Featured Faculty

IBM Professor of Operations Management and Information Systems; Professor of Operations

Michael Meier

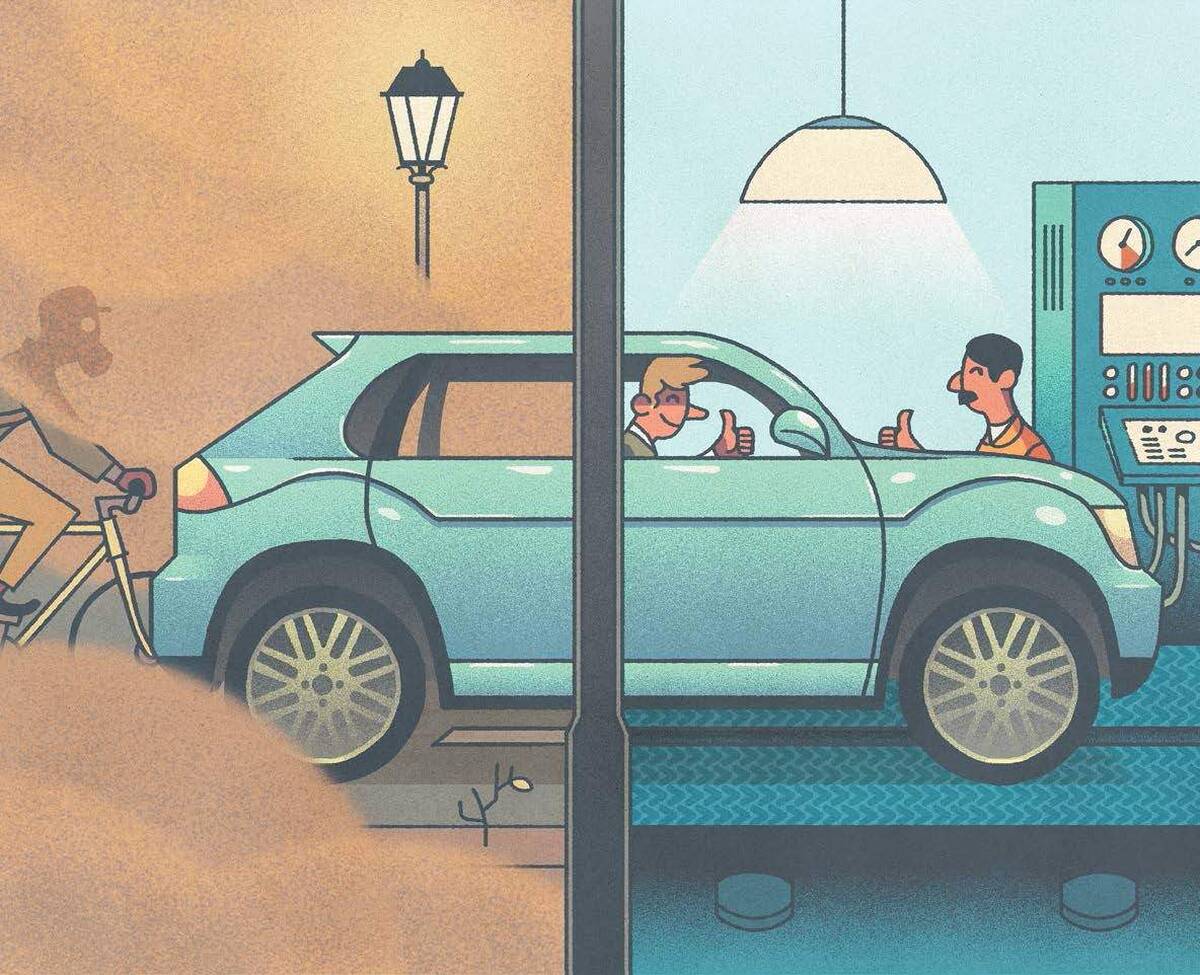

When news broke that Volkswagen had cheated on emissions tests, Professor Sunil Chopra and PhD candidate Keija Hu immediately thought about a dataset they had sitting on their computers. Perhaps, they thought, it could help explain why the company made such a seemingly reckless decision.

Chopra, a professor of operations at Kellogg, had been using the dataset for a different project with Hu. But with the 2015 discovery of the company’s cheating, they turned their attention to a more pressing question: What would lead a firm like Volkswagen to put its reputation on the line by cheating on nitrogen oxides (NOx) emissions on 11 million vehicles?

In new research, Chopra and Hu find that fierce competition coupled with tight standards that are expensive to meet can drastically increase odds of misconduct among carmakers. Instead, temporarily relaxing the acceptable NOx standard—as the European Union has now done—will likely decrease the probability of misconduct by up to 11%.

The research also demonstrates the urgent need for government auto regulators to improve their monitoring capabilities.

“If your monitoring system is imperfect, just tightening standards might actually make the situation worse,” Chopra says.

Economists have already established that increased market competition can boost misconduct. For example, one study found that hospitals exaggerate their transplant patients’ health problems if competition for organs is high.

So it seemed perfectly plausible to Chopra and Hu that Volkswagen might cheat in order to stay competitive. After all, meeting NOx standards is costly for automakers who must foot the bill for engineers and extensive research. Plus, improving emissions tends to hurt engine efficiency. Chopra and Hu theorized that since it is virtually impossible for car buyers to verify their NOx emissions, automakers may well be willing to cheat on that dimension in order to remain competitive on price and engine performance.

But they suspected that harsh competition was only part of the story.

“There’s no point in tightening the standards if you can’t improve monitoring and enforcement.”

The European Commission, which oversees policy in the EU, had tightened NOx emissions standards four times between 2000 and 2014. “What we wanted to understand was, does the tightening of standards have anything to do with misconduct as well?” Chopra says.

Theoretically, the authors reasoned, standard-tightening should increase misconduct for two reasons: stricter standards are more expensive to meet, and when the cost of meeting standards rises, the penalty for being caught cheating becomes relatively cheaper. “They now have less to lose by cheating,” Chopra says.

But would real-world data bear that out?

Before the Volkswagen scandal, Chopra and Hu had been interested in how actual NOx emissions fluctuated with standards. To that end, they had managed to procure a huge dataset on 13 years’ worth of emissions from the European Union.

The data came from sensors installed on European roads, which had captured speed, acceleration, vehicle characteristics, and NOx emissions data from 288,350 vehicles that passed by between 2000 and 2012. This was far more reliable than data from cars that were tested in labs, because Volkswagen had installed devices that could guess when a car was being tested and instruct it to behave differently.

“We never even thought of linking the data to whether people were cheating or not,” says Chopra. Until the scandal, that is.

To understand the impact of both emission standards and competition, the authors created a series of mathematical models that incorporated actual emissions, strictness of standards, vehicle characteristics, prices, and competition intensity.

Competition was measured both at the industry level, by calculating the portion of the auto market that the carmaker controlled, and at the vehicle level, by counting the number of similar substitutes that a buyer could choose for a given car model.

The models confirmed the authors’ hypothesis that fierce competition leads to more cheating. But, even more interestingly, they found that tightening the standards played a bigger role. For every 1% the standards were tightened, the probability of misconduct increased by 1.72%.

“Even if I were to add up model-level competition and market-level competition, the effect of standard-tightening is almost twice that,” Chopra says.

And not all cars were created equal. According to the model, carmakers invested in meeting standards on more expensive cars with profit margins that justified the cost, as well as on lower-power cars, whose buyers were less likely to care about loss of horsepower and acceleration.

“Whenever it made sense to reduce emissions, they were doing so,” Chopra says. “But they were failing to meet standards when either that would result in a big loss relative to the margin, or it would upset the customer because the customer really cared about power.”

In the aftermath of the Volkswagen scandal, EU policymakers chose to double the acceptable NOx emissions limit. It was a counterintuitive move, seen by some as regulators kowtowing to the industry they were supposed to oversee. (The U.S., whose NOx limits have been considerably stricter than those of the EU, has not rolled back its standards.)

But Chopra and Hu do not see it as buckling. When they ran their model again with the new limits, they found that carmakers are likely to exert more effort toward actually meeting the lower levels, reducing misconduct by 9–11% in the short term.

It is a temporary fix. Once regulators have found a way to detect cheating, Chopra says, they can consider tightening standards again. Which speaks to another key lesson from the paper: if regulators want standards to work as intended, they must increase the odds that an automaker will incur a penalty for cheating. This means improving monitoring capabilities. The EU has already begun to do this, adopting a new emissions test that will prevent companies from deceiving inspectors as Volkswagen did.

It’s a solid start. But Chopra emphasizes that regulators must remain one step ahead of the industry year after year. “There’s no point in tightening the standards if you can’t improve monitoring and enforcement,” he says.

One could see this research as offering a forgiving perspective on the Volkswagen scandal, depicting a rational firm responding logically to a set of strong incentives in a hypercompetitive and overregulated industry.

Might any other company in the same situation—constrained on one side by tight regulations and on the other by the imperative to outdo the competition—also feel that cheating was its only option?

Chopra doesn’t think so. “Rather than trying and failing, what Volkswagen did was recognize the form of imperfect monitoring and seek to exploit it,” he argues.

“I don’t have much sympathy for Volkswagen.”