Featured Faculty

IBM Professor of Operations Management and Information Systems; Professor of Operations

CSA-Printstock via iStock

Dell impressed many in its early years with its distinct model of supply chain management, selling customized computers directly to customers to meet burgeoning PC demand. By using this innovative sales model, Dell became an industry and shareholders’ darling, a high-tech pioneer with seemingly limitless growth. Those days appear to be over: Dell’s profits and shares have dropped considerably from their peaks in recent times.

And when corporate giants stumble, everyone takes note. Competitors look for weaknesses to exploit or lessons to learn. Investment analysts and the public observe maturing companies closely to decide whether to buy, sell, or hold their stock. Business professors study such firms to understand the forces that made them falter—and what they can do, if anything, to recover. Such was the motivation for Sunil Chopra, Associate Dean for Curriculum and Teaching and IBM Distinguished Professor of Operations Management at the Kellogg School of Management, to examine Dell’s business situation and supply chain management strategy more closely.

Specifically, Chopra posited that the computer manufacturer would have to shift its longstanding direct sales model in the face of the PC business’s increasing maturity. Chopra suggested that to stay competitive, Dell would have to consider selling through retail channels such as Costco or local computer stores. About six months later, Dell announced that it would offer Dimension PCs and Inspiron notebooks through Wal-Mart and Sam’s Club. And in September 2007 Dell announced that it would take this channel strategy overseas, selling computers through China’s largest electronics retailer.

But what was Dell’s rationale for the recent sales model shift? To answer this question let’s consider the argument behind Chopra’s assessment.

Channel Strategies in Mature Markets

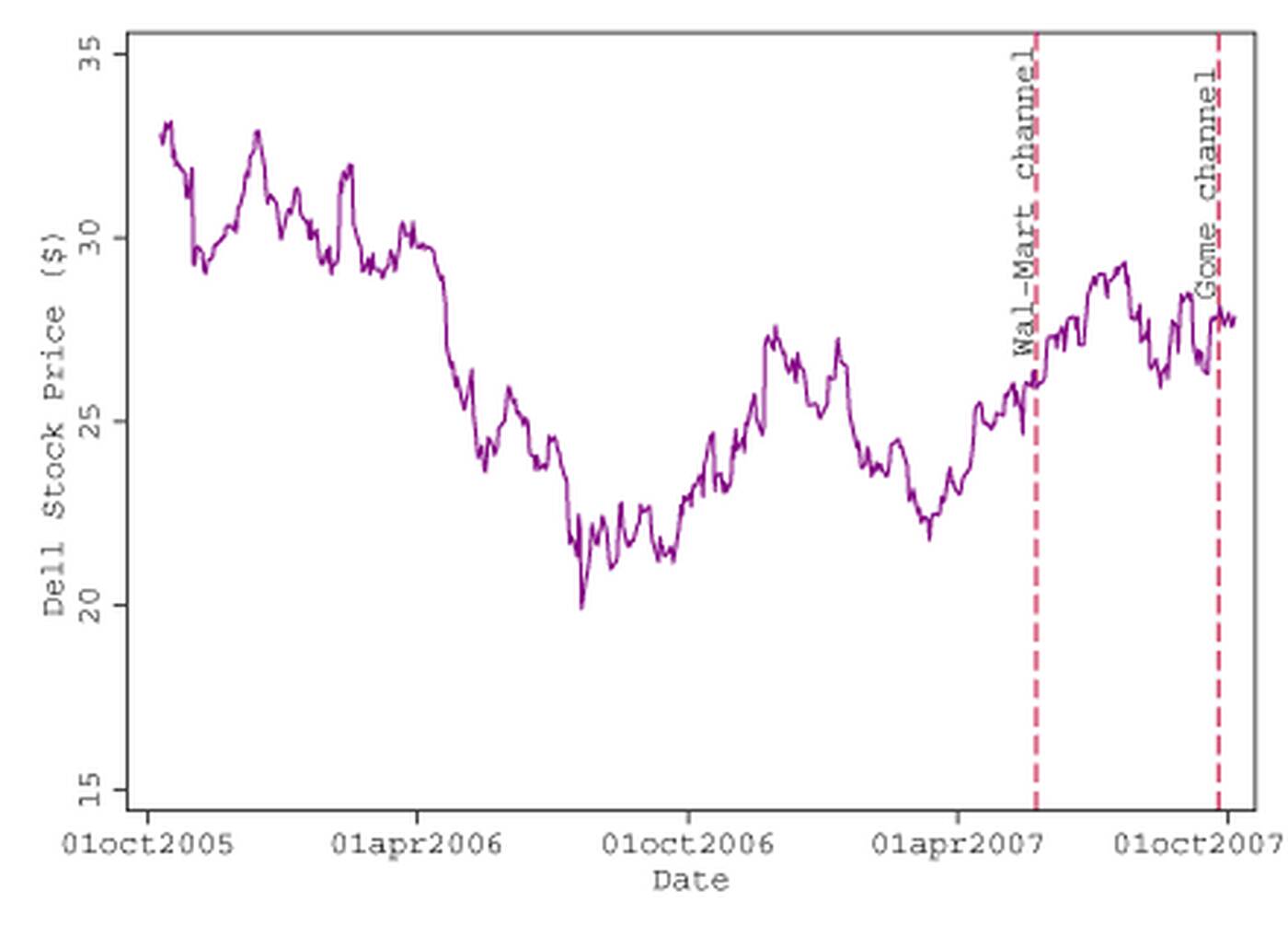

Chopra’s analysis of Dell appeared in an article in the October 2006 volume of Supply Chain Strategy, a newsletter published by MIT. Part of the motivation for the article was Dell’s stock price, which had fallen over 30 percent in the previous year (Figure 1) while rivals such as Hewlett-Packard had performed much better. In the article Chopra acknowledges that Dell could still enjoy competitive advantage from customizing computers and selling them directly to consumers, but notes that the market for such offerings has shrunk, largely because customer needs and related supply chain costs have shifted in the mature PC business. As such, Chopra endorses a “hybrid model that embraces both direct and reseller channels” for Dell, noting that the general lesson is “that your choice of sales channel should depend on the type of product you are selling and its level of maturity.” In separate communication Chopra is quick to note that he was not the only observer advocating a sales strategy shift for Dell; others, including several analysts, endorsed a similar model.

“Companies cannot select one channel and expect it to always be successful.”

Chopra presents two major factors underlying Dell’s arrival at this crossroads: channel trade-offs and PC market dynamics. With regard to the former, he suggests that direct sales channels like Dell’s (or Amazon.com’s), have much lower facility and inventory costs than retailers (e.g., your local Borders bookstore) but higher transportation costs; retailers, in contrast may have instantly available products and offer more comprehensive support, but cannot profitably stock as many different products as direct sellers. Chopra’s general point: product type and lifecycle stage will always influence both customer needs and supply chain costs. As such, “companies cannot select one channel and expect it to always be successful.” To sustain advantage they must align their chosen channels’ strengths with product and market characteristics.

This is especially true given the PC and consumer electronics industry’s dynamics over the last decade. According to Chopra, while the speed of integrated circuit development has remained relatively constant—doubling about every 24 months, in line with Moore’s law—the relative value that consumers derive from each more powerful computing chip has diminished considerably. For example, a three-year-old computer today is capable of handling most common business applications such as Microsoft Office.

This technology trend has clear implications for customers’ needs and, in turn, business models for computer sales. According to Chopra, when Dell first emerged consumers valued customization highly, and surplus stock quickly lost value, making assembly-to-order and centralized storage more profitable than selling pre-configured PCs in retail stores. But today’s customers are willing to choose from a smaller number of off-the-shelf PCs, and are less concerned with customization. And, as PC prices have plummeted, inventory of standardized models turns quickly, and is less of a factor in profitability. These shifts have converged to dampen dramatically the value of the direct sales channel built around centralized inventory storage and PC customizability. So it is no surprise that Dell’s profits and market share have flagged recently. “The inevitable conclusion,” Chopra writes, “is that Dell will be forced to consider the retail channel as it moves forward.”

Chopra presents two potentially complementary routes by which Dell could go retail. The first, a hybrid business model, combines direct and retail sales channels to serve both broad segments of the computer market: those seeking standard models and those placing a premium on customization. Using this approach, Dell would continue selling direct but also offer a selection of pre-configured computer models through retail stores. The second model, most effective when customization is valued, involves the retailer’s performing the final product configuration, thus decreasing inventory costs—because supplies are maintained in component form—but increasing assembly capacity costs. Chopra notes that this model has been used successfully in India, where customization is valued and technicians inexpensive to employ.

The bottom line, as Chopra notes, is that “channel choice must be related to customer needs and product characteristics.” As such, he concludes that Dell would be best served by a hybrid model that includes the centralized channel for wider variety and the retail channel to move popular standardized PCs and other products.

Dell Makes a Decision

Apparently Dell shared much of Chopra’s thinking. In a New York Times article on May 25, 2007, the manufacturer announced that it would begin offering two PC models through Wal-Mart stores in June. In a subsequent New York Timesarticle, Dell announced that it would sell Inspiron notebook computers through Wal-Mart’s Sam’s Club outlets. And most recently the company announced that its computers would be available in major Chinese cities through fifty Gome Electrical Appliances stores, China’s largest electronics retailer, starting in early October 2007. Dell also plans to extend its international retail strategy by opening its first retail store in Russia. Although the actual number of Dell products offered through the initial retail channels is small—just two low-end Dimension PC models were to be available at Wal-Mart, for example—the symbolic importance of the move is significant, reflecting a rethinking of the direct sales strategy Michael Dell pioneered and rode to great fame and fortune. In an April memo to employees, Dell, who returned in late January 2007 as the firm’s chief executive, suggested, “The direct model has been a revolution, but it’s not a religion.” (NYT 5/25/07) This sentiment is in line with Chopra’s belief that Dell would have to look beyond its bread-and-butter sales model to sustain profits in today’s mature computer market.

Chopra presents two major factors underlying Dell’s arrival at this crossroads: channel trade-offs and PC market dynamics.

Another Dell executive was quick to point out that the limited move to retail was not an indication that the direct-sales model was “broken” (NYT 5/25/07). In fact, Dell’s hesitation to enter the retail channel may have resulted from unsuccessful or inconclusive past experiments. In the early 1990s Dell products were available through Best Buy, Costco, and other retailers, but the company stopped this distribution in 1994 due to low profit margins. Last year Dell opened a mall-based store in Dallas where customers could see and use computers or other products, but ultimately had to order these online through the store rather than taking them home with them.

Despite clearer motivation for Dell to enter the retail channel today, as Chopra’s article makes clear, some industry observers point out the risks of this move. “They don’t want to get their brand name too closely associated with Wal-Mart,” a Forrester Research analyst points out, citing the danger of Dell’s products being viewed as the market’s value-end. (NYT 5/25/07) Others note that it may take some time for Dell to realize much financial gain from its retail offerings, given their limited nature.

Risks aside, Dell’s move into Wal-Mart, while retaining the centralized direct sales model, is a clear response to the trends Chopra points out, and the tactic completely aligned with his endorsement of a hybrid channel model. As another industry analyst suggests, “Dell is finally listening to its customers.” (NYT5/25/07) Either that or taking the time to read the occasional Supply Chain Strategy article by a Kellogg professor.

Editor’s Note: For a more recent take on the future of Dell, hear what Chopra has to say in this blog post.

Chopra, Sunil (2006). “Choose the Channel that Matches Your Product,” Supply Chain Strategy, 2(9): 8-9