

So they ran the model again, adding the option of capacity pooling: the business could commit to four weeks’ worth of trucking that could service multiple locations, albeit at a higher cost than using dedicated routes.

The model predicted that in this situation, partial information and capacity pooling weren’t substitutes. Instead, they complemented each other, allowing the business to fine-tune its four-week contracts to include an optimal balance of dedicated and flexible transportation.

Consider a company with two delivery routes: one to Chicago and one to St. Louis. Usually, the company needs ten trucks for each city and uses a dedicated route for each to save costs. But now it sees that next week’s demand is an unusual deviation from business as usual: Chicago needs fifteen trucks, but St. Louis needs only five. What kind of four-week contract should the company sign?

“I could commit to fifteen dedicated trucks for Chicago and five for St. Louis—but that is only going to work for next week, and not the three weeks after that,” Chopra explains. Instead, the company can use its partial information to commit to five dedicated trucks for each city for the next four weeks (thus covering its known demand as cheaply as possible), while also committing to ten more expensive trucks that can service both cities.

“Next week I’ll use my pooled capacity to absorb this blip that I’m observing in Chicago, but in the weeks after that, I can also repurpose those trucks for St. Louis if demand there goes up to normal levels,” he says.

Chopra says that the model shows that old theories about the value of partial information don’t necessarily hold up in an economy where contracts are getting shorter and the supply-chain resources supplied by those contracts are becoming more flexible.

Even warehouses can now act more like trucking companies: instead of requiring companies to commit to years’ worth of dedicated shelf space in advance, they can supply short-term storage for fulfilling on-demand orders.

When business moves this fast, seeing just a little bit into the future with partial information can make a big difference.

“This is a direction we seem to be generally headed, with the way technology is evolving,” Chopra says. “It’s a relevant problem for everybody.”