Policy Aug 19, 2019

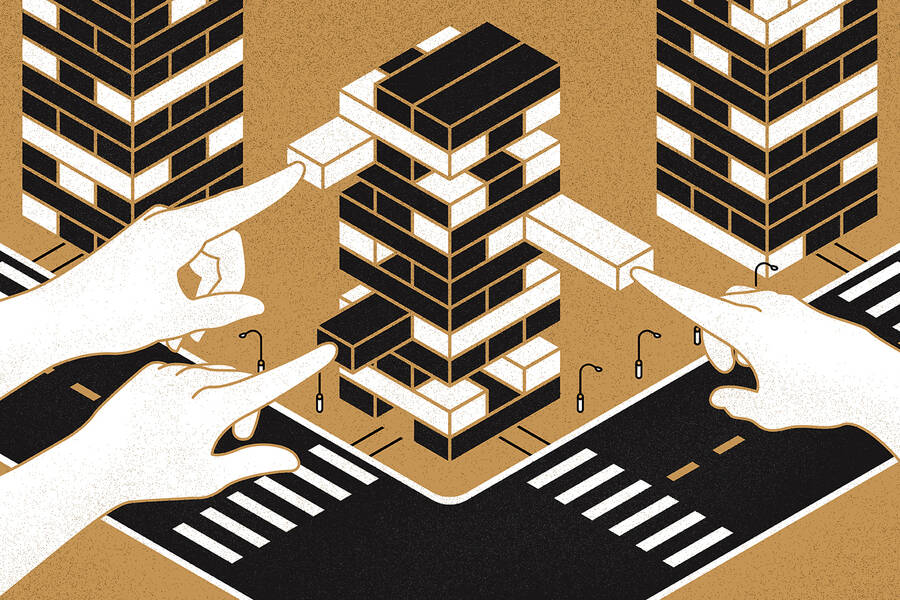

Why Antitrust Regulators Don’t Scare Big Tech

A business law expert explains why the market is more likely than the government to rein in Apple, Amazon, Facebook, and Google.

Michael Meier

In June, the House Judiciary Committee announced that the U.S. Department of Justice‘s antitrust division and the Federal Trade Commission would investigate Apple, Amazon, Alphabet (parent company of Google), and Facebook over alleged anticompetitive behavior.

Should these investigations worry Silicon Valley’s largest tech companies?

Despite calls across the political spectrum that Big Tech is, in fact, too big—wielding an outsized influence over democracy, our data, and our economy—these companies may be less concerned than you might think about the investigation, according to R. Mark McCareins, codirector of Kellogg’s JDMBA program and a clinical professor of business law who specializes in antitrust issues.

In his view, there is little evidence that the firms ran afoul of antitrust regulation, as currently understood and applied.

“If the companies have created documents that reflect consciously taken positions, which can’t be justified for legitimate business reasons but instead have been hatched to memorialize strategies for the purpose of hurting a competitor, then that’s a problem,” he says. “But we don’t know yet if those types of documents exist. These are really expensive battles to fight, and government agencies do have finite resources.”

McCareins offers several additional reasons why the big tech firms may be feeling confident heading into these investigations.

Antitrust Law Is All About Protecting Consumers through Competitive Markets

Antitrust regulation has historically been aimed at ensuring that consumers, not particular businesses, are not harmed by a lack of competition. And because search engines, social media platforms, app stores, and online marketplaces offer many valuable services to consumers for free, this complicates any arguments that consumers are being harmed, even if other businesses and industries are experiencing disruption.

“Simply because a firm becomes large and has innovated better than its competition does not in and of itself lead to the conclusion that an antitrust violation has occurred,” McCareins says.

The Big Tech Firms Are Devoting Resources to Antitrust Compliance

Because their sheer size makes them highly attractive targets for antitrust investigation, big tech companies like Apple, Google, Amazon, and Facebook will have spent a lot of time, money, and energy on staying on the right side of antitrust laws.

“They should have devoted serious resources to what I would call ‘antitrust compliance,’” McCareins says. “Before they launch a new product or service, they’ve already probably run it through an antitrust filter and either said, ‘This is a solid idea,’ or ‘That may be crossing the line. Don’t do that.’”

This “antitrust filter” happens on a few levels. For one, these firms are educating their employees about compliance issues. Their business development and strategy teams are also consulting with antitrust compliance experts—both within their own companies and with outside firms they’ve retained—to evaluate whether existing programs and new products and services might run afoul of regulators.

“Walmart and Amazon are now bringing the benefits of their competition to the consumer. This is the exact result envisioned by the U.S. antitrust laws.”

In McCareins’s view, these large businesses have to date played within the antitrust rules to keep markets competitive. Large-scale government investigations like the ones the DOJ and FTC plan could not only prove costly and ineffective, but could also draw resources away from targeting actual abuses in other markets.

“It’s a trade-off,” he says. “If regulators bring a highly speculative case in one of these big-name markets because they think it will show America that they are tough on regulation, and they lose—and while they’ve been doing that, they let 20 other markets go unattended—I don’t know if that’s a good allocation of our prosecutorial resources. The Antitrust Division’s loss earlier this year in the ATT/Time Warner merger litigation is an example of the government rolling the dice with a speculative case and limited resources. One would think with respect to the current tech investigations that the government cannot afford a repeat of the ATT/Time Warner outcome.”

The Feds Don’t Have Time on Their Side

Even where there may be cause for concern, federal regulatory agencies are notoriously slow to investigate anticompetitive practices by tech companies. The investigations of any of these four firms will take years to unfold, and even longer to prosecute.

Take, for example, Microsoft. The FTC launched an investigation into the software firm’s bundling practices in 1990, with the DOJ following suit eight years later. At the time, the company’s Windows operating system accounted for 90 percent of the PC market. The DOJ eventually charged Microsoft, claiming that its Internet Explorer browser, which was built into Windows, had an unfair advantage over other web browsers like Netscape.

In 2000, a federal judge ordered the company to be split into separate entities, but an appeals court reversed the ruling. The DOJ and Microsoft finally settled the case in 2002—a full twelve years after a regulatory agency first launched an investigation. Microsoft was ultimately required to give computer manufacturers identical licensing contracts for Windows, which gave other companies more equal access to the browser market, as well as undergo nine years of court supervision into its business practices.

The punishment was, to say the least, much reduced from its original form. “The U.S. Department of Justice was not overly successful in that attack,” says McCareins, who was a partner in the firm that represented Microsoft, Winston & Strawn.

Any Penalties Are Likely to Be Insufficient

Which brings McCareins to his final argument: even if regulators are successful in proving anticompetitive behavior by one of the big four, the penalties will likely be civil judgements in the form of large fines, which may not serve as an effective deterrent for such huge, highly profitable companies. In addition, the antitrust division announced earlier that it is not a big fan of what it describes as “behavioral remedies.” So if the division does find grounds to sue, it will need to be sure that a structural remedy will be the ultimate result.

At worst, the FTC and DOJ could force a divestiture similar to the federal ruling in the Microsoft case. However, according to McCareins, divestitures do not always work to quell anticompetitive behavior in a timely manner, especially in markets where technological change is rampant.

In 1984, for example, the federal government broke AT&T into eight regional telecom providers, which became known as the “Baby Bells.” But those companies have since been reunited through a series of mergers and acquisitions. AT&T is now even bigger than it was in the 1980s thanks to its acquisitions of cellular and cable companies.

“You look at the telecom landscape today and you look at AT&T back in the day; you laugh and say, ‘I can’t believe we spent so much time and energy on that process,’” McCareins says.

The Tech Sector Is in Flux

McCareins argues that, instead of devoting time and resources to breaking up tech companies, the federal government should consider a more deliberate, wait-and-see approach to competition in highly fluid industries. As innovations continue to disrupt those sectors, companies reliant on older technology or less responsive business models can quickly find themselves out of favor with consumers.

Sears, for example, dominated retail for decades using telephone and mail order. At its peak in 1969, Sears’s sales accounted for one percent of the U.S. economy.

“People loved it. They could order a house, literally a house, from Sears, and it would be delivered,” he says. “Fifty years ago, Sears was Amazon.”

For years, Sears was responsive enough to hold competitors at bay. When cars became commonplace, decreasing the need for mail-ordering, Sears developed the “big-box” store model to replicate the all-inclusive nature of its mail-order catalogue under one roof.

But while Sears was distracted fighting off chain retailers such as Walmart and Target, Amazon adapted Sears’s catalogue model for the Internet, becoming the largest e-retailer in the world.

“Where’s Sears? Bankrupt,” McCareins says. “What was the hottest thing ever is now passé.”

The same could be said about public concern several years ago that Walmart’s explosive growth, and its effects on local and regional retailers, merited government oversight.

“The government’s wait-and-see approach to Walmart proved to be the right approach,” McCareins says. “Walmart and Amazon are now bringing the benefits of their competition to the consumer. This is the exact result envisioned by the U.S. antitrust laws.”

As big as it is, Facebook may be facing a similar scenario, as other social media platforms gain popularity among younger users. Last November, Facebook released Lasso to try and compete with Tik Tok, a 15-second viral video app that has garnered more than 1 billion downloads since its launch in 2016, making it the web’s fastest-growing platform.

“A lot of us may not even know what Tik Tok is,” McCareins says, “but my kids don’t even use Facebook.”

Despite the reach and resources of tech giants, the market has a stubborn way of reining them in when they overreach, like when Amazon attempted to get into the on-demand food-delivery game.

In 2015, it entered a food-delivery market already filled with competitors including DoorDash, GrubHub, and UberEats. Even with free delivery for Prime members, Amazon Restaurants failed to expand past its initial opening in 20 cities and ultimately shuttered this past June.

“It’s a great example of deflecting the idea that Amazon is so big it needs to be regulated because they can squash anybody in what they do,” McCareins says. “There was strong competition in that market. Amazon reflected and said, ‘Well, that one didn’t work.’ Just because it’s Amazon doesn’t mean they’re going to control that business.”