Many hiring managers like to think they operate in a meritocracy. But separate research from Kellogg researchers Lauren Rivera, associate professor of management and organizations, and Paola Sapienza, professor of finance, suggests that’s far from true.

For her research, Rivera interviewed 120 hiring decision makers and was also given permission to observe almost every component of the hiring process as an HR staffer herself. She found that applicants’ socioeconomic backgrounds play an outsized role in hiring decisions at elite professional-services firms.

Those from the most privileged strata of society are much more likely to receive job offers—not because the firms intentionally want to hire the most affluent candidates, but rather because they look for candidates whose resumes reveal accomplishments, activities, and other desirable assets that require a great deal of time and financial investment from applicants and their parents. Hiring managers also tend to look for a sense of personal connection with an applicant—with upper-class interviewers generally preferring candidates with similar pedigrees, whether they realize it or not.

Meanwhile, results from a study conducted by Sapienza and colleagues suggest that gender bias also creeps into the hiring process, with employers initially assuming that women are less competent at basic mathematical tasks than men, even when they are not. The study also found that women (but not men) tend to understate their abilities, and that employers believe these understatements, making them less likely to hire female candidates for jobs involving math.

In other words, even when we set out to hire on the basis of merit, hidden biases can get in the way. Being aware of those can help us not only act more fairly, but also make the best business decisions.

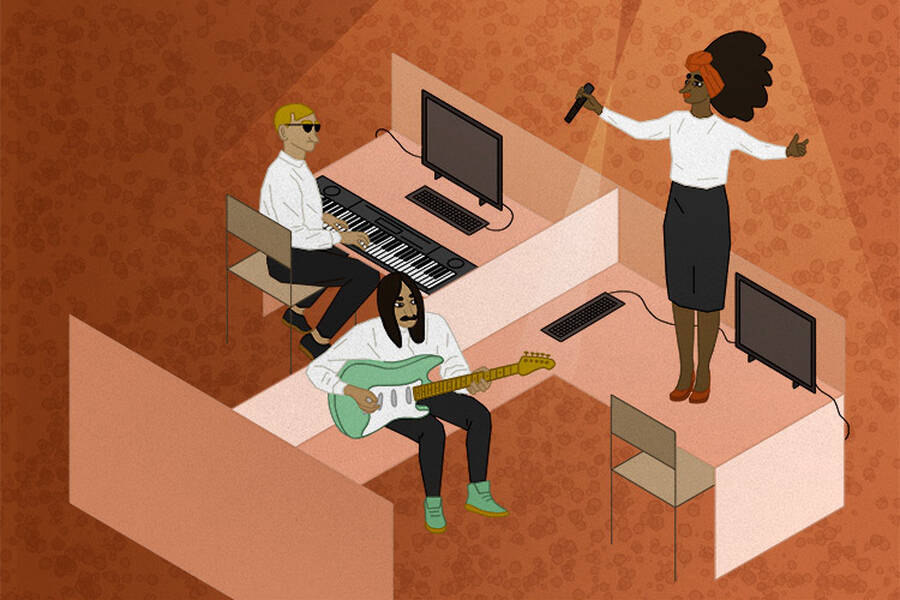

Whom are you more likely to hire: a jack- or jill-of-all-trades, or an employee who specializes in one particular skill set?

Probably the former, according to the late Keith Murnighan, who was a professor of management and organizations. In a series of studies, he and a coauthor found evidence of a bias towards generalists over specialists. But is that the wisest way to go when making hiring decisions?

To find out, the researchers first looked at three-point shooters in the NBA. By sinking long-distance shots, three-point shooters can change the entire course of a game, yet these players rarely get the same respect as their generalist teammates. And such discounting translates from the court to the cubicle. In another study, the researchers found that participants posing as hiring managers tended to ignore better qualified specialists in favor of generalists with more overall experience.

Why the bias toward generalists? Murnighan said that because hiring managers tend to look for one employee at a time—rather than hire an entire team all at once—it’s hard for them to see exactly which specialists they need. In addition, going with a specialist is seen as a high-risk (albeit high-return) strategy.

To avoid missing out on the value specialists can provide, Munighan suggested that managers think of themselves as orchestra conductors—looking at the entire team from afar, able to differentiate the violinists from the cellists from the flautists, and knowing exactly how many of each are needed and when.

“Look at the interactions from a distance and say, ‘What is it that I need to change? What do I know that I’m too close to the process to really see?’” Murnighan said.

Bell’s Brewery of Kalamazoo and Comstock, Michigan, began life in 1983 as a small-time homebrew supply store founded by the father of the current CEO, Laura Bell. Thirty-five years later, it’s the seventh-largest craft beer producer in the nation. How has the company achieved such impressive growth while maintaining its “local” identity?

In part, by focusing on hiring local talent, Bell tells Michael Mazzeo, a professor of strategy at and an expert on growth in midsized companies: “All of our sales reps—and we have almost 100 now—are Bell’s employees who live in our sales territories. They work directly with our distributors. They call on accounts. They really know the area,” she says in this 2017 interview.

That means that the reps are able to build solid relationships with their accounts. “We want to build trust that the product is going to move, that we’re going to be a brand that they can rely on,” she says. Even with accounts that are many miles away, “we say, ‘Hey, we recognize that we’re 300 miles away, but we have people that live in this community that work for Bell’s. We have people that buy Bell’s and support our product that live in this community, and so we also want to be a part of it.’”

The moral of the story: firms whose success depends on establishing themselves as a “local” brand should consider the importance of thinking—and hiring—locally.

Less than 0.5 percent of Americans serve in the military—meaning that many firms are unaware of the skills and experiences veterans acquire during their years of service.

And that’s a shame, because veterans represent a skilled and loyal talent pool, says Col. Dan Friend, who was a U.S. Army Chief of Staff Senior Fellow at Kellogg. Forget everything you’ve seen in movies about screaming drill sergeants and empty-minded recruits; the military actually fosters collaboration, adaptability, leadership, selflessness, and many other qualities that make veterans invaluable in the business world.

To cite just one example: By their early 20s, many service members are responsible for assembling and training teams, overseeing the well-being of subordinates, and maintaining millions of dollars of equipment. “All the while they’re learning how to make decisions, plan, organize, execute, and provide clear guidance to their subordinates at an age much earlier than most of their peers on the outside,” Friend says.

His experience (accumulated over more than 26 years of service) is consistent with the findings of Kellogg finance professors Efraim Benmelech and Carola Frydman. In a study of chief executives from more than 2,000 U.S. firms, the pair found that firms run by CEOs with military experience performed better under pressure than those run by other CEOs. They found, too, that CEOs with a military background were up to 70 percent less likely to engage in corporate fraud compared to their civilian-only peers.

Getting a job drastically increases an ex-offender’s chances of staying out of jail. Yet many employers are reluctant to hire people with criminal records, assuming that they possess fewer skills, are more likely to behave unethically in the workplace, or both.

Yet, research from Nicola Persico, a professor of managerial economics and decision sciences, shows that ex-offenders who do get hired are no more likely to be fired than non-offenders—and are about 13 percent less likely to quit, resulting in lower turnover costs for the companies that hire them.

Persico, along with former Kellogg colleague Dylan Minor and Deborah Weiss at Northwestern University’s Pritzker School of Law, examined data on about a quarter of a million applicants for sales and customer service jobs in the U.S.

The data did reveal one downside to hiring ex-offenders: those placed in sales positions had a 28 percent higher chance of termination for misconduct. “I would think twice before hiring someone with a record in that setting,” Minor says.

Still, employers may wish to consider giving people with criminal records a chance at employment. Not only can doing so save money on turnover costs, but from a societal level, it also can help keep ex-offenders from going to jail again. As Minor says: “If these people don’t get a job, the chances are that they’re going right back.”