Featured Faculty

Member of the Marketing Department faculty until 2014

Professor of Marketing; Mondelez Chair in Marketing; Marketing Department Chair

Getting into debt often happens haphazardly: a company downsizes, a car breaks down, a surgeon turns out to be out-of-network after all. Getting out of debt, on the other hand, generally requires a plan.

But what sort of plan? With many different creditors entitled to a chunk of your income, a big question is often which debt to pay down first. Theoretically, it makes sense to pay off debt with the highest interest rate, followed by debt with the next highest interest rate, and so forth. This ensures that interest payments are kept as low as possible.

But the real world is messier than most theories. Other factors—human factors—also come into play. “There are lots of ways you might think about trying to complete a task,” explains Blake McShane, an assistant professor of marketing at the Kellogg School. “Some tasks are very linear. You might have a paper to write, and you might say, ‘first I’m going to write the introduction.’” Alternatively, he continues, at a grocery store, you might grab everything you need from the dairy section before heading to the cereal aisle. Or, for other tasks, you might choose to tackle the toughest steps, or the simplest ones, first. “Various ways of doing these things might affect your motivation,” reasons McShane.

The Role of the Debt Settlement Firm

People with multiple creditors who owe a great deal more each month than they can afford to pay might end up at a consumer debt settlement firm, explains David Gal, also an assistant professor of marketing at the Kellogg School. The settlement firm then negotiates with creditors on their behalf to reduce the principle they owe. Individuals put an agreed-upon sum into a single, dedicated account each month. The settlement firm then approaches creditors with this money and asks them if they will accept a lump sum to close the account. “Typically they’re able to slash your payments by about 50%,” Gal says of the settlement firms.

Because debtors do not themselves approach creditors, they tend not to control the order in which the creditors are paid off. This provided the researchers with a unique opportunity to ask whether, if all else is held equal, the order in which debts are paid off influences how likely a debtor is to get back in the black.

Specifically, the researchers hypothesized that debtors would have more success if they started with small debts, which can be paid off more easily than larger ones. The idea is that starting small “could motivate you, because you check something off your list,” says McShane. “It can make you think that you potentially have it in you to complete the whole list. ‘Hey, I’ve achieved this! I wasn’t sure whether I could do it, but I’ve got one of these items, so maybe I can.”

Gal and McShane tested their hypothesis using data taken from nearly 6000 clients of a leading debt settlement firm. They asked whether debtors who had paid off a larger number of creditors would be more likely to eventually complete the debt settlement program—a process that often takes years—than those people who had paid off fewer creditors. Critically, they wanted to know if this was the case even if the actual amount of debt paid off was exactly the same.

Two Is Better Than One

Consider two hypothetical debtors, each owing $10,000 spread out over four accounts: one $6000 debt, one $2000 debt, and two $1000 debts. A year into the consolidation program, one of these debtors has paid off both $1000 debts, while the other has paid off the $2000 debt.

The number of accounts closed better predicted successfully completing the program than the dollar amount an individual had paid off.

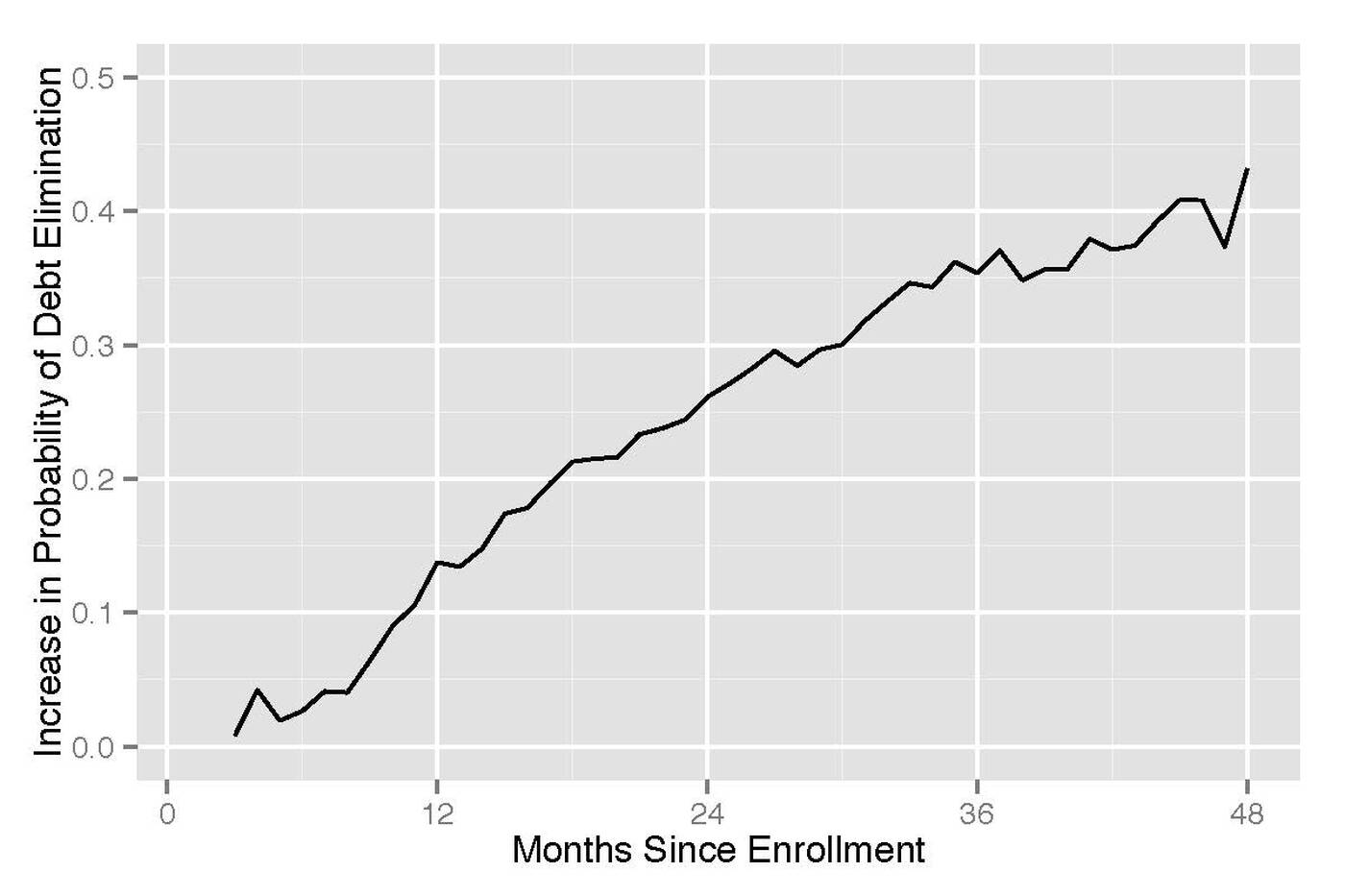

“So the question is, does that person who looks the same in every respect, except they’ve paid off two of their four debts versus one of their four debts—are they more likely to successfully exit the program?” asks McShane. “And it turns out we see overwhelming evidence that they are.” There is an advantage to having closed more accounts—an advantage that holds along every point in the debt settlement process: six months, a year, even two years after enrollment.

Indeed, the number of accounts closed (as a fraction of the total number of accounts) better predicted successfully completing the program than the dollar amount (as a fraction of the total dollar amount) an individual had paid off—though the researchers caution that the two values are highly correlated and difficult to disentangle. “It’s not that dollars don’t matter—dollars matter,” says Gal. “But at least within the range of fractions of accounts and dollars that we have in our dataset, the fraction of accounts is more predictive.”

Getting Started

The researchers also examined something they call the “starting problem”—roughly the idea that we have a hard time working up the motivation to begin a task that seems large and daunting. They indeed found evidence of the phenomenon in debt repayment: individuals with at least one relatively small account were more likely to pay off a single account in the debt settlement program than customers with only large debts. “That suggests that just having some small task to tackle early on might motivate you to get started,” says Gal. “From a rational perspective, you should always pay the higher interest balances first,” he continues. “And that’s what people have recommended in the past. But what we’re saying is, there’s another factor to consider.”

Namely, what will keep you motivated? If you’re like many people, you may be better off focusing on closing small, manageable accounts first—at least if the difference in interest rates between the smaller and larger balances is modest. Starting small may even be a strategy to consider outside of the context of paying off debt. “Lots of different tasks can be perceived of being comprised of a set of subtasks,” says Gal. “How you go about structuring the sequence in which you tackle the tasks is a problem that we face constantly.”

Gal, David, and Blake McShane. 2012. “Can Fighting Small Battles Help Win the War? Evidence from Consumer Debt Management.” Journal of Marketing Research. 49: 487–501.