A significant part of the value of a house depends on what the next generation will be willing to pay for it, explains Sergio Rebelo, a professor of finance at the Kellogg School of Management. “So we are always making a guess about how well the next generation is going to do.” And the rosier our view of the future, the more we are willing to pay for existing homes.

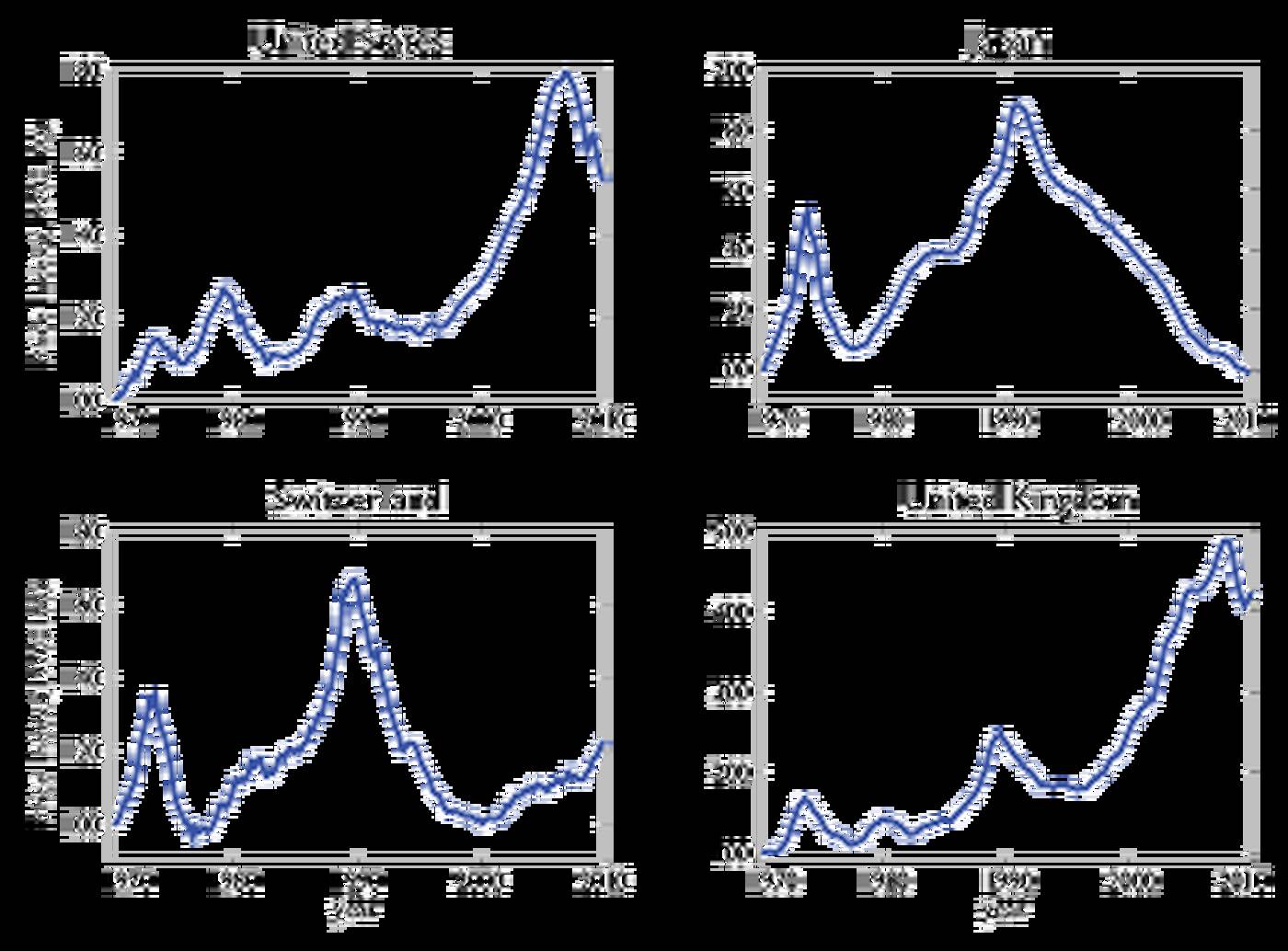

Still, economists who tried to understand booms and busts in housing markets have had a notoriously difficult time of it. Economists assume that, while the future is uncertain, people generally agree about the likeliness of different future outcomes and operate rationally on this knowledge. And in a world where everybody has the same expectations, Rebelo points out, learning good news about the future today should drive prices up, well, today. But in practice, home prices change gradually; on average booms last six years and busts five. (See Figure 1.)

Complicating matters further, Rebelo explains that “in many episodes we have a hard time finding variables that correlate well with large house price movements.” That is, factors like rental prices and employment rates, which people might use to determine whether buying is a good idea, are simply not strong predictors of house prices.

Disagreement About the Future

So Rebelo, along with colleagues Craig Burnside, a professor of economics at Duke University, and Martin Eichenbaum, a professor of economics at Northwestern University, made a key assumption: even though we are all rational beings with access to the same information about the economy, we may nonetheless interpret the information differently. In other words, we can all look at the same predictors of future U.S. growth, but still “agree to disagree” about just what those predictors indicate.

So, just how realistic is the researchers’ assumption that knowledgeable people might disagree? Consider that in 2005—just one year before housing prices began their decline and three years before financial markets imploded—the president of the Federal Reserve Bank of St. Louis suggested that house prices could potentially rise another 40 percent. In reply, the president of the Federal Reserve Bank of Dallas said to Alan Greenspan,“Mr. Chairman, I’d like to propose that he buy my house in Washington.”

Rebelo and his colleagues put their assumption to work in a model that describes both gradual boom–bust cycles and permanent price increases. In the model, some people believe that the long-term fundamentals of the economy will change for the better, and that house prices should rise, whereas other people believe that the fundamentals of the economy should stay the same, so prices should not change. (A third group of people is agnostic about future house prices.)

People meet randomly. When two people with different views meet, the one who is more certain of his viewpoint convinces the other that his viewpoint is correct with some probability. Thus, via word of mouth, optimism about the housing market can gradually spread through a population—much as would a socially contagious disease. (Indeed, the model borrows mathematical techniques from Swiss mathematician Daniel Bernoulli, who used them to describe the spread of smallpox.)

So What Happened in 2006?

If the fundamentals of the economy are revealed to have changed for the better—after a strong uptick in employment, for instance, or an important international trade agreement—everyone agrees about market prices, and any increases in housing prices are permanent.

But where there is disagreement about market prices (with optimists believing them to be low and wanting to buy, and pessimists believing them to be high and wishing to sell), the model can produce boom–bust cycles. In a boom–bust cycle, an increase in the number of optimists drives prices up. But, Rebelo explains, “what makes the price come down is there’s not as many people excited about buying a home all of a sudden.”

These dynamics can be useful for understanding what happened to the U.S. housing market in 2006, says Rebelo. “Some people say, ‘Oh, prices crashed because there was new regulation imposed on the financial industry. But this argument gets the causality all wrong. Nothing happened in 2006. Absolutely nothing. We simply ran out of new home buyers.”