Policy Jun 16, 2020

How Is the Pandemic Affecting Antitrust Enforcement?

Deals will be ramping up again soon. Companies shouldn’t expect a free pass from regulators.

Michael Meier

For companies across the economy, the events of 2020 have thrown current operations and long-term plans into deep uncertainty. But companies are still striking deals—and regulators are still on the hunt for anticompetitive practices.

With so much of the business landscape up in the air right now, what deals can we expect, and what does the regulatory enforcement landscape look like?

R. Mark McCareins, codirector of Kellogg’s JDMBA program and a clinical professor of business law who specializes in antitrust issues, sees several trends in the regulatory environment.

Lots of Work for Regulators—Just Not Yet

With public health and economic uncertainty sky-high, companies have been reluctant for the most part to enter into mergers and acquisitions. But given the existential threats faced by many firms and industries, this is likely to change.

Still, in the near term, even as M&A activity picks up, McCareins thinks it is unlikely that many of these post-virus transactions will raise antitrust concerns, since much of the deal activity will come from private equity, venture capital, and hedge funds that have cash on hand.

“They’re seeing wonderful purchasing opportunities,” he says. And because these funds aren’t typically buying up all the competitors in a particular industry, “these types of deals may not raise a lot of antitrust issues.”

Eventually, however, McCareins thinks that companies that have weathered the downturn, or whose underlying markets were recession-proof, will look into deals that will help them vertically integrate—that is, combine multiple stages of production, such as manufacturing and distribution.

“Since many larger firms play in horizontal spaces that are very competitive, deals that make those companies more efficient upstream and downstream will become very attractive,” McCareins says. “They’re going to take advantage of some other people’s misfortunes and be buying assets that fit into their vertical-integration plans. If there’s a need for the asset, and they can get it far below market price, I think they’re going to go full speed ahead.”

He notes that at the moment, the Department of Justice Antitrust Division’s draft guidelines for vertical mergers are still in flux. Once they are finalized, firms will have more certainty about which deals will be challenged.

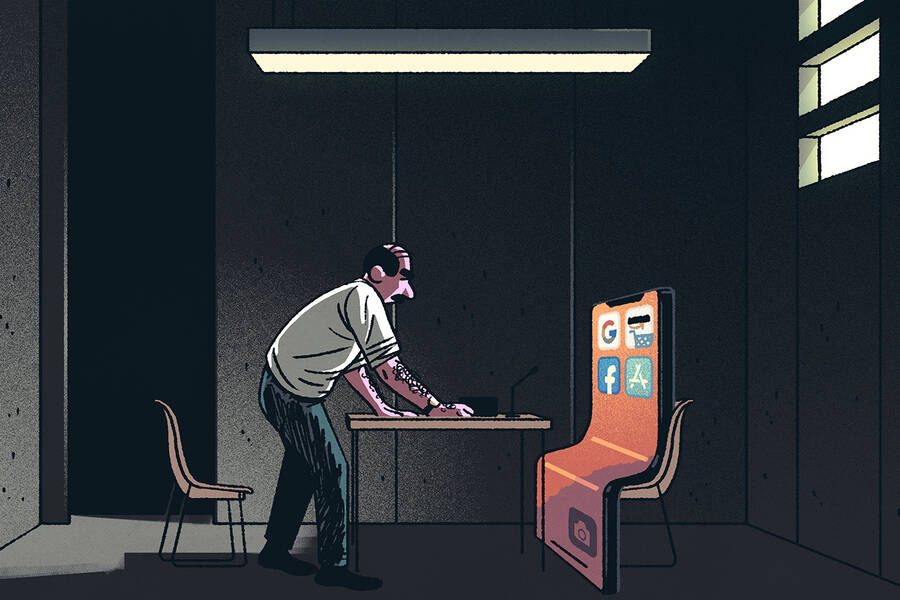

No “Free Pass” from Antitrust Regulators

When M&A activity does start to accelerate, companies looking to get in on the action should not expect a break from regulators, says McCareins.

“The enforcers in Washington have been pretty clear that at least in the current climate, if a deal was going to get challenged before the virus, the rules of the game have not changed enough to come up with a different outcome now,” he says. “We can dispense with the idea that the virus is going to give people a free pass to consummate deals for which they otherwise would not receive antitrust clearance.”

That said, it is also the case that the pandemic has shifted the business landscape—in many instances, significantly. With companies more likely to argue that “failing firm” provisions apply to their deals, the economic fallout from COVID-19 could change the rulings that regulators ultimately make, or even spur those regulators to reconsider deals that were previously rejected.

“[Larger firms] are going to take advantage of some other people’s misfortunes and be buying assets that fit into their vertical-integration plans.”

— Mark McCareins

McCareins is not sure that will happen in the U.S. but mentions how Amazon’s bid for the UK food-delivery company Deliveroo was first rejected by the UK merger authority on the grounds that it was anticompetitive.

“Then the pandemic hits, and Deliveroo wasn’t doing well at all,” McCareins says. “So Amazon raised the issue again with the UK Competition Authorities, saying, “we’d like to save their employees and their business model. We’ll do whatever you want to do, but we should be allowed to acquire them even though you told us before we couldn’t.” And the UK Competition Authority allowed it to proceed under these changed circumstances.”

Price Fixing and Bid Rigging

Antitrust regulators will also continue to investigate other kinds of anticompetitive practices—including price fixing and bid rigging—across a wide range of industries.

For instance, even deep into the pandemic, long-standing investigations into price-fixing among chicken producers have continued unabated. Antitrust enforcers continue their long-standing interest in the healthcare industry, including this widespread investigation into antitrust practices in the oncology industry. Just this April, the Florida Cancer Specialists & Research Institute agreed to pay a $100 million fine for colluding to avoid competing with another cancer treatment provider over services in certain counties in Southwest Florida.

Other anticompetitive practices have been spurred by the pandemic itself.

Over the last few months, for instance, prices for items such as PPE have fluctuated wildly with spikes in demand and constraints in availability. While steep markups in and of themselves don’t violate antitrust laws, they may violate state statutes.

“Since these investigations and the convening of grand juries take time—especially while virus concerns remain present—it may be well into 2020 or even 2021 before we see the fruits of these investigations into PPE-related pricing,” he says.

But, he believes, the investigations are coming.

“Companies that flagrantly gouge customers may think they’re getting away with something, but attorneys general and the like will start pursuing them with greater vigor—beyond the moral outrage in a time of the pandemic.”