Policy Oct 5, 2023

Big Tech Takes the Stand

Google may look like a monopoly, but is its power actually hurting consumers? A legal expert weighs in.

Michael Meier

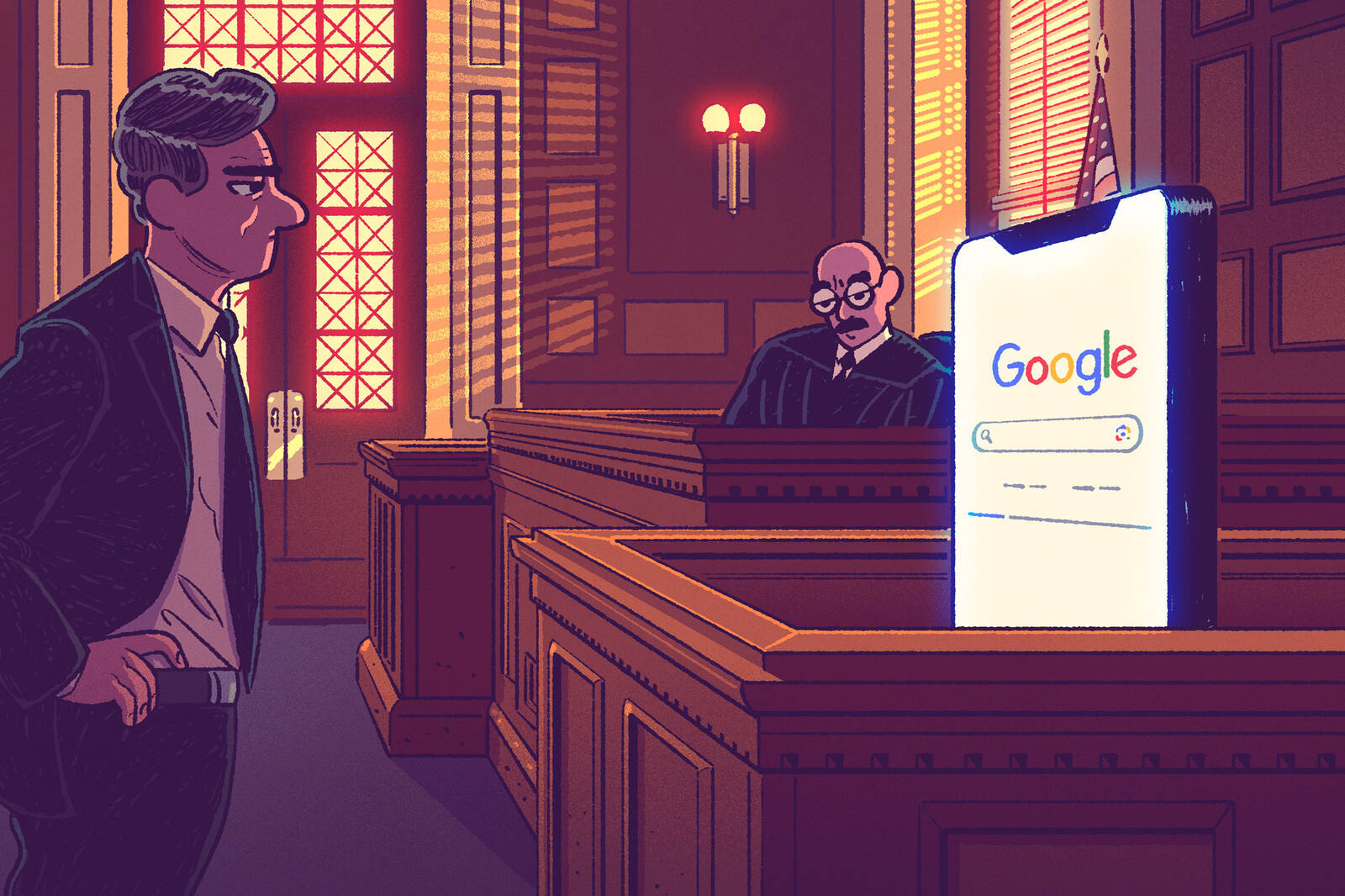

Last month, when Google appeared in court for the first big antitrust trial of the internet era, there was plenty of speculation over the legal framework underlying the government’s case against the company. Was the proper analogy Microsoft in the 1990s? The AT&T trial of the 1980s? Or was Standard Oil the standard?

Part of the trouble in drawing a throughline from the past has to do with the nature of Google’s business. After all, their service is free, and historically, antitrust law—going back to the Sherman Antitrust Act of 1890—has focused more on preventing firms from dictating, controlling, or manipulating prices for the consumer.

“People worry this old statute might not fit this modern problem,” says R. Mark McCareins, a clinical professor of business law at the Kellogg School. “But it was drafted with the understanding that business and technology would evolve. Whether its buggy whips or widgets, the courts have done a pretty good job of applying this nineteenth century law to the business practice before it.”

However, there has been renewed interest in using a different interpretive lens for federal antitrust law, especially when it comes to tech. This movement, led by Democrats in the Biden administration, wants to challenge the legal theory behind the “consumer welfare standard”—a principle based on the work of conservative legal scholar Robert Bork—which has dominated monopoly law since the early 1980s. They see the consumer welfare model as too narrowly focused on efficiency and price, while ignoring other potential harms to workers, innovators, entrepreneurs, and society at large.

“That’s a different paradigm,” McCareins says. “Those are different rules.”

Whether the court’s decision in the Google trial—and others to come—changes the standard for what constitutes anticompetitive behavior remains to be seen. But until the focus of enforcement is settled, companies are going to be operating around a good deal of uncertainty.

McCareins weighs in on what to expect from the Google case.

What is the Google case about?

In the broadest sense, the case is part of the Biden administration’s effort to rein in the tech companies, given the scope of their impact and the power they have accrued.

And in terms of size, Google certainly looks like a monopoly. More than 90 percent of web searches are performed using its site, and the company is currently worth $1.7 trillion.

But holding monopoly power isn’t actually illegal. What’s illegal is taking steps to suppress competition in order to preserve that monopoly.

“The antitrust laws are clear on this,” McCareins says. “Just because you’re big doesn’t mean what you’re doing is illegal.”

In their defense, he expects Google to say that they dominate the market because they have the best product. As one of the company’s lawyers has argued, people use Google because they want to, not because they have to.

Yet the government claims that when Google signed contracts with Apple, Samsung, and others that make Google the default search engine on most devices, these agreements are effectively an abuse of its position. The charge is that they are leveraging money and power to stifle competitors.

“The antitrust laws are clear on this. Just because you’re big doesn’t mean what you’re doing is illegal.”

—

Mark McCareins

For their part, Google denies that this behavior is anticompetitive, McCareins says. “They’ll argue that these contracts are not actually exclusionary, and that under the law as written, they are certainly within their rights.”

The government will also argue over both Google’s impact on the cost of advertising and its use of consumer data. The Justice Department’s view is that by amassing more consumer data, Google can more easily entrench itself as effectively consumers’—and advertisers’—only choice. The company says the government overstates the importance of data—that it’s all about the elegance of their search algorithm.

“The question is, who’s complaining?” McCareins says. “Typically, a monopolist will drive out competition, then raise prices. That’s not happening here for consumers, since the product is essentially free.”

While Microsoft’s Bing and DuckDuckGo may wish they had more market share, from Google’s point of view, those companies would need to show that they have been directly impaired in order to make the government’s case.

What happens if the government wins?

The Department of Justice doesn’t have the most sparkling record when it comes to recent antitrust cases, as McCareins points out. In the last three years especially, “they’ve lost a lot more cases than they won. And if Google wins this one, the other tech companies might think, ‘Okay, sue me. I am willing to make a sizeable investment in my legal team and have faith in our interpretation of monopoly law.’”

Even if the government does win the case, it’s not clear what the remedy would be—and whether any potential solutions—including forcing Google to restructure or spin off aspects of its business—would effectively increase competition in the industry.

Consider the case against AT&T. Back in 1984, the telecom giant was broken up into eight regional companies, the goal being to lower the price of long-distance telephone calls and offer more consumer choice.

“The same arguments that were being made then are being made today,” McCareins says. “But is it realistic or even possible to ‘break up’ Google? The question becomes, just as in the AT&T case, whose job will it be to manage that remedy? What will it look like?”

And, in a world of ever-changing technology and heightened merger-and-acquisition activity, what would be the long-term effects of a government supervised breakup? Interestingly, the eight “Baby Bells” resulting from the AT&T ruling have since been reunited through a series of mergers and acquisitions. AT&T is now even bigger than it was in the 1980s.

“To the consuming public I say be careful what you wish for, because the next iteration of this, if there’s a remedy, it may not go smoothly.”

What does this case mean for the future of Big Tech?

One reason this case has garnered so much attention is because it might set a precedent for future battles with tech companies, including Amazon, which has been sued by the Federal Trade Commission.

The DOJ has allocated significant assets to the Google case, while the FTC has done the same in the Amazon case. This lowers the likelihood of the government launching further antitrust investigations into big tech for the time being. Instead, the agencies are likely to see how the current cases play out before they go after any other companies.

“If the DOJ wins the Google case, that’s going to embolden them to get more active,” McCareins says. “If they lose, you would think that they would retrench and rethink their litigation strategy. The same thing goes for the FTC in the Amazon case.”

For those who hope for more-aggressive enforcement of antitrust law, a win could signal a major shift in the lens through which the courts are willing to view the effect of monopolies—and not just on advertisers or competitors, either. The courts could eventually consider monopolies’ impact on the labor market, or on user privacy, or on misinformation in the public sphere, or on the extent to which the burgeoning field of artificial intelligence remains open to smaller players.

But doing so would represent a major upheaval, as consideration of issues through this broader scope would stretch current law to an extent unsupported by case law. This would represent a major upheaval.

“Some would say the consumer welfare model isn’t working here,” McCareins says. “The issue is that we have more than a hundred years of jurisprudence that has looked at monopoly law through that lens. Federal judges are smart—they understand the issues and the technology. So the courts are not ill-equipped to enforce the law. They are just used to enforcing it through the consumer-welfare model.”

Looking beyond the consumer-welfare model would give regulators more wiggle room to combat monopolistic behavior among the many tech companies that offer free products. But a broader interpretation of who may be injured by anticompetitive behaviors comes with some risks, according to McCareins.

“Should we stop a merger because a plant is being closed? We’ve never done that before. That’s a whole different paradigm. If we’re going to reject the consumer-welfare model, that’s really quite revolutionary, and all bets are off.”

Andrew Warren is a writer based in Southern California.