Innovation Jul 1, 2022

The Desire to Be Acquired Is Stifling Innovation at Startups

The result is “more-conventional, less-radical, less-novel innovation,” adding a new wrinkle to antitrust debates.

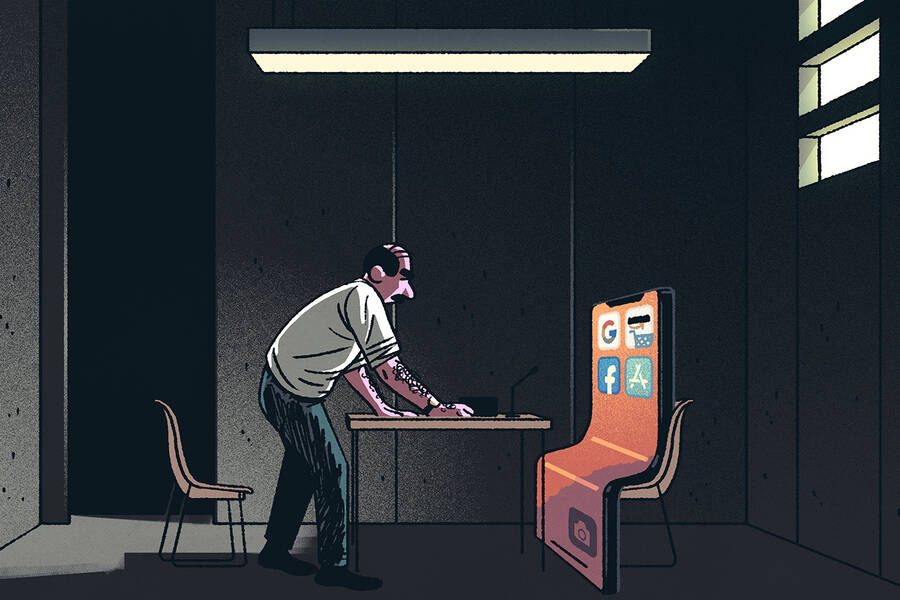

Michael Meier

When a startup succeeds, it’s not uncommon for it to be snapped up by a giant firm. Facebook bought WhatsApp; Amazon bought Zappos; Microsoft bought LinkedIn; the list goes on.

This pattern of acquisitions has fueled a debate about whether such maneuvers should be regulated more strictly. After all, while the end result of these acquisitions might be greater efficiency, leading to larger-scale production at lower cost, acquisitions could also weaken competition, which drives prices up.

But a recent study suggests that policymakers may also need to consider another possible downside of acquisitions: the effect on innovation. Specifically, do acquisitions end up discouraging startups from striking out in new directions?

Niko Matouschek, a professor of strategy at Kellogg, and a colleague investigated how the prospect of a startup being bought later by a large company influences which products the startup will develop.

A model they developed suggests that in the absence of the possibility of an acquisition, new firms generally pursue bolder innovations than do older, established companies. But the possibility of being acquired in the future can push startups to be more conservative and create products that are already quite similar to existing ones. This is because similar products can pose a greater competitive threat to a large firm, thus driving up the acquisition price.

The new company’s logic is “I want to make myself a nuisance to you, precisely because then you’re willing to pay quite a lot for me,” Matouschek says.

The result adds a new twist to the antitrust policy debate.

“By having a more or less lenient antitrust policy, by being more or less likely to challenge mergers, you also might be affecting what kind of products firms develop,” Matouschek says. If large firms are allowed to gobble up small ones indiscriminately, that might lead to “more-conventional, less-radical, less-novel innovation.”

Vertical and Horizontal Moves

The study began with a broader question. Matouschek and his collaborator, Steven Callander at the Stanford Graduate School of Business, wanted to know whether newer or older firms were more likely to pursue bold new products.

In the 1960s, economist Kenneth Arrow argued that older companies with an established product had a weaker incentive to innovate. After all, the new product’s profits would replace some of the old product’s profits, so the net benefit might be relatively small. In contrast, a new company wouldn’t be cannibalizing sales of its own products, so it had a stronger motivation to develop something better.

However, Arrow was considering “vertical” innovation—that is, making a higher-quality version of a product. Matouschek and Callander wanted to study “horizontal” innovation, which means creating a product that is different and not just better. For example, moving from the iPhone 12 to the iPhone 13 is a vertical innovation; moving from the flip phone to the smartphone is horizontal.

Opposing Forces

So the researchers created a model of an older incumbent firm, which already had an established product on the market, and a new entrant firm. The product space was represented as a straight line, where each product was a point on the line; the farther apart two points were, the more different were the products.

The team then compared two situations. In the first, the incumbent had to decide how innovative their next product would be—that is, where on the line it would fall relative to the existing one—to maximize profits. In the second scenario, the entrant went through a similar decision-making process.

If large firms are allowed to gobble up small ones indiscriminately, that might lead to “more-conventional, less-radical, less-novel innovation.”

— Niko Matouschek

It wasn’t immediately obvious which company would end up pursuing bolder innovation. A few opposing forces were at work: The older firm might want to make a very different product because it would be less likely to eat into sales of their existing product. But the more radical the departure, the higher the R&D cost. Meanwhile, the startup might not want to develop something too similar to existing products on the market because competition would be intense, driving down prices and lowering their profits.

“It’s a rat race,” Matouschek says. “What force is stronger?”

The model suggested that, when it comes to innovation, the new firm’s incentive dominated: competition forced the company to create a product that was more different than the one the incumbent pursued.

“It turns out that the independent entrant wants to differentiate more than the incumbent does,” he says.

Who’s Disrupting Whom?

But more radical innovation also comes with more risk. If a product is very different than an existing one, it might be less clear which materials or manufacturing processes are best to use, for instance. That uncertainty could increase the likelihood of creating a low-quality product.

The team captured this concept in the model: A radical new product had a higher chance of failure. But as long as the product didn’t fail, its chances of being high-quality were higher. In other words, the outcomes tended to be more extreme. “It might be really great, or it might be really crappy,” Matouschek says.

The researchers then considered how this dynamic might affect disruption, the process by which a new product kicks an older one out of the market. The conventional thinking is that startups have bolder ideas and thus are more likely to be disruptors.

But surprisingly, the model suggested that an older company is more likely to disrupt itself than to be disrupted by a new firm. Because the incumbent gravitates toward less radical innovation, its new product is relatively similar to its existing one and can more easily replace the older one.

In contrast, the entrant’s product is so different that it may not be able to draw all consumers away from the established one. Because it’s a radical departure, it requires “a much more high-quality product to wipe out the incumbent,” Matouschek says.

Exit Strategy

Finally, the researchers turned to the question of acquisitions: They considered a scenario in which the older firm could purchase the new one. How would the entrant’s product-development choices be affected?

In this situation, the startup tended to make a product that was more similar to the established one. The new firm was eyeing the possibility of being bought in the future; if they made something closely related, they could induce more competition with the older company and push up the acquisition price.

In the real world, are new firms actually making these types of calculations consciously? Matouschek thinks it’s reasonable to assume that startups might consider the prospect of a future acquisition in their decisions.

“In many industries, I think the number-one exit strategy is not an IPO but an acquisition,” he says. “Being bought up by Cisco is what they’re hoping for.”

But he cautions that the model isn’t meant to be fully representative of the real economy. Rather, it’s intended as a feasibility check to test logical arguments and assess whether certain effects might dominate more than others. For instance, Matouschek had initially thought that startups might be more likely than established firms to disrupt an existing product, but the model suggested otherwise.

The study lends support to the argument for stricter antitrust legislation. If large firms are prevented from buying so many startups, those smaller companies might strike out in more new directions—a high-risk but high-reward endeavor that could ultimately benefit consumers.

“That is going to induce the entrants to engage in more radical innovations, which are likely to fail, but every now and then they’re going to succeed spectacularly,” Matouschek says. “And that’s really what we care about.”

Roberta Kwok is a freelance science writer in Kirkland, Washington.

Callander, Steven, and Niko Matouschek. “The Novelty of Innovation: Competition, Disruption, and Antitrust Policy.” Management Science 68(1): 37–51.