Social Impact Jun 9, 2020

Some Companies Actually Do See Financial Returns on Their Social Investments. Here’s What They Have in Common.

A new study finds that ESG investments—when paired with high employee satisfaction—boost stock performance.

Michael Meier

More and more companies are channeling capital into programs meant to serve a social purpose—and they’re eager to tell us about it.

Wells Fargo touts its commitment of $1 billion to address the U.S. housing-affordability crisis; Ford Motor Company is investing $11 billion to introduce 16 fully electric vehicles by 2022; Pfizer is educating students about preventing antimicrobial resistance.

In fact, according to a 2019 report published by Deloitte in partnership with Forbes Insights, two-thirds of global business leaders surveyed said their budgets for such “programs with a purpose” had increased in the previous two years.

For publicly owned companies, doing good hasn’t always been well received. Economists have long debated whether it’s ethical for firms to devote their resources to social causes, when doing so could compromise shareholder value. In 1962, economist Milton Friedman wrote, “there is one and only one social responsibility of business—to use its resources and engage in activities designed to increase its profits.”

Increasingly, business leaders are eager to state for the record that they disagree with Friedman’s pronouncement, and many have pledged to consider their impact on society more broadly. But skepticism around whether and how they should do this remains widespread.

New research stands to shake up the long-standing stalemate by calling into question an assumption held by many on both sides: that ESG investments necessarily come at a cost to shareholder value.

Aaron Yoon, an assistant professor of accounting and information management at the Kellogg School, and Kyle Welch, an assistant professor of accountancy at George Washington University, find evidence that ESG investments can enhance shareholder value after all—when there are satisfied employees.

Measuring ESG’s Stock Performance

The researchers first scored publicly traded companies on the ESG practices, as well as on their levels of employee satisfaction.

For ESG scores, Yoon and Welch turned to data from MSCI ESG Ratings, which draw from annual reports, investor presentations, financial filings, NGO databases, and other sources to assign companies scores based on their ESG practices.

The researchers obtained proprietary data on companies’ employee satisfaction scores from Glassdoor.com, a website where individuals can anonymously review their current and former places of employment.

First, they put together a portfolio containing firms that performed in the top quartile according to ratings of both their ESG practices and their levels of employee satisfaction. The researchers compared this portfolio’s performance between 2012 and 2019 to that of several other portfolios using ESG and employee satisfaction as signals.

The Financial Impact of Satisfied Employees

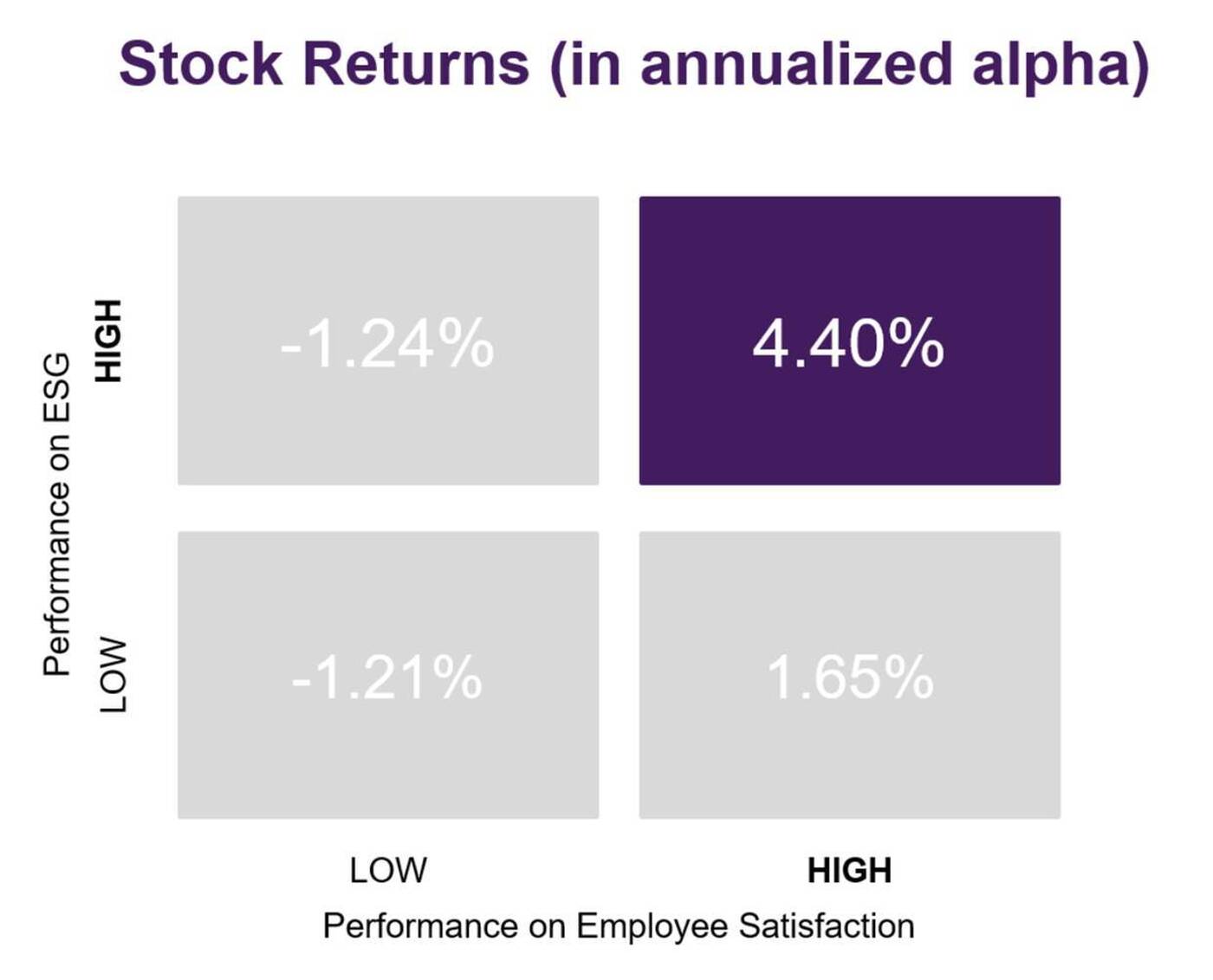

As previous studies have found, there was no difference in performance overall between portfolios of firms with the highest ESG scores and those with the lowest ESG scores—suggesting that ESG does not itself create financial value.

However, the story looks much more interesting when employee satisfaction is taken into account.

Yoon and Welch found that the portfolio of stocks with top ratings in both ESG practices and employee satisfaction generated 4.40 percent alpha per year, outperforming the portfolio with the lowest ratings in both categories (which generated -1.21 percent alpha) by 5.61 percent per year. This portfolio also exhibited stronger growth in both sales and return on equity than its lower-performing counterpart.

A portfolio of companies with high employee-satisfaction ratings alone did outperform the firms with low satisfaction—by about 2.43 percent per year. But the portfolio of firms with high ESG ratings and employee satisfaction outperformed the firms with high employee satisfaction alone by 1.6 percent per year.

“When ESG is combined with employee satisfaction, it works. But it works beyond the effect of employee satisfaction by itself,” says Yoon. “Employee satisfaction is a necessary condition for ESG to create value.”

In addition, Yoon points out that most of the effect on stock performance comes from a firm’s score in the social component of its ESG score, as opposed to the environmental or governance components. This component tends to include investments that directly affect employees, such as investments in labor management and health and safety.

This suggests a “synergy between ESG and employee satisfaction,” says Yoon. “In my view, it’s likely that ESG motivates employees and makes them more productive. And it makes a lot of sense: you need hard-working employees who buy into the firm’s vision in order to grow.”

Finding the ESG Initiatives That Fit

Yoon notes that the findings have several direct implications. For business leaders, the findings provide evidence that firms can benefit financially by investing in ESG programs whose fruits, at first blush, may not appear to contribute to the bottom line. “Employees and their satisfaction are absolutely crucial in improving firm value,” Yoon notes.

So, which types of socially responsible initiatives should companies consider launching?

“In our paper, we can’t necessarily disentangle whether ESG investments cause employee satisfaction,” Yoon says. “I think we have to flip this question to the companies themselves: What types of ESG investments do your employees get most satisfaction from?”

The findings are also useful for investment firms interested in unlocking value via responsible investment strategies.

In March, Yoon published research suggesting that a significant proportion of the hundreds of asset managers who have signed on to the United Nations Principles for Responsible Investment have not followed through by actually altering their investment strategies. His new paper shows how investors might take similar steps to ones he took to build portfolios with both ESG and financial outperformance in mind.

“This paper is essentially a sequel to the last one,” Yoon says. “It’s showing another way to find value in firm sustainability efforts and is consistent with my first work on financial material ESG investments improving shareholder value.”